Hope for Homebuyers as Inventory Climbs

Plus: a Weekly Round-Up of things you should know about

I saw something strange this week on the front yard of a home down the street from me: a For Sale sign. It seemed out of place, almost anachronistic. It was the same feeling you get when you happen upon a functional payphone or unfurl a tri-fold paper map, like seeing a relic of times gone by.

For Sale signs have been a rarity in recent years. For starters, there just haven’t been many homes on the market. In 2023, there were only about 4 million existing home sales, which was the fewest since 1995. High interest rates, high prices, concerns about inflation and other economic uncertainty, not to mention the lock-in effect combined to keep the housing market pretty much frozen last year. On top of that, homes that were put on the market have typically been selling fast, sometimes before a For Sale sign can even be hammered into the ground!

Things Look Different Already in 2024

There are signs that the inventory freeze is thawing out, however, which should provide hope to buyers who have been frustrated by a lack of choices on the market and the heavy competition for such paltry supply.

According to data from the St. Louis Federal Reserve, there were about 665,000 homes-for-sale nationwide in the month of February. While this is still low historically speaking, the 665,000 listings does represent more homes-for-sale than in any of the previous three Februaries, which saw:

February 2021: 465,000 homes for sale

February 2022: 347,000 homes for sale

February 2023: 579,000 homes for sale

Comparing against the same month of the year is the best way to look at this statistic because the homes market is very seasonal; inventory typically peaks in the late-summer before troughing out in the winter. The fact that this year’s trough is at a higher-water mark than previous troughs suggests inventory is improving. Looking specifically at the low-point of February 2022, there are almost twice as many homes for sale today.

There are also a lot of new homes being built. Whereas the statistics above are for active listings of existing homes, there are quite a lot of newly constructed homes for sale as well. Per Federal Reserve data, there were 463,000 new homes for sale in February, which is just about the high point for the last 10 years (October 2022 had 466,000 new homes for sale, just marginally higher than today). Although the number of newly constructed homes for sale is below the pre-Great Recession peak of 572,000, it’s not off by much and the trajectory suggests we will be pushing to over 500,000 new homes for sale and beyond in the months ahead if trends continue.

Another interesting way to look at the homes-for-sale data is based around a statistic called Monthly Supply. What Monthly Supply represents is how long the number of homes currently for sale would be expected to last if no new homes were listed or built. As of February, the Monthly Supply was 8.4 months. This is up substantially from an August 2020 low of 3.3 months. If you remember back to that time, there were two different variables that combined to choke the housing market: homes that were actually for sale were selling extremely quickly, and at the outset of the pandemic, builders and banks had momentarily slowed down on new construction, thinking that the housing market was going to collapse. In fact the opposite happened and the housing market exploded, but for those first few months the supply of homes available was extremely limited.

How does the Monthly Supply compare with previous time periods? The chart below shows the trends in this statistic. Again, keep in mind that Monthly Supply can change based on a variety of variables including interest rates, the rate of construction, and conditions in the overall economy. It is interesting to me, however, that almost every time the Monthly Supply of houses peaks, the United States is either in an economic recession or about to be in one (recessions are shaded in grey in the chart below):

Clearly economic recessions and spikes in Monthly Supply of houses are correlated, although the direction of causation is probably that the Monthly Supply increases because fewer homes are being sold because conditions in the economy are weak. In other words, the economic downturn causes a peak in supply rather than a peak in supply causing an economic downturn. Because, remember, Monthly Supply can increase due to new homes coming onto the market, but it would also become elevated if the homes that are already on the market are not being sold and therefore remaining on the market, which would be the case immediately before, during, or after an economic recession; people slow down with home purchases if the economy is bad. For the crowd of people out there expecting an economic downturn, spiking Monthly Supply of homes-for-sale could be a leading indicator.

What About Prices?

For now, home prices have stayed elevated according to most metrics. For example, the S&P CoreLogic Case-Shiller home price index shows prices were up 6.03% year-over-year in February. This is largely a function of such limited supply; since there have been so few homes for sale, prices have stayed elevated.

