Home Loan Rates Near Yearlong Lows

Commercial rates also tick down

Over the past few months leading up to Wednesday’s meeting of the Federal Reserve, there has been a good deal of optimism among those in the real estate industry that a lowering of interest rates might provide some juice to a stagnant housing market. Indeed, the Fed lowered its key benchmark interest rate by a quarter point this past week, which should help certain types of borrowers, particularly those in the commercial world. This is because banks typically benchmark commercial rates to certain interest rate indexes, such as the Fed’s Prime Rate, which dropped from 7.50% to 7.25% this week, the first such drop since the end of 2024. A lowering of the benchmark should mean a lowering of commercial interest rates.

In other areas of the lending world, however, rate relief may take some additional time. Home loan rates, specifically, are not benchmarked to Fed rates, but are instead subject to the complicated forces of supply and demand and, even more complex, expectations of future inflation. So although certain interest rates did decline this week, home loan rates did not. In fact, the average 30-year fixed-rate mortgage rose from a low point of 6.13% on Tuesday to finish the week at 6.35%, according to nationwide data aggregated by Mortgage News Daily. Many would-be borrowers and other observers are likely surprised that during a week when all the talk in the financial news was about falling rates, home mortgage rates actually increased.

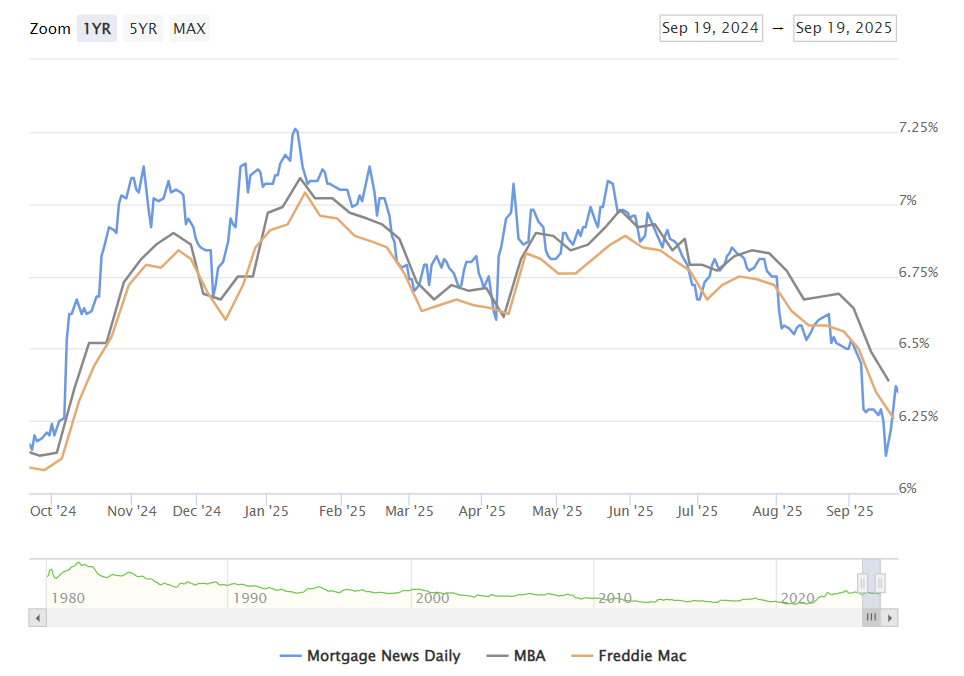

Still, despite the jog upward in rates over the past week, this 6.13–6.35% range for 30-year mortgages is right around an 11-month low, as shown in the chart below. Overall, it is cheaper to borrow for a home than at almost any time over the past year, particularly last fall, when rates were above 7.00%:

From people I talk to in the industry (realtors, title attorneys, mortgage brokers, etc.), the high-rate environment over the last two years has made things feel pretty much frozen in the residential market. Buyers have been on the sidelines, unable to make the math work on home purchases at high prices and with high interest rates. With mortgage rates now at their lowest point of 2025, will buyers come back? There is already some evidence that mortgage applications have been ticking up in the month of September, per data from the Mortgage Bankers Assocation, after a fairly anemic summer.

