Housing Market Preview 2022

Happy New Year! There are big things in store for The Sunday Morning Post in 2022 including more audio, interviews, specialized article content feeds, and more. Make sure you’re subscribed (for free) to get researched, detailed, ad-free content about the economy and real estate in your inbox each Sunday morning. Thanks for reading and if you think others might get something out of it, please consider sharing this article.

If you’re a homeowner, seller, builder, construction contractor, real estate agent, or otherwise connected to the overall housing market, 2021 was a good year. And despite a sharp dip in the spring of 2020 at the outset of COVID here in the United States, the previous year wasn’t so bad either, at least if you’re on the building and selling side of things. If you’re a buyer? Well, your perspective is probably different. Stories abound of fierce bidding wars, properties going under contract far above list prices sight unseen, and precious little inventory especially at low and moderate price points.

Home prices rose by nearly 20% in 2021. In certain markets, the increase was even more significant. This boom has been fueled by robust demand from buyers with healthy balance sheets and strong credit scores amid a recovering economy, a new generation of potential homebuyers coming of age who want to buy, a surge of institutional and small-to-mid scale investors scooping up real estate, and, perhaps most importantly, record-low interest rates. You can buy a lot more home when interest rates are low, which has been the case for quite some time now.

For retrospective looks at housing and my previous housing analysis and predictions, you can review my articles “2021 is Different than 2007” and “The Housing Supply Gap,” among others from the archives. But the new year is upon us. It is time to look ahead!

The Key Question for 2022

What I will be watching most closely in the months ahead is how the tension plays out between buyer demand for homes and rising interest rates. What will be the stronger variable? Will there be enough buyers to sustain continued growth in the housing market even as interest rates go up? Or will the impact from rising interest rates be so significant that it pushes buyers to the sidelines, deflating home prices in the process.

And interest rates are definitely going up. After holding tight to the word “transitory” (i.e. temporary) to describe inflationary pressures in the overall U.S. economy over the past year, the Federal Reserve, faced with steadily rising inflation, has finally given in. Consumer prices rose at an annualized rate of 6.8% in November, the fastest rate of increase since the early 1980s. Fed Chairman Jerome Powell responded by saying, “I think it’s probably a good time to retire that word [transitory].” He also signaled up to three rate increases for 2022 including one as soon as March.

From the archives: analysis of the relationship between employment, inflation, and interest rates.

What do these expected rate increases mean for the housing market? Market experts believe that the Fed’s expected rate increases will take the average fixed rate on a 30-year mortgage from its current level of approximately 3.00% to at least 3.60% by December 2022. I actually think it will end up closer to 3.80-3.90% by the end of 2022. This should have a modest dampening effect on the housing market because, as noted above, the average buyer just cannot afford as much house as rates go up.

What does a dampening effect even mean, though? What dampening means to me is that home prices will continue to increase over the next 12 months, but the rate of increase will decline. In other words, I believe that home prices will continue to rise, but they will not be rising at the same rate as they have over the last 12-18 months. Whereas home prices increased nationwide nearly 20% in 2022, I believe that home prices will rise by an average of 7-9% over the next 12 months. I think the bulk of that increase will come in the first half of 2022 with prices starting to plateau (though not actually falling) by the third and fourth quarters of 2022.

The Factors Still at Play

Many of the catalysts that drove and supported a robust housing market in 2021 are still relevant as we enter 2022; the changing of the calendar itself from December 2021 to January 2022 is somewhat arbitrary. The problem of low inventory, for example, continues to plague the housing market (at least from the buyer’s perspective). And there are still significant headwinds towards the broad creation of new housing stock, which include the still-high prices of all types of building materials, the scarcity of labor including an aging workforce especially in the trades, and restrictions on the construction of housing at the municipal and state levels of government. These are all tough nuts to crack from a policy standpoint, and will take a fair amount of leadership and cooperative efforts among executives and in legislative bodies around the country to help solve them. Unfortunately that type of leadership is in thin supply these days.

Another factor providing fuel to the buyer-boom is that it has become increasingly hard to rent (again, oftentimes for lack of supply). A study by John Burns Real Estate Consulting and shared on Twitter by their Director of Research Rick Palacios Jr. shows that vacancy rates for residential rentals are around 3.0% or less nationwide these days. Vacancy rates historically have been more like 6-8% and in the middle part of the last decade topped out at just over 10%:

On the one hand, the challenges faced by renters actually provide a boost to the home-purchase market because while not every renter actually wants or is capable of buying a home, for some potential renters faced with the challenge of finding a good affordable rental unit, the prospect of buying a home becomes more attractive. This represents a basic economic principal known as the substation effect. On a much simpler level, if the price of Coke gets too expensive, consumers will shift to Pepsi; on a more complex level, if it becomes too difficult or expensive to rent, renters will look to buy instead.

