"A Year of Moderation" Begins for the Construction Sector

Thank you for reading The Sunday Morning Post. If you enjoy what you read here, please consider sharing with friends and colleagues.

On Tuesday, one of America’s bellwether companies released its quarterly earnings report, providing a key look at the health of the country’s construction and homebuilding sectors not to mention the overall retail environment. Home Depot’s numbers are closely watched, and the ones from Tuesday injected a jolt of uncertainty into the market as the corporate giant reported sales that were down 4.2% in the first quarter of the year versus the first quarter of 2022. “Our sales for the quarter were below our expectations,” said President and CEO Ted Decker. Decker also noted that after three years of robust revenue growth through the pandemic, they are expecting 2023 to be “a year of moderation.” Home Depot’s revenue miss was, in fact, its worst miss versus analyst expectations in twenty years.

So What’s Going On?

In April 2022, there were 1.176 million new single-family homes newly under construction on a seasonally adjusted basis. One year later in April 2023 there were 846,000, a decline of 28%, as shown in the chart below of new home starts over the past five years:

It is no wonder this is hitting Home Depot’s numbers, as fewer home construction projections means fewer purchases of lumber and materials, but also of other big ticket items like patio furniture and appliances. As a brief aside, multiunit construction remains pretty robust, which is a topic I am coming back to in an article in the near-future, but the single-family home construction market has clearly slowed.

Undoubtedly higher interest rates over the past year are the key variable here, with the cost of borrowing to build a home nearly doubling in the past twelve months. Inflation, too, is an issue; with more of people’s paychecks going to other things like food, utilities, and the ordinary expenses of daily living, there is less money for that home renovation project or to add a new deck, etc. And although lumber and materials prices have come down, broader inflation on all types of construction products and services mean that project dollars just don’t go as far, so people are likely cutting back to renovation just a bathroom, for example, instead of an entire section of a house.

There is also just a general feeling of dread out there right now. I wrote about this last week in The State of the American Homebuyer is Strong in terms of how strange it is that loan delinquencies are at historically low levels, but there is this general feeling that the economy is in peril. According to one survey, economists peg the likelihood of a recession later this year at 64%. When people are feeling apprehensive about the economy, they pull back some of their spending especially on large projects. I have a feeling this phenomenon of people feeling worse and worse about things is only bound to become more exaggerated as we enter what could be a fairly toxic 2024 campaign cycle. My advice: turn off the news.

Context Does Matter

It is important to keep in mind, however, that even though construction spending appears to be easing up, it is also only down relative to artificial pandemic-induced highs. Stuck at home and unable to spend as much on discretionary expenses like travel and entertainment, people invested in their homes instead. This was fueled by ultra-low interest rates and several waves of stimulus that had people feeling cash-rich. Businesses, too, have been actively expanding and investing in themselves during a period of cheap debt (the window on which has more or less closed). So yes, Home Depot’s revenues are down, but they are only down versus a pretty lofty peak.

Earlier in the week I happened upon the chart below that shows the Personal Savings Rate nationwide over the last ten years:

Clear spikes in savings are evident in 2020 and 2021 that correlate with the virtual shutting down of the country plus the months when stimulus checks were mailed out. The bulk of this savings was then spent down, however, which fueled the construction boom we’ve seen over the past three years. Interestingly enough, the Personal Savings Rate for March 2023, which is the most recent month for which data is available, was 5.1% of income. This puts it below the March 2019 rate of 9.1%, but up from the low point of 2.7% in June 2022. I will be very interested to check this data over the months to come. For better or worse we live in a consumer-driven economy, the overall health of which depends on the sometimes-conflicting needs for people to save and spend. I think it is actually likely that if Americans become even more worried about the state of the economy, the Personal Savings Rate will actually increase. On the one hand, increased savings leads to more economically sound households, but on the other, if people are saving more it will lead to a slowdown in economic activity including in construction projects.

Certain things are much better today in the construction market versus a year ago let alone two or three years ago. Supply chain issues have eased up, for example, although the labor market is still extremely tight. I spoke to one homeowner recently who said he could build twenty homes over the rest of the year if he had the crews to help do the work; instead, he will probably build four or five. But people I talk to in the construction field are also noting a slight pullback in activity, which is borne out in the national numbers. I do not foresee a crash or a complete plummeting activity, but I do think the comments from the Home Depot CEO about a year of moderation are a good assessment of the months to come.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram. Opinions and analysis do not represent First National Bank. © Ben Sprague 2023.

