Housing Market Preview 2023

Greetings, readers, and welcome to The Sunday Morning Post. Each week I write about the economy with a focus on real estate and investing. If you are new here and would like to receive my free weekly articles, please click Subscribe below. Thanks for reading. If you enjoy this week’s article, please consider sharing with friends and colleagues.

[Editor’s Note: the focus of this week’s article is on owner-occupied residential real estate (i.e. homes). Check back in the next couple of weeks for more discussion and analysis about rental properties and other commercial real estate, although some of the conclusions are relevant to multiple categories of real estate.]

Housing Preview 2023

This past year was marked by several pivots in the housing market, which took things from booming, pandemic-related frothiness to a place of cautious apprehension. According to the National Association of Realtors, the number of homes sold in 2022 was down 35% versus 2021 with prices leveling off towards the end of the year. The number of transactions dropped ten months in a row through November (and will probably continue). Here in Maine, the number of transactions was down 28% in November as compared to November 2021, although prices were still up 8.33%.

A Quick Look Back

Before looking at the year ahead I wanted to quickly assess my housing preview article for 2022. Among the things I got right was a call that there would be a dampening in the housing market in 2022. I wrote:

What dampening means to me is that home prices will continue to increase over the next 12 months, but the rate of increase will decline. In other words, I believe that home prices will continue to rise, but they will not be rising at the same rate as they have over the last 12-18 months. Whereas home prices increased nationwide nearly 20% in 2022, I believe that home prices will rise by an average of 7-9% over the next 12 months. I think the bulk of that increase will come in the first half of 2022 with prices starting to plateau (though not actually falling) by the third and fourth quarters of 2022.

For this prediction, I give myself a passing grade. According to the Case Shiller Home Price Index as illustrated in the chart below, home prices rose by about 10% in the first half of the year before leveling off to an annual increase of 3-5% depending on how December’s data comes in once it is available later this month:

What I also got basically right was the overarching point that interest rates would be the driving variable in 2022, particularly if inflation remained elevated despite the Fed’s initial efforts to reign it back in. This is what happened, and it was the most important variable in the housing market in 2022. Talk to any realtor or banker you know and they are all likely to say that the housing market started to freeze up as soon as the 30-year fixed rate mortgage hit 6.00% towards the end of the summer.

What did I miss on in my 2022 predictions? While I predicted mortgage rates would rise, which was obviously to almost everyone at the time, I did not expect them to rise as much as they did, spiking above 7.00% in the fall before leveling off to the low 6.00% range by the end of the year. As of the time of this writing, the average 30-year fixed rate is 6.20% with the average 15-year at 5.70%. I did not think rates would rise above 4.0% last year. The speed and magnitude of interest rate increases were both more significant than I expected. Can’t win ‘em all.

The Year Ahead

I believe that home prices will drop in every regional market in 2023. Declines will be the most significant in the areas of the west that previously experienced the most significant increases in the early days of the pandemic, which includes places like Phoenix, Denver, Salt Lake City, Las Vegas, Seattle, and Boise. Some of these markets may experience average price drops of 20-25% before things stabilize. Declines will be less significant in the south and northeast, where the run-ups during the COVID boom were also not as significant, but prices will also ease down in these markets.

Why will prices drop? It is simple economics: home prices are too high relative to the current level of demand. While homes are certainly a complex “item” to buy, the basic principle of economics applies as it does to other items for purchase like cars, pizzas, pineapples, and widgets, which is that if the price of a good or service is too high relative to demand, the price of that thing will drop until equilibrium with demand is met.

And home prices now are way too high relative to demand. Consider the following: one year ago, the average median home price in the United States was $360,000. Based on a 3.00% interest rate at the time on a thirty-year fixed rate mortgage, the monthly payment on that home assuming a bank loan that financed 90% of the purchase would have been $1,366/month. Today the median home price is around $370,000 and the average 30-year fixed rate is 6.20%, which means the average monthly payment is around $2,039/month, an increase of $673/month or just over $8,000/year.

An additional $8,000/year in mortgage costs is simply too much for many qualified buyers. And for other potential homebuyers, they are no longer even eligible for bank financing because their debt to income ratios do not support an additional $8,000/year of debt. At the current 6.20% interest rate, a home price would have to be about $248,000 to generate the same $1,366/month payment that a buyer on a $370,000 home would have paid twelve months ago. This is about one-third lower.

What I am seeing right now when I talk to people is patient buyers who are willing to wait things out. With many of these buyers staying on the sidelines and millions of other potential buyers removed from the market due to no longer qualifying, it represents evaporating demand, which will lead to prices coming down.