Then again, many of the very same people who are getting squeezed out of the rental market also can’t get into the housing market because transactions are too competitive, prices are too high, and inventory is too little, which means a lot of people are left out and faced with the very real challenge of figuring out where to live. I plan to write more about rising rents and low rental inventory in a future article as they represent crucial challenges to our economy as a whole as we look ahead to 2022 and beyond.

The Impact of Investors

The strength of the rental market has also drawn a lot of investors into it over the past few years. I see this every day in my work as a commercial lender. Literally not a day goes by when I am not in communication with either an existing client or a prospective one about their interest in buying a rental property. And oftentimes investors are buying single-family homes that might otherwise have been sold to a single person, couple, retiree, or young family to live in as their personal residence but instead is being purchased by a real estate investor who is then renting it out as a source of income. There has been a proliferation of rental property buyers in the past few years who are attracted to the positive yields and prospect of price appreciation of their properties.

I think this is a big part of why home prices have risen so much and why they are likely to continue doing so over the next 12 months. The landscape is so competitive right now because prospective homebuyers are not only competing with one another, but they are also competing against these investors, who range from large-scale institutional investors who are chasing yield for their portfolios to mom-and-pop retail investors, couples who just want a source of side income, or young, eager investors hungry to grow what they hope will someday be consistent passive income from owning rental properties. Still other investors are scooping up properties simply to operate them as AirBNB’s.

In summary, with yields on other so-called “safe” investments like bonds, CDs, and money market accounts being so low, real estate has become a hot asset class and the result is more buyers, which represents greater demand, which leads to higher prices, which is exactly what has happened.

How the Housing Market Reverses

It is easy to look at a chart of the housing market or the stock market or the economy as a whole in hindsight and say that people should have known what was coming. And there are always voices in the wilderness predicting all sorts of possible events and outcomes. I am on the record as saying I don’t think the housing market is currently in a bubble, but at some point that will change. I think the housing market has legs to run. But a year from now, or two years, or five years: the story might be different.