Weekly Round-Up

Here are a few things that caught my eye this week.

According to Black Knight, nearly two-thirds of home mortgages have an interest rate below 4.0%, which is handcuffing homeowners to their homes. “To consider a shift to something in the 6%-plus range does not make sense if it can be avoided,” notes Michael Sklarz of Black Knight.

The above comes as data from Bill McBride of Calculated Risk Blog shows the 30-year fixed mortgage rate back on the rise, nearly touching 7.00% this week.

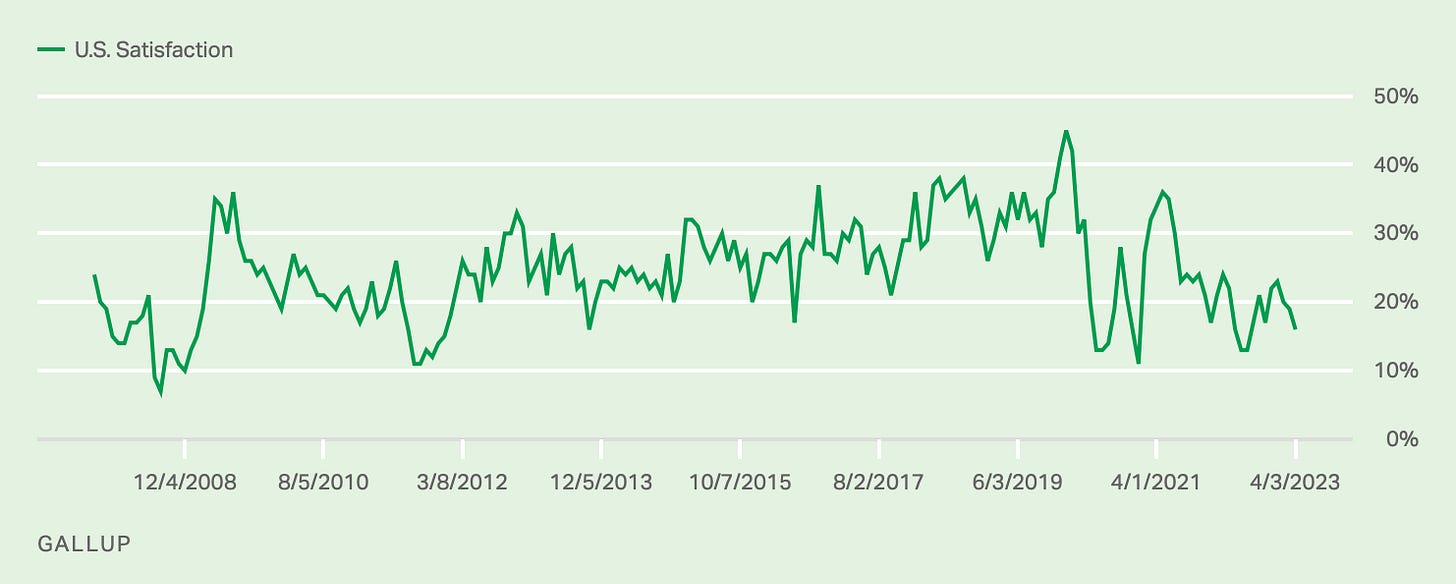

Per Gallup, just 16% of Americans are satisfied with the direction the economy is going.

Via Conor Sen and Gallup, just 9% of Americans now say that inflation is our greatest challenge, down from 20% last October. Inflation has, indeed, cooled off since last year; April’s report showed prices rising by 4.9%, well down from summer and fall 2022 peaks.

A $22 million office building is being town down in Orange, California to make way for multifamily residential units instead. Joe Beeton on LoopNet describes the challenges of converting office buildings to residential, which feels like it would make intuitive sense in a work-from-home era when demand for office space is down, as such, “Offices are notoriously indisposed to [conversion to residential.] Most modern offices simply cannot be adapted to residential uses due to their wide and deep floorplates that restrict natural lighting to only the perimeters, and because of the overhauls required to run mechanical, electrical and plumbing to individual residential units.” For that reason, this particular office building is being torn down to make way for a new build of residential units.

