Home Listings are Up 30%

Plus: NEW home sales fastest in 15+ years

Like the greening of the grass, the blooming of cherry blossoms, and the return of robins north, housing has a seasonal pattern to it that is as predictable as nature. The number of homes for sale (and subsequently, the number of transactions) starts to increase each year in the spring as people emerge from their winter slumber, peaking in the mid-to-late summer before subsiding in the fall for another winter lull.

The issue over the past couple of years has been that while this seasonal pattern has indeed remained intact, the overall level is at a lower water mark. In other words, the cyclical pattern has been there from January through December, but the number of actual homes for sale has been at a lower level each and every month as compared to the same months in previous years.

The seasonal pattern is holding true in 2024. And yet, something is different this year, which should provide some hope to would-be buyers and give procrastinating sellers something to think about: the number of homes for sale is rising more rapidly than expected and is notably outpacing previous springs. In fact, per the St. Louis Federal Reserve, there were about 734,000 home listings in April. While this is still below pre-pandemic numbers for this time of year, it is up 30% over April 2023 and nearly double the 380,000 homes for that were for sale in April 2022!

The trend is a hopeful one for buyers, who have had to deal with frenzied competition among buyers for the dearth of inventory out there over the past few years. The new homes for sale provide more options, but could also lead to an easing up of price pressures.

Why the Increase?

There are really three key variables at play right now that are leading to this jump in available homes for sale:

New home construction: builders have recognized how limited the existing inventory of homes for sale has been, so they are doubling down on new home construction to provide options to (and to earn profits from) frustrated buyers. In fact, the pace of new single-family home construction is the fastest in 15+ years! In April, on a seasonally-adjusted annualized basis, there were 480,000 new homes for sale, which is the most since January 2008.

Homes are staying on the market for longer. As of April, the average home stayed on the market for 47 days. This is almost equal to the 46-day average in April 2023, but it is up from 30 days in April 2022 and 37 days in April 2021. Homes are staying on the market longer for several reasons, most notably higher interest rates that have slowed the buyer frenzy a bit, but also probably because people are feeling more apprehensive about the economy and its future; when that is the case, people are likely to hold back on major purchases. With homes staying on the market longer, it expands the existing inventory at any one place and time.

Pent-up seller demand. I don’t have a statistic for this, but my intuition is that so many people held off on selling homes from 2020-2023 that it created pent-up demand among sellers. I have written a lot about this before (e.g. interest rate lock-in effect, golden handcuffs, etc.) so I won’t dwell on it further, other than to say that I really do believe that if interest rates were to drop in a meaningful way, it would be like a dam bursting on home inventory as there are so many people out there who want to sell, but are not going to until they can find (and afford) a place to move to. At some point, those listings are going to burst through.

There is a lot of regional variability in the home market. Local economic conditions, the rate of new-home construction in those local markets, and other factors are going to continue to be major drivers in the number of homes for sale not to mention prices. And yet, these nationwide trends are happening in all corners of the country. Inventory is up everywhere.

The question of prices is really the million dollar question for would-be buyers (and sellers, too). Prices were still up in April nationwide on a year-over-year basis by 5.7%. I’ll say what I’ve said before: I do not think a housing crash is coming anytime soon, but I do think there will be a continued leveling off of prices and even price drops in many markets. It would not be unreasonable to see prices drop of 10-15% in many parts of the country over the next year or two. The potential for a price drop combined with the likelihood of eventual interest rate drops should provide hope to buyers. There is a continued need for patience when making such a large financial decisions like buying a home, especially when the market is likely to become more attractive in the short-to-intermediate term ahead.

For sellers who have someplace to go, now is a good time to sell. In fact, the ideal scenario for sellers would probably be to sell now before the inventory pool continues to rise, rent for a year or two, and then buy in what could be a lower interest rate environment than it is today in a market with more options and potentially lower prices.

Lastly, the inventory rise is good news for realtors and others who make their living off of the real estate market. More homes for sale means more transactions, which is good news in what is otherwise a somewhat turbulent time for the industry. It seems like right now there are some real estate agents getting out of the industry, but those who remain could see the benefits of more homes for sale and fewer competing agents selling them.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.

Weekly Round-Up

Here are a few things that caught my eye this week!

The data I used in researching this week’s article was mostly based on April figures. But just prior to publishing, I read a story via Bill McBride of the CalculatedRisk Blog showing new home inventory is up 37% in May, a jump even further than the 30% I wrote about above. Read more here.

Per Felix Richter of Statista, the girl’s name “Alexa” has declined in popularity from being the 32nd most popular girls name in 2015 to the 536th most popular in 2022. Data from the Social Security Administration shows that there were 6,052 babies named Alexa in 2015, but just 574 in 2022. Poor, Alexa(s). Read more here.