Other Variables Driving Demand

Besides interest rates, there are several other variables impacting the demand side of the equation that are no longer the same as they were from 2020 to early-2022. For example, COVID-related population migrations especially out of the larger tech centers on the west coast and other large cities like New York have largely petered out and, in some cases, are actually reversing.

The impact from investors, which I flagged as a major variable in my 2022 housing preview article, has also significantly lessened in the past few months. Deals just do not cash-flow as positively with a commercial interest rate of around 8.00% versus a rate of 4.50%, which is what a lot of rental property deals were priced at from 2020 to early-2022. I am seeing significantly fewer rental property deals coming across my desk as a commercial lender today than I did at any point over the past seven years.

There are also fewer so-called iBuyers today, with algorithm-driven real estate companies like OpenDoor, Zillow, RedFin and others backing out of the market. Many of these online firms experienced significant losses in 2021 and 2022. With fewer of these firms being active in the real estate market plus mom-and-pop investors and other small-to-mid size rental property owners at least temporarily going to the sidelines, there will just be fewer buyers propping up prices for single-family homes that they want to then rent out or for 1-4 family rental properties or larger multiunits (more on this topic in a future article about rental properties).

This sentiment is starting to be seen in several of the commentaries and analyses of national real estate analysts I follow:

And lastly, one additional variable that is likely helping to freeze up the housing market (and this may be the most important one other than interest rates in the months ahead) is that people are nervous about the economy. Consumer sentiment is down, people are nervous about a possible recession, and persistent and stubborn inflation continues to hit people’s wallets. People are not in a buying mood.

What it Will Look Like

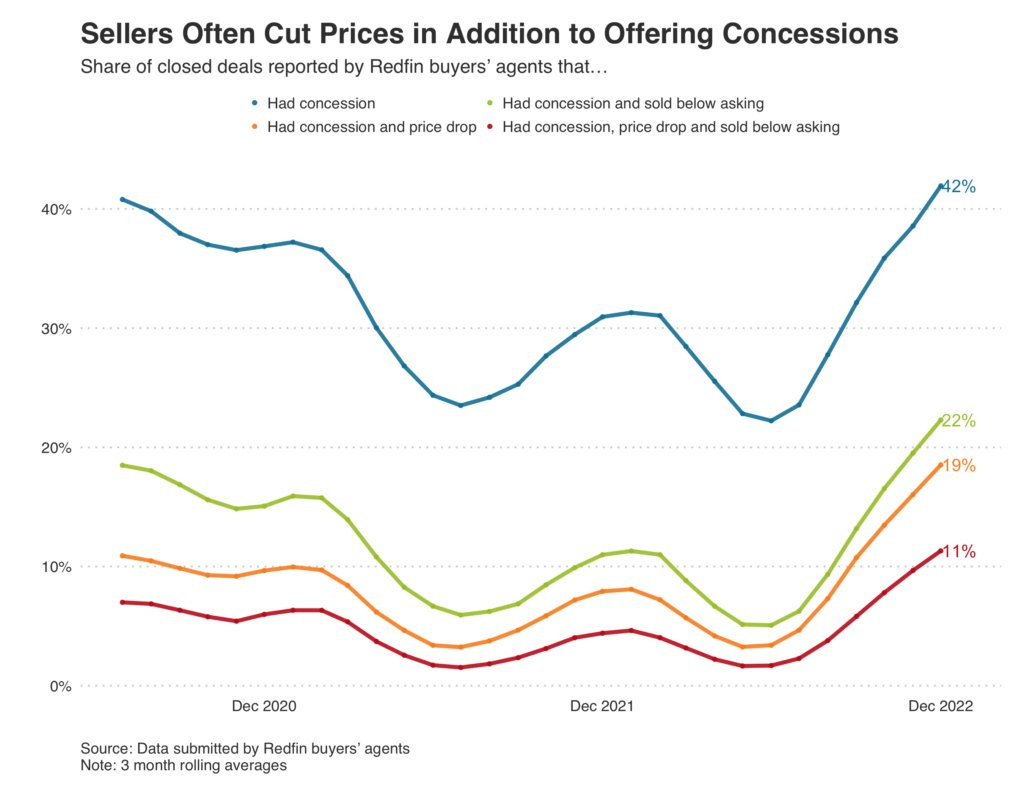

Signs of what the housing market will look like over the next year are already evident. A key theme has been, and will continue to be, the shifting of power in the real estate market from sellers to buyers. According to Taylor Marr of RedFin, a record 42% of home sales in the fourth quarter of 2022 included some sort of seller concession like money for repairs or closing costs.