There is more than one variable that will further answer this question over the coming months. First, the decision to purchase a home is often the most significant financial decision of a person’s life, and it is not based on prices and interest rates alone. The macroeconomic environment matters a great deal, and so does a would-be homebuyer’s own household situation. On the macro side, people don’t tend to make big changes if they are feeling economically uncertain. While Americans’ economic sentiment is up from the lows we saw in the spring, it eased down in the most recent reading, signaling that people are still wary about the economy. Per the University of Michigan’s consumer sentiment report released this past week:

Consumer sentiment moved down less than three index points in early September. This month’s easing in economic views was particularly strong among lower and middle income consumers...Consumers continue to note multiple vulnerabilities in the economy, with rising risks to business conditions, labor markets, and inflation. Likewise, consumers perceive risks to their pocketbooks as well; current and expected personal finances both eased about 8% this month. Trade policy remains highly salient to consumers, with about 60% of consumers providing unprompted comments about tariffs during interviews, little changed from last month. Still, sentiment remains above April and May 2025 readings, immediately after the initial announcement of reciprocal tariffs.

When there are notable reasons for pessimism (e.g. political turmoil, tariff uncertainty, a changing job market that is showing some signs of softness), people may delay big purchases and major life decisions even if interest rates do come down. If the economy were to falter and the unemployment rate were to rise notably, it would result in weakness in the housing market, for sure.

The second major variable is the interest rates themselves. I mentioned above that home mortgage rates are not directly controlled by the Federal Reserve. True, residential loan rates often correlate with Fed moves, but they don’t march in perfect lockstep. The difference comes down to the term of the loan. Many commercial loans have 5-, 7-, or 10-year terms, while most home loans are either 15 or 30 years. Thirty years is a long time for uncertainty, and banks price home loans not just based on interest rates today but also expectations of inflation over decades. If investors believe inflation may rise in the future, mortgage rates in the present will reflect that risk by rising.

To complicate matters further, most banks and mortgage brokers sell their home loans to aggregators who then repackage them into investment securities. That means mortgage rates ultimately depend less on the Fed and more on the expectations of the global investors who buy these securities. If those investors believe future Treasury yields will be higher, they will demand higher yields on mortgages today to compensate for the risk. In short, it is the intersection of inflation expectations, investor demand, and banking supply — not simply the Federal Reserve — that sets home mortgage rates. That is why this week, for example, the Fed brought interest rates down, but home loans actually rose in rate (because people are feeling jittery about the economy right now, including the possibility that inflation could rear its ugly head again a little bit down the road).

The Current State

Keeping all of the above in mind, it is notable that interest rates for home loans have dropped for much of the past year, despite the slight increase this past week. The primary reason rates have eased is that inflation has cooled. That has made borrowing more affordable than it was at the peak of the cycle last fall.

But does cheaper borrowing truly “juice” the market? The answer depends on what kind of juice we’re talking about. Lower rates may bring more transactions, which is good for realtors, lenders, and sellers. But if more buyers chase the same limited housing supply, it could mean higher home prices, which is a mixed blessing, the feelings towards which depend a lot on where one sits in the housing market. For would-be buyers, the critical question is whether lower rates actually improve affordability, or if they simply fuel another round of price gains that keep homeownership just out of reach.

For now, lower rates provide some optimism, but not a clear resolution. The coming months will reveal whether falling inflation and modestly lower borrowing costs are enough to thaw a frozen housing market — or whether economic uncertainty and limited supply will keep the freeze in place. Questions persist about the impact from tariffs on inflation, with price increases in many still being unrolled as the world waits to see what deals are brokered in this new regime.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.