Household Formation Stats and the Potential Easing of the Housing Crunch

Want to receive my Sunday morning articles each week? Click Subscribe below.

Household Formation Stats and the Easing of the Housing Crunch

Economists and sociologists will study the pandemic era for generations trying to understand how this global event impacted so much of our collective behavior, economic and otherwise. I remember reading one thing relatively early on (and I’m sorry for not remembering or saving the reference), that the economy was surging during COVID because demand was being pulled forward. In other words, people were accelerating plans they had, which created an artificially high level of spending.

This demand pulled forward was due to a variety of factors, including the fact that people were stuck at home pondering life’s meaning and unpredictabilities with reminders about our mortality all around us, yet often frustrated and rudderless. Spending became a form of therapy, to some.

This spending was also boosted by several rounds of stimulus funds plus historically low interest rates that made it cheap to borrow. People renovated kitchens, added patios, and created home offices. Others moved or acquired properties and other assets. Eventually people traveled, once it was safe and socially permissible to do so. Entertainment and eating out took a little bit longer to rebound, but they eventually did. And people invested money in weird things, like NFTs, cryptocurrencies, and even sports cards and shoes. All of this I wrote about in June 2021, calling it the “The Eat, Drink, and Be Merry For Tomorrow We Die” economy.

But what also happened over the past three years is that people made lifestyle adjustments. Some were easy to see, like work-from-home migrations out of some of the big tech cities in the west and from places like New York City. This was evident here in Maine, where we saw an influx of new residents and a growing population after years of stagnancy. Others adjustments were harder to see at first, but are becoming more clear as the data unfolds, including the topic I am getting to today.

All of this demand pulled forward created, arguably, some bubbles in the economy including in the real estate and rental markets. I am not saying that in pre-COVID times the housing picture was perfectly rosy and that everyone who needed a place to live had one; we have had a housing shortage for at least ten years and really longer. But it did seem like the housing crisis became much more acute over the past three years? Why?

A lot of what I wrote about in May 2022 about the reasons for declining vacancy rates in rental units is still applicable, but I want to hone in on one of the variables I touched on in that piece and in subsequent articles but have never really focused on: household formation and its related statistic, the fact that there are fewer people living in each home or rental unit today than at any other time in U.S. history. Let’s dig into the statistics and also take a look at whether some this might now be reversing.

What are Household Formation Statistics and Why Do They Matter?