RedFin also reports that 40.4% of home sales at the end of 2022 faced some sort of competition between buyers, which was down from over 60% in 2021. Homes are also staying on the market for longer, an average of 37 days versus 23 days the year before. Less competition among buyers and homes staying on the market for longer are both indicators of flagging demand.

Another factor at play is that millions of existing homeowners are locked into fixed-rate mortgages around 3.00% or even less. What is the motivation to sell? Unless people can turn the sale proceeds into a cash purchase of a new home or have other assets to be able to pay for a home out-of-pocket, the need to otherwise finance a new home acquisition with a bank loan disincentivizes moving right now. People who might be passively interested in moving or thinking about moving up-market might simply decide not to because of this lock-in effect.

So add this all up and it means fewer and less urgent buyers, which combined with high prices and high interest rates will mean that fewer transactions will take place, which will lead to lower prices in the months ahead. Sellers may still be anchored in their minds to 2021 prices, but 2023 will be different.

Don’t Fight the Fed

There was a saying I used to keep in mind when I was working as an investment advisor: Don’t Fight the Fed. What that meant in the investment world was that at least for awhile following the Great Recession, the Fed was signaling in different ways that it was going to make efforts to prop up the economy. This combined with fiscal stimulus from Congress meant for a pretty positive investing environment, and, indeed, U.S. stock markets had great returns starting in 2009 for most of the next decade.

What is the Fed signaling today and how will it impact the real estate market? Clearly, the message from the Fed is that there will be some pain in the economy until inflation gets under control. And the pain that will be felt will be most acutely experienced by people in certain industries, including real estate.

Fed officials are also signaling that there will be yet more rate increases in the months ahead, including likely increases of 0.25-0.50% at its next two meetings. On November 30th, Fed Chair Jerome Powell said the following:

We need to raise interest rates to a level that is sufficiently restrictive to return inflation to 2 percent. There is considerable uncertainty about what rate will be sufficient, although there is no doubt that we have made substantial progress, raising our target range for the federal funds rate by 3.75 percentage points since March. As our last postmeeting statement indicates, we anticipate that ongoing increases will be appropriate. It seems to me likely that the ultimate level of rates will need to be somewhat higher than thought at the time of the September meeting.

The Fed is dead set on raising rates until inflation is back to a more manageable level of 2.0%, which means more pain to come for the real estate market and a continuation of all of the variables noted above that are hampering demand.

A Word on Inventory

One reason I believe that prices have not already dropped more at this point is that inventory levels are fairly low, at least historically speaking. This may be partially a result of sellers not wanting to subsequently buy into such a detrimental market right now, as noted above, so they are just not listing. There is also some evidence that potential sellers are listing their homes for rent instead, a topic I plan to delve into more in the weeks ahead.

According to Mike Simonsen of Altos Research, inventory levels are 67% above where they were this time last year, but they are still way down relative to 2020. This is also what I’m hearing from some buyers out there, who report that even if they are interested in buying, there is just not much on the market right now.