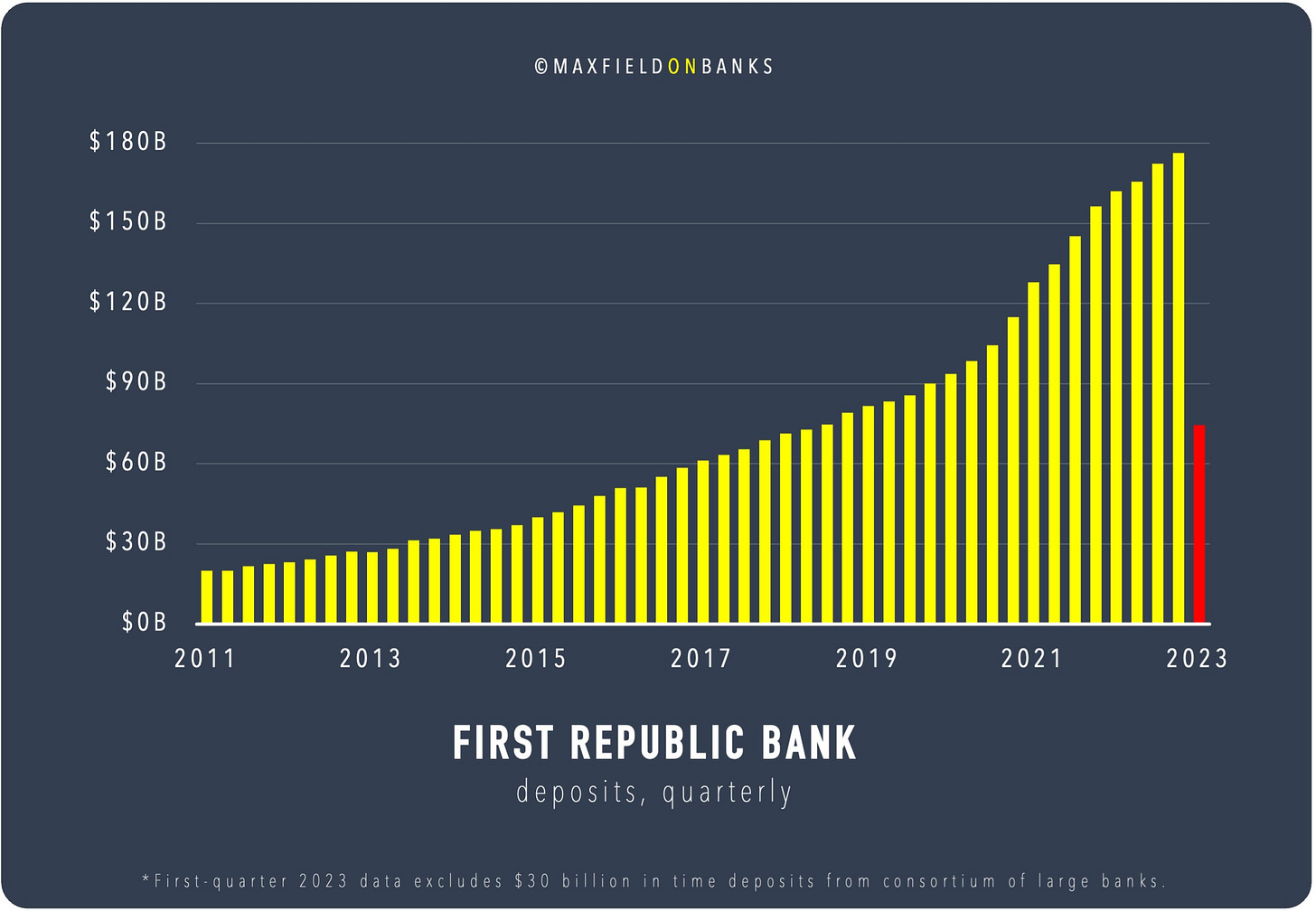

Maxfield on Banks has a chart showing First Republic’s deposits over the past few years. A Black Swan event, for sure:

Check back for upcoming articles on multiunit construction and more. Have a great week, everybody!

Next week: Lowes