A Check on Rents

In the most recent Consumer Price Index (CPI) report, nationwide rents showed continued growth, up 0.4% month-over-month (July 2024 to August 2024) and up 5.2% year-over-year (August 2023 to August 2024). Yet other data sources with alternative methodologies offer a different perspective, one that suggests rents are easing down. What’s the true story? Are rents continuing to rise or have the tides turned, spelling relief for tenants and cautionary winds for landlords and property owners who may have been projecting continued increases in ever-rising rents. Let’s dig in.

How Change in Rents are Calculated in the CPI

The U.S. Bureau of Labor Statistics (BLS), which calculates the CPI, does not calculate changes in rents in a very intuitive way. The following post from the Brookings Institute does a better job of explaining it than I could, but essentially it comes down to surveys of tenants and property owners including both in-person visits and phone calls. The BLS also attempts to calculate the Owners Equivalent Rent (OER) to determine what homeowners would pay to rent their homes if they didn’t own them, and this data, too, is included in the CPI rent statistic (I don’t know why).

This methodology feels clunky to me. It is perhaps a vestige to a time before the technology existed to track the data in nearly real time. Indeed, other current methodologies from the likes of Zillow and ApartmentList.com are able to track changing rents practically as leases are signed or renewed.

As a result, the BLS/CPI data tends to lag these other rent trackers. The chart below (again, via Brookings Institute) illustrates several interesting things. First, at the outset of the pandemic, there is a brief drop in rents. Then, there is a clear surge. But finally, within the last 12-18 months, rents particularly as calculated by the Zillow and CoreLogic Data have eased down to pre-pandemic rates of change (note: this does not mean that rents themselves have decreased or reverted back to pre-2020 levels, only that the rate of change in rents has normalized; rents are still much higher than they were a few years ago). The chart:

What is interesting in the chart above is that the blue line, which is the CPI rent statistic, lags the other two every step of the way. Whereas rent growth per the Zillow and CoreLogic models bottomed out in the middle to latter part of 2020, the CPI rents didn’t do so until early 2021. The rent-growth peak for Zillow and CoreLogic came at the very end of 2021; but in the CPI data, the peak did not hit until early 2023. And now, while the rates of rent growth in Zillow and CoreLogic have normalized, CPI rent growth is still above normal readings. If recent history is any guide, CPI rent growth will normalize to around 3.0% in the data 6-12 months after it normalizes in the other two, which would be at the very end of this year or in the first half of 2025.

The time lag has consequences. Now certainly I expect the Federal Reserve Board of Governors is sophisticated enough to be aware of the time lag. But it is notable that shelter makes up about 30% of the CPI statistic. If rent, which is a large component of the shelter category, is inaccurately being calculated as +5.2% year-over-year but in reality it is less than that, it means the overall CPI inflation statistic is also skewed higher than true inflation actually is on the ground. The latest CPI report showed overall inflation back to a near-normal level of 2.5%, which is good news. But without the rent skew, perhaps inflation is actually more like 2.0%. There are significant risks to the Fed having kept interest rates as high as they did for so long; perhaps a realization that inflation is easing down so notably and would be even lower without the time lag in the rent data is why they reduced rates by 0.50% instead of 0.25% at their recent meeting.

So What Does the Other Data Show?

Across the board, other data sources show that nationwide rents are essentially flat across the board year-over-year. A sampling:

Per the August ApartmentList.com Rent Report, rents were down 0.7% year-over-year. The source calculates the average nationwide rent at $1,412/month, which is still $200 than it was at the beginning of the pandemic, but rents have been easing lower for much of the last year, according to ApartmentList.com.

Realtor.com found an identical 0.7% year-over-year drop in rents. The report says rents have dropped year-over-year for 12 straight months.

The Zillow Rent Report for August reports nationwide rents were up 3.4% year-over year, although rents have been easing down of late. Of note, per Zillow:

As more multi-family new construction is completed and more rentals come on the market, rent growth will likely continue to moderate. Additionally, recent declines in mortgage rates may pull more renters into the sales market, further softening rental demand. But despite these glimmers of hope for renters, multi-family construction starts have fallen to pre-pandemic levels, which could signal that the modest improvements in rent affordability may not last for long.

In summary, there is no credible data source out there that says rents are still growing by the 5.2% as determined in the CPI. This suggests that, as noted above, the CPI data lags and the overall inflation statistic is skewed. As it continues to moderate to catch up with reality on the ground, the overall inflation statistic, too, will continue to drop.

Final Thoughts

Easing rents should provide some hope to beleaguered tenants, but no matter what data methodology is used, rents are clearly still much higher than they were several years ago. The discussion above is cold comfort to those struggling with a continued lack of affordable housing. As I’ve written about in the past, rents will ultimately drop (and not just decelerate) only if there is a prolonged surge in construction of new units, thereby increasing supply. The country showed a notable jump in new construction for several years from 2018-2023, but it has eased off with the high interest rates because said rates make the cost of construction higher and sometimes non-viable. As interest rates come down, perhaps construction will tick back up, which would be the ultimate path to actually lower rents.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.