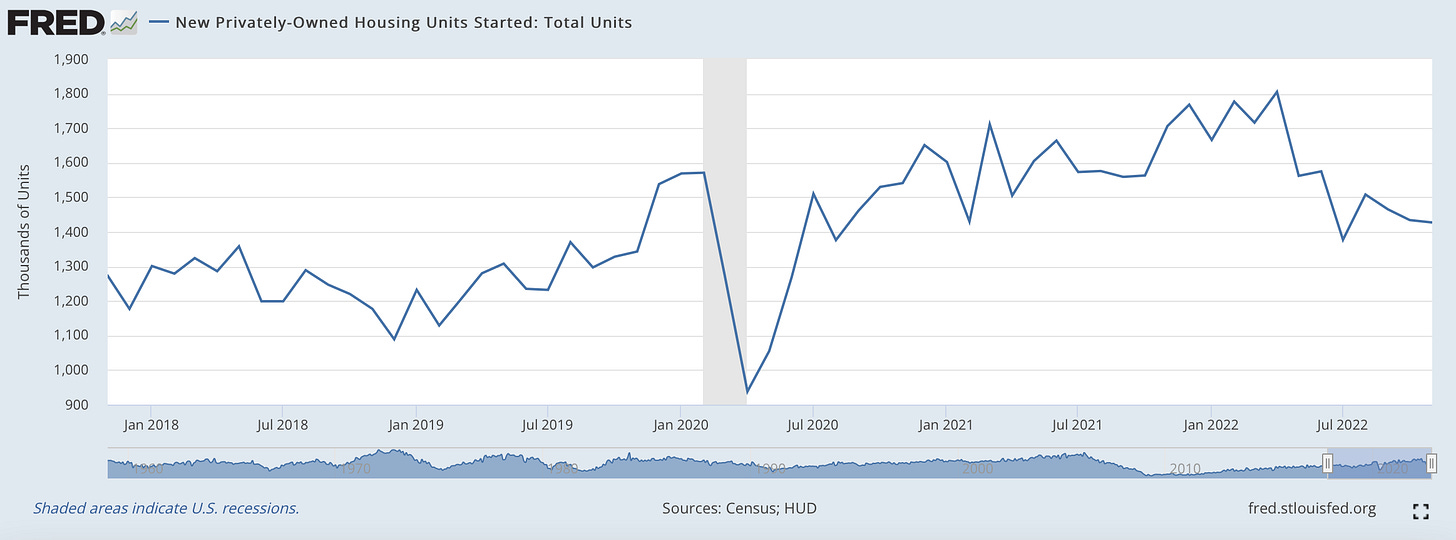

Will inventory come back? Well, according to data from the St. Louis Federal Reserve, after steadily increasing from the early days of the pandemic, new housing starts have dropped considerably in the past few months from a peak of 1.8 million homes in April (on a seasonally adjusted basis ) to about 1.4 million in November. This is the interest rate effect, I am sure, where home buyers of newly constructed homes are going to the sidelines in the face of higher rates. The chart below of new housing starts shows the drop evident on the far right side just in the past few months:

It does not feel to me like a massive wave of new housing is going to hit the market (rental properties may be different; stay tuned). However, one additional thing to keep in mind is that cancellation rates are also spiking. This is important to consider if you are a buyer who is waiting out more options, but it is also crucial for homebuilders to be mindful of as we look to the year ahead. Not only is there more buyer remorse creeping into the market, but the interest rate a buyer had locked in at the beginning of a home construction project may not be the same one they have by the end of the construction, especially keeping in mind that construction has been taking a lot longer due to a tight labor market for workers, contractors, and subs, plus continued supply-chain issues. According to John Burns Real Estate Consulting, the cancellation rate as of October 2022 was 26% nationwide, up from 8.0% the year prior. The cancellation rate was a staggering 45% in the southwest and 39% in Texas, both up even more significantly versus the year prior than the nationwide totals. It is a tough time to be a homebuilder in Phoenix, I’m guessing.

Is the Housing Market About to Collapse?

Falling home prices in and of themselves don’t necessarily constitute a housing crisis. The ones who will feel the most pain are people who need to sell and may find there are significantly fewer buyers than there were a year ago. And even if people are not selling their homes, it certainly doesn’t feel good to know that your home value is dropping. But this doesn’t mean it is a housing bubble or that we are about to see an all-out collapse.

But you have to keep in mind other variables too that do not suggest we are about to experience some major economic collapse. For starters, the labor market remains very strong. People are working and wages are generally rising. Consumer spending also remains high despite consumer sentiment being low.

The housing crisis in 2008 came from people not being able to afford their mortgages. And that is the great risk to the federal reserve right now: if they raise interest rates in such a way that crushes the economy, leading to job losses and other financial peril, which would make people not be able to for the mortgage payment, then we will be at the precipice of a real housing crisis.

Personally, I think the path to a soft landing still exists. Bank underwriting standards have also been generally higher since the Great Recession and existing homeowners have more equity built in than they did in 2007. So the credit risk of massive defaults and foreclosures is less than it was back then.

But it is time for the Fed to stop hiking rates and let things settle out for awhile. There is already evidence that inflation is on the decline, and housing inflation, which includes both home prices and rent, is definitely declining. I am optimistic that future inflation readings throughout the first half of 2023 are going to show continued declines in inflation with or without more intervention from the Fed. The key thing to watch will be the tension between further rate increases, inflation, and all the other key variables in the economy like employment, wages, and spending that will need to not weaken too much in order to prevent a true housing crash. I think the path is there to a soft landing, but only if the Fed recognizes that inflation is already on the decline and it does not necessarily need to keep hiking rates as aggressively as it did for much of 2022.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram. Opinions and analysis do not represent First National Bank. © Ben Sprague 2023.