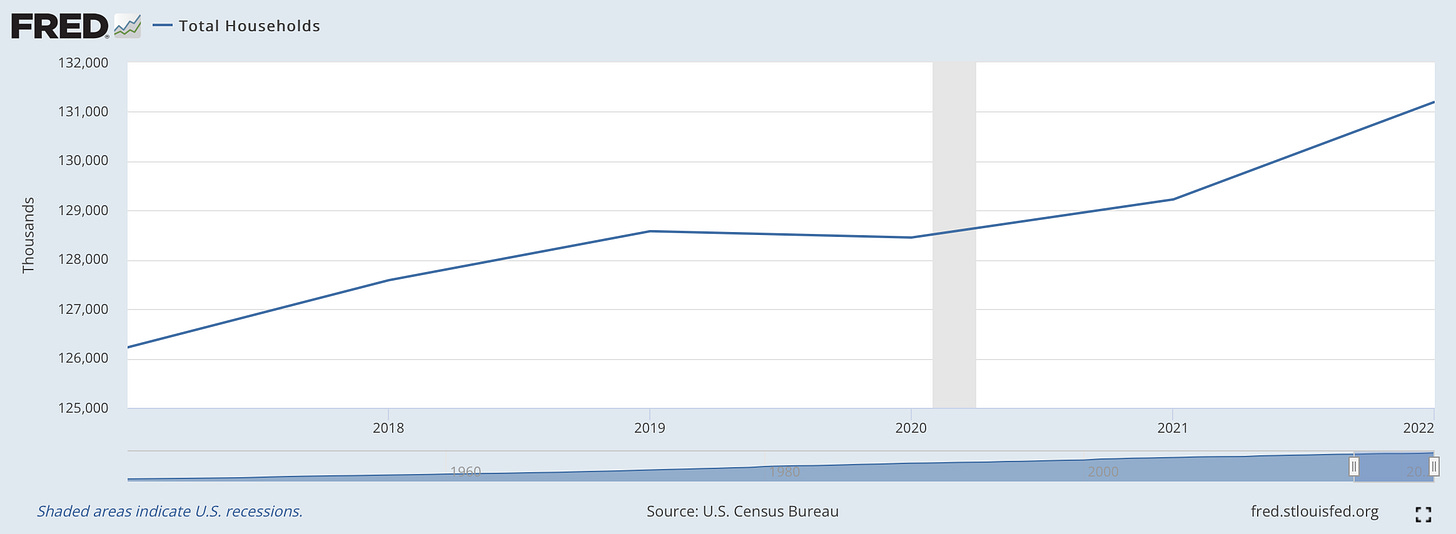

The chart below shows the number of households in the United States (in thousands) over the past few years. A “household” can be a family with children, a couple, people living alone, an apartment with multiple roommates - you name it - there are lots of different households out there. The number of households dropped modestly from 128.6 million in 2019 to about 128.5 million in 2020 before the pandemic. But then by 2021, the number of households had increased to 129.2 million and then the number increased again to 131.2 million in 2022. That is about 2.7 million new households in two years.

Where did these new households come from? While some new households were certainly created by new immigrants moving to the United States, the net migration rate in this country has actually been down over the past few years. Divorces can create additional households as families split, although the divorce rate is actually historically low in the United States these days. And while there are always new births, these do not really create new households as it is rare for a baby to live alone.

I would submit that the number of households in the United States has increased over the past three years because, simply put, more people want to live alone and have had the economic means to be able to do so. It is possible that wanting to be socially isolated during the early days of COVID played a part of this. But I think more notably, this growth in household formation has been driven by larger variables including the fact that the labor market has just been so strong over the past several years, which means that most people are working and are feeling financially secure thanks to earning money and having job stability.

Several rounds of stimulus funds also played an important role. People who might not have been economically secure enough before now had extra funds to put down a down payment on a home, pay first and last month’s rent and a security deposit on an apartment, or just feel confident enough to be able to make mortgage or rent payments living alone or at least with fewer roommates to share the rent. In other words, the economic boost that came from these financial stimulus programs led people to go out on their own.

Add it all up (low interest rates + economic security + fiscal stimulus) and you get demand pull forward for new home purchases and for more stable rental situations including people wanting to live alone. Absent an increase in net migration and without a jump in divorce that would lead to new households being formed, the growth in household formation is best explained by lifestyle adjustments due to these economic and sociological factors.

What Happens Next

I’ve shared this chart in the past, but I’ll do again here as I find it to be particularly interesting and relevant. The number of people per household was 2.5 as of 2022, the lowest number since the statistic was first tracked:

I don’t think this figure is likely to jump up anytime soon to, say, 2.60+ people per household because birth rates in this country are so low. In comparison, the large number of people per household in the 1970s was more a factor of families having so many more children than they do today. But, I do think the number of people per household is likely to tick up over the next year or two. So too will household formation statistics start to change. While there might not be a major drop-off in the number of households, it is also not likely that the trend over the last 2+ years during which time the U.S. has seen an additional 2.7 million households created will continue either.

Why? The same factors that created a surge in new households are largely reversing. Interest rates are much higher, which makes it harder to buy a home. The passing of COVID-19 combined with stimulus fatigue and a split Congress make any additional fiscal stimulus very unlikely. And people are starting to feel less economically secure due to inflation and the potential of a looming recession as business activity starts to slow down. Look at what happened during the last most notable period of economic uncertainty (to put it lightly) in this country; from 2007 to 2011 the number of people per household increased from 2.56 to 2.59.