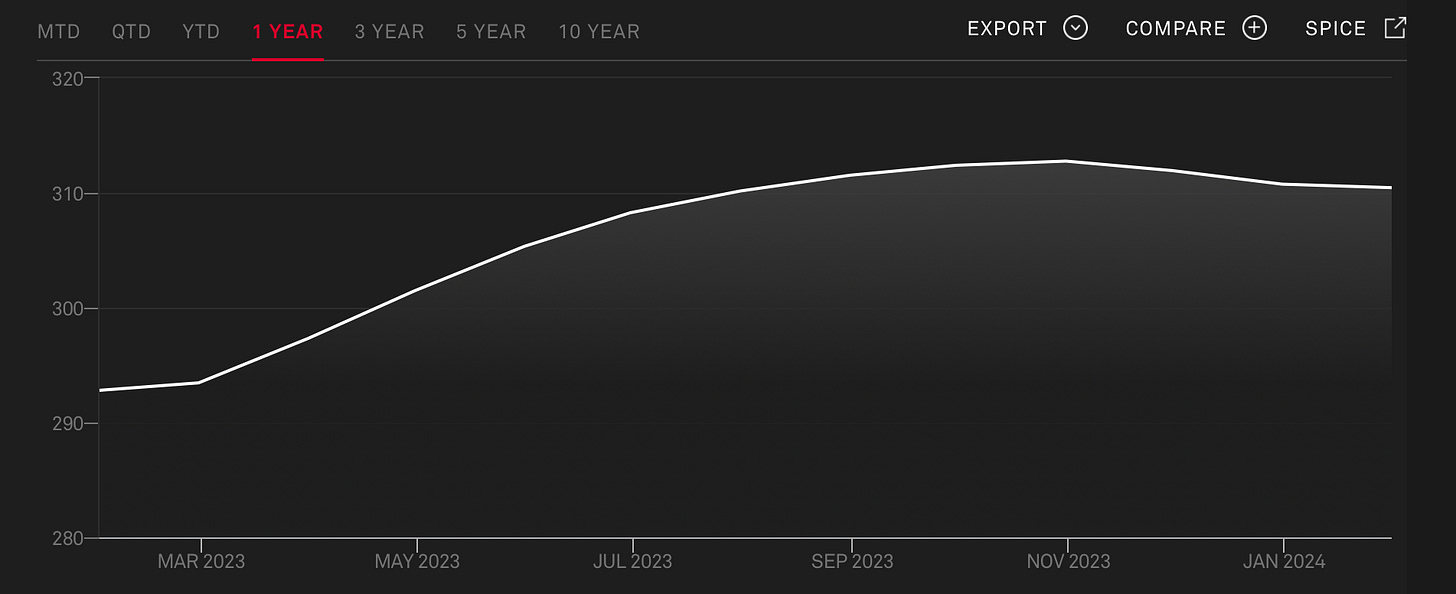

This might not tell the whole story, however. If you look at the Case-Shiller chart, you will see that most of the year-over-year increase was, in fact, achieved in the first few months of the period before prices leveled off:

It is almost certain that future readings of this index from, say, August 2024 onwards will show price declines on a year-over-year basis.

Why are prices declining (or, about to)? It is all about supply and demand. The supply of new homes for sale has been increasing both from sellers listing their homes and developers building new ones. At the same time, demand for new homes has dropped. The number one variable impacting demand has been high interest rates, which make the math of buying a home extremely frustrating if not downright impossible. As I wrote about last August, a lot of would-be homebuyers have simply given up. A second variable is that people are generally pessimistic about the economy right now; in a Gallup poll from earlier this month, only 30% of Americans rate the economy as “excellent” or “good” while 69% of those polled say the economy is “only fair” or “poor.” As mentioned above, people are not as likely to make big financial moves like buying a home when they are feeling economically uncertain.

What it all adds up to is rising supply and falling demand, which is a recipe for lower prices. If you’re a seller and you have a place to move to, now is a good time to sell. If you’re a buyer, patience is key: conditions for buyers are only set to improve as we progress through 2024.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.

Weekly Round-Up

Here are a few things that caught my eye this week:

Here in Maine, investments in mobile home parks are under scrutiny. I wrote in December about a new rule here in Maine that requires sellers of mobile home parks to give park tenants potentially up to 150 days to secure financing to buy the park before they can sell it to someone else. Well now, the Governor of Maine is proposing a $5 million fund to help support tenants who want to buy their parks. Per Michael Shepherd of The Bangor Daily News, “The new fund will offer low or no-interest financing to resident cooperatives and complement other financing options to support mobile home park purchases in Maine.” Read more here. This come after a different Bangor Daily News story that found that mobile home park rents increased considerably after out-of-state buyers purchased the parks.

For the past two years I have been writing about The Golden Handcuffs, also known as the lock-in effect. Well now researchers from the Federal Housing Finance Agency have actually quantified the impact. In a recent working paper, they say:

In the United States, nearly all 50 million active mortgages have fixed rates, and most have interest rates far below prevailing market rates, creating a disincentive to sell. This paper finds that for every percentage point that market mortgage rates exceed the origination interest rate, the probability of sale is decreased by 18.1%. This mortgage rate lock-in led to a 57% reduction in home sales with fixed-rate mortgages in 2023Q4 and prevented 1.33 million sales between 2022Q2 and 2023Q4.

The researchers also say the impact of contracted supply due to the lock-in effect in terms of increasing home prices was greater than the impact of higher interest rates in lowering prices. Read the summary and/or the actual white paper here.

Via Odeta Kushi, economists had only been expecting there to have been 1.44 million new housing starts in February. But the actual number? 1.52 million. This figure was 10.7% above the January number of new housing starts and 5.9% greater than the February 2023 number.

Daniel Kahneman died this week. Kahneman wrote, among other things, Thinking Fast and Slow, which is the best book I can think of to help explain how human beings make decisions. From a write-up this week in Financial Times, Kahneman found, “People rely as much on flimsy as on solid evidence of what the probable outcomes are; they are guided less by probabilities than by how closely a situation represents preconceived ideas…they also have a propensity to stick with the status quo.” You can buy the book from your local book store. Maybe we should have a Sunday Morning Post book group!

Have a great week, everybody!

Great post Ben. Monthly supply looks like an excellent indicator or the prospects for a recession.

Let us imagine that housing could be financed at half a percent more than the average of the 20 year Government bond rate over twenty years. First, is there any reason why private banks should not do it. Second, if not banks then who? Would superannuation funds be interested. Or would it require a government owned bank? Would this ever be possible in the USA? Finally, how would this impact the economy? Would it not tend to stabilized and de-risk the building industry and tend to flatten the cycle of house price inflation? It should help people sell houses to move on to better job prospects or to downsize that would tend to increase efficiency and national productivity.