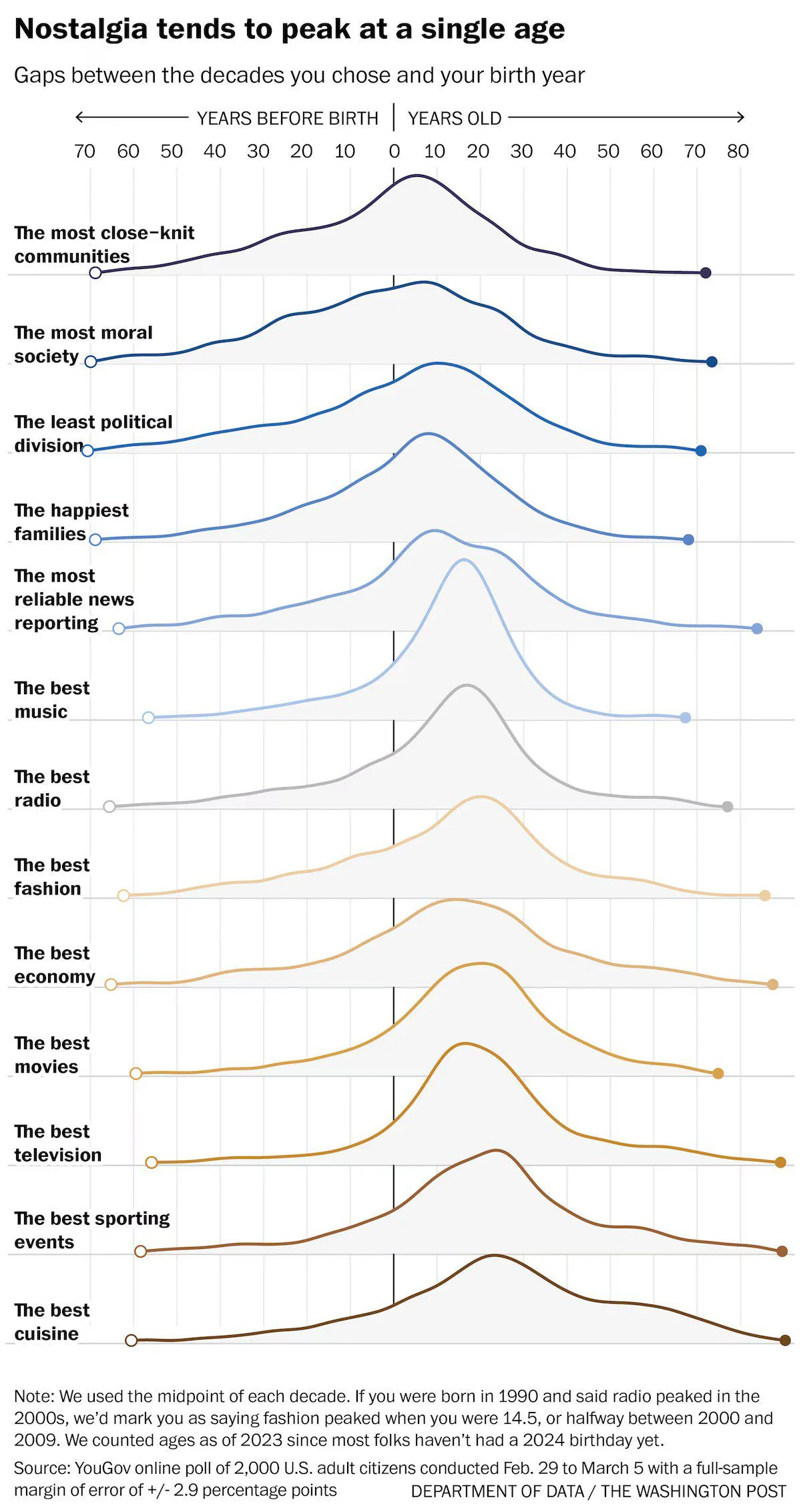

Regardless of age, people seem to think the best of nearly everything occurred when they were 10-20 years old, especially music!

Have a great week, everybody!

Well written and right on the mark as usual. In the era of record levels or credit card debt, cost to feed a family, skyrocketing home insurance rates (I'm up from $1200/year in 2022 to $1800/year in 2024), and the inability of politicians to stop spending resulting in further inflation, I'm afraid the American dream of home ownership has disappeared for many. Yes the home builders are erecting new Levittowns in numerous areas across the country. The difference is that unlike the 1950s when Dad could afford the house payment and maintain one newer car and one older car, while Mom watched the kids, Mom and Dad are both slaving away for the same lifestyle. Look for a small increase in interest rates at the next meeting of the Fed which will be entirely political. Then the next lowering of rates will only occur when the economy slows enough to put some of those Moms and Dads out of work.

Have a great week too.