People are tightening up and becoming more conservative financially, which is going to lead to some household contraction because just as people made lifestyle adjustments as conditions loosened up, so too will they make adjustments if things do continue to change for the negative. For the rental market, in particular, this has significant implications. What if we don’t have 2.7 million more households over the next three years but instead have several hundred thousand fewer households? This would be the case if enough renters decide to live with more roommates in order to share rent or as they move back in with family members to save on rent altogether. Fewer renters in the pool of available tenants as households combine would mean a less competitive rental market, which could mean higher vacancies and declining rents.

As I have mentioned before, one’s perspective on this depends largely on where one sits in the rental ecosystem. If you are renter, there is hope that the acuteness of the housing crisis might ease over the next 12-24 months, which would provide some relief. If you are a rental property owner, this is a reason for caution.

To the latter category of people including real estate investors, my advice remains the same: constantly challenge your assumptions, think long-term, and be patient. You need to analyze your predicted cash flows based on average market conditions over a historical period and not the buzz of the last few years, which means factoring in higher interest rates, greater vacancy rates, and rents that do not steadily appreciate. The conditions that created such a positive environment for real estate investment particularly with regard to residential rentals over the past few years are not likely to remain the same. Economies evolve and people adapt, which we saw in one direction from 2020-2022 and we may see in another in 2023-2024. A free market economy will still reward risk and hard work so real estate investment is still a worthy (and profitable) pursuit, but changing economic conditions could point to changing margins, and thinner ones at that, as people and markets adapt.

Ben Sprague lives and works in Bangor, Maine as a Senior Vice President/Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram. Opinions and analysis do not represent First National Bank. © Ben Sprague 2023.

Weekly Round-Up

Author’s Note: I stopped doing the Weekly Round-Up in order to focus my time more on the full articles and because I wasn't sure people actually enjoyed the Round-Up’s. However, a few of you have reached out to say you are missing them. And I had some extra time this week, so here we are - a few things that caught my eye from around the internet this week:

Some members of Gen Z won’t even apply for a job if the salary isn’t listed. This is a sign of changing expectations and a new generation coming of age that values transparency and not wasting time. Read more via: Business Insider.

As a follow up to last week’s article, a group is asking the FTC to investigate price collusion in the egg market, which a few of you said last week was actually the cause of rising egg prices instead of just the avian flu. From an interview with Southern Illinois Public Broadcasting, “We saw nothing that justified these egg prices, these price hikes…they are up 138% since last year. That's more than double. Meanwhile, companies that haven't reported a single case of avian flu are raking in record profits, reaching as high as 40% in some cases.”

NBA legend Steph Curry and his wife do not want new development near their home in a San Francisco suburb.

It’s been a great start to the year for the stock market. The NASDAQ is up nearly 12% in January. The S&P is up more than 6.00% and the Dow is up 2.54%. Why the big jump for the NASDAQ? This index is more weighted to tech, which has seen a big jump in the past few weeks after a dismal 2022 (note: some of this jump is due to massive tech layoffs, which investors have cheered. So this is a bit of a mixed story for sure).

Do you still want the weekly round-ups? Let me know by commenting below, Liking the article, or sending me a message at bsprague1@gmail.com. Have a great week, everybody.

Keep up the weekly round up. Very informative.

This was a great read! Personally, I’m a fan of the ones where you apply history and demographics to advice for current investors (like this one, encouraging discipline). The comparison to 2007-11 was a good point.

An article about aging populations and their effects on tax bases, the viability of investment in a region, and if it can become a self-fulfilling prophecy of decline (aging customers consume less, fewer opportunities for new businesses, fewer people moving into the area?) could be a cool future topic. I think about it a lot at least, but I may be overblowing it’s real effect.