Housing Market Preview 2025

Housing Market Preview 2025

Many of the key economic storylines in