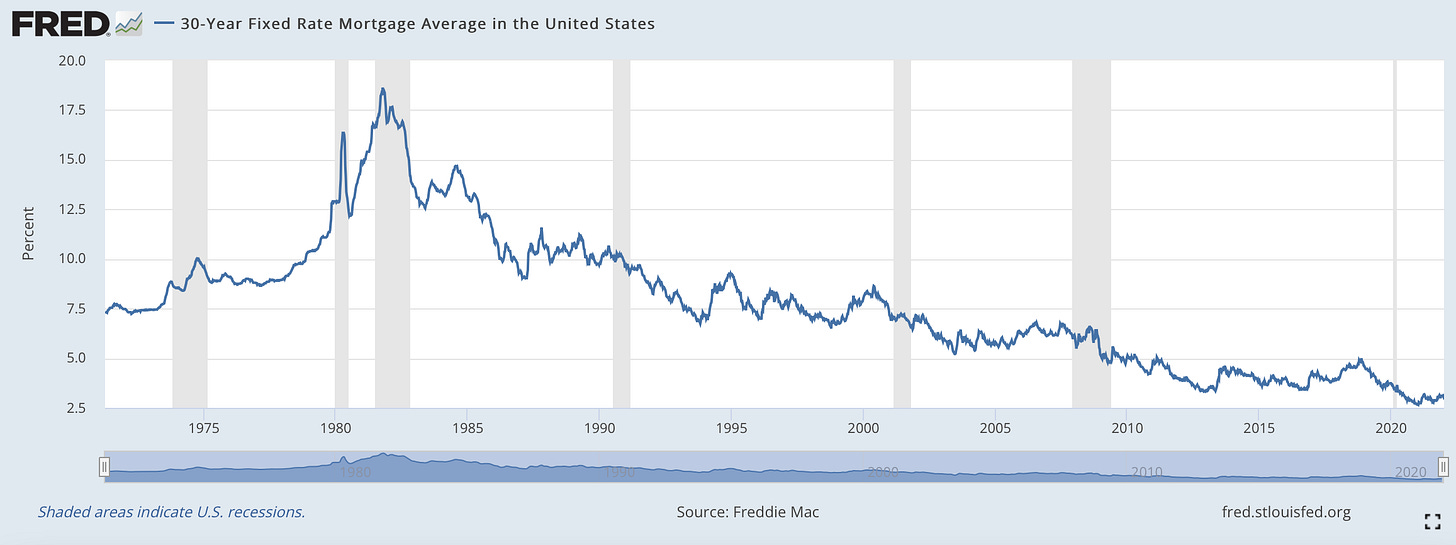

How does this housing market reverse itself, or, dare I say, burst? The number one way I see this happening is if inflation continues to spiral to the point that it is out of control. If COVID-related supply chain headaches loosen up and the flow of global business gets somewhat back to normal but inflation still persists, it will spell a big problem. The Federal Reserve is in a tricky place of needing to balance the competing needs of encouraging strong employment while not letting inflation get out of hand. The mechanism they will use if inflation continues to spike is to not just edge up interest rates but to raise them hard in an effort to stifle inflation back to a more manageable level. People who lived, work, borrowed, and invested in the early to mid 1980s will remember a time when this was exactly what the Fed did, which was to knowingly cause a recession by dramatically and punitively hiking interest rates in an effort to bring inflation down. The average 30-year fixed mortgage rate in 1981 ended up pushing 20%!

Can that happen today? Even though the Fed is supposed to operate independently of politics, I simply do not think the American Public today would stand for interest rates anywhere close to that level today. However, if rates do, say, double from an average of 3.00% to an average of 6.00% by 2023 or 2024 and perhaps even increase beyond that, it will have an impact on not just the housing market but the economy as a whole.

The other unknowable variable is that economic crises are, in fact, difficult to predict. Sure, in retrospect it is easy to make sense of what happened, but in the summer of 2007, for example, not that many people were expecting the sudden and significant downturn we had in the real estate market over the next 2+ years. There is, of course, a chance that COVID truly does not go away, for example, and governments around the world have arguably exhausted their stimulus options and no further relief might be available for individuals, families, and businesses. What then? The global economy could be in significant peril. If people were to start losing their jobs in mass, not only would a lot of existing mortgages potentially go bust, but there simply would not be as many eager and confident buyers in the market, which would depress housing prices.

And then there is always the proverbial, “Someone sneezes in Saudi Arabia and suddenly we are on the precipice of war with Russia and China.” Do I think something like that is likely to happen, well…not really. But the point is anything can happen that could disrupt an otherwise healthy market. Residential real estate has historically been an excellent investment and it likely will continue to be for many years into the future, but people should not expect there won’t be dips and dives and perils and pitfalls along the way.

If you had to pin me down on it, though, and what’s the point of analyzing things like this if you can’t put a number on the line, I’d say home prices will increase by an average of 8.1% in 2022. I offer this with a 85% confidence interval. Check back in with me this time next year and, by the way, make sure you’re subscribed below to continue getting my weekly articles and other upcoming content in your inbox each Sunday morning. Thanks for being here, thanks for reading, and best wishes for a happy and healthy 2022.

Ben Sprague lives and works in Bangor, Maine as a V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram.

Weekly Round-Up

Here are a few things that caught my eye around the web this week that I think you should know about:

In California and elsewhere, insurers want to base insurance premiums on the potential for future damage rather than retrospective data. Why? Climate change. Fires are becoming more common and more costly in California. Some insurance providers won’t even cover certain areas in California anymore. Via Debra Kahn in Politico:

Many property owners are already struggling to find insurers willing to renew their policies. The state also has intervened, demanding that they continue covering at-risk homeowners for the time being. But insurers dropped about 212,000 California properties in 2020, and about 50,000 homeowners — many in the Sierra Nevada foothills on the eastern side of the state — couldn't find another option on the private market.

Matty Yglesias shares a chart showing that wage growth is now significantly trailing inflation, implying that this is one reason people are so frustrated/grumpy these days.

Nicole Friedman writes in the WSJ about a point I made in this week’s article: that the demographics of demand (i.e. young potential homeowners coming of age) provides tailwinds for the current housing market in an article entitled, “Millennials Are Supercharging the Housing Market”: https://www.wsj.com/articles/millennials

Got a story idea, tip, or suggestions? Email me at ben.sprague@thefirst.com or bsprague1@gmail.com.

Our family spent New Years in Freeport and Portland and had a great time seeing the sights and lights. Happy New Years to you and yours and best wishes for a great 2022 ahead!