Weekly Round-Up + Errors and Omissions

The silver lining of making an egregious typo is that you hear from a lot of readers. I didn’t know so many people cared! Anyway, from last week’s article, the Market Cap of Amazon is $2 Trillion and not $2 Billion. A simple slip, but when you think about the difference being One Trillion, 998 Billion dollars, it puts these large numbers in some sort of stark perspective. $2 billion is a lot. But $2 trillion is a REALLY lot.

Fitch Ratings expects mortgage rates to hover around 5.2% over the next couple of years, saying rates probably won’t be below 5.0% until 2027. The average 30-year rate as of Friday was 6.2%, so still above what Fitch projects, but headed in the right direction. Read more here.

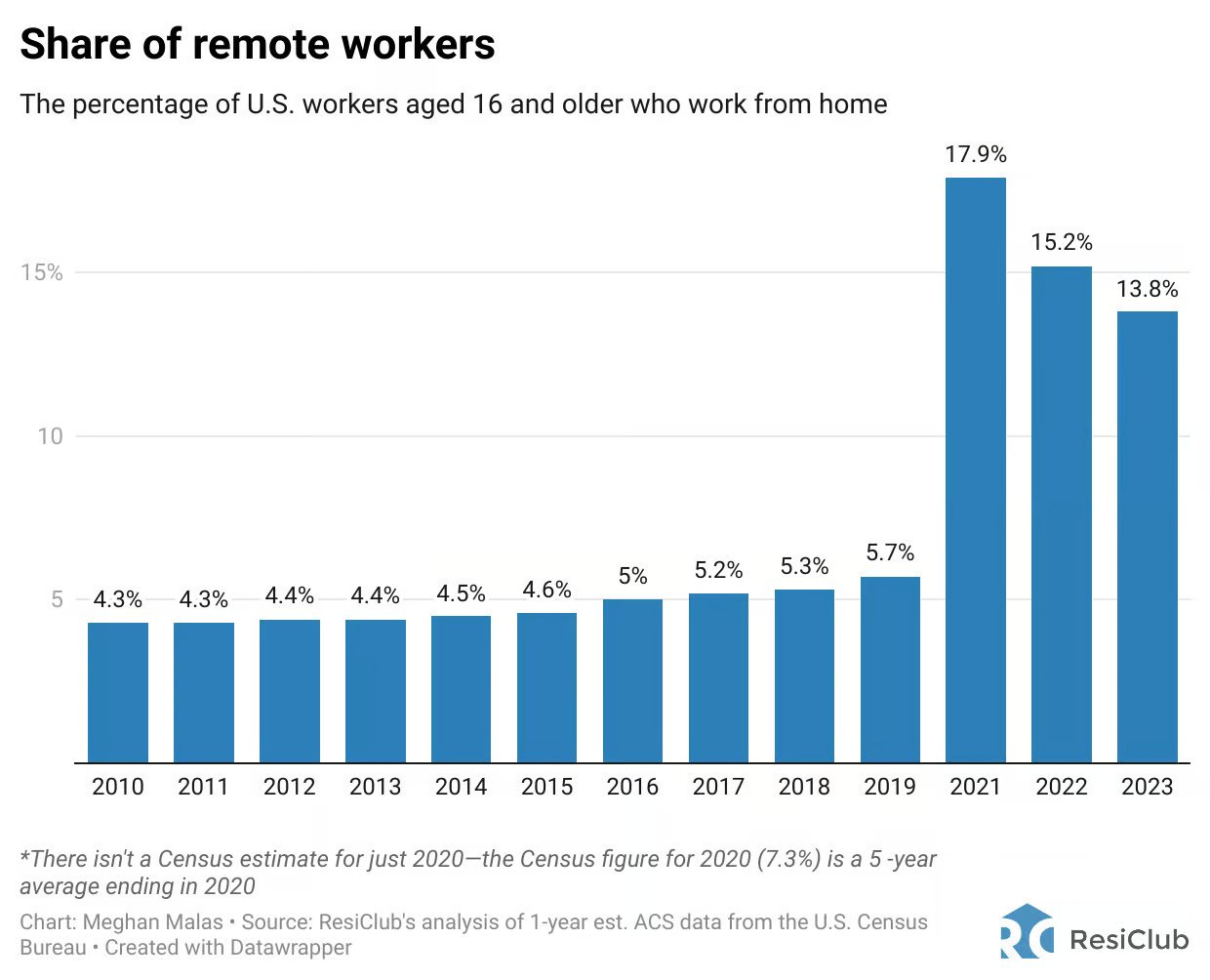

Also as an interesting follow-up to last week’s article, Lance Lambert of ResiClub shared some data on X this week showing a decline in work-from-home workers from the pandemic peaks. Pre-pandemic just over 5% of workers were remote. That jumped to nearly 18% when the pandemic hit, but has eased back down each of the last two years to about 1 in 7 U.S. workers.

Have a great week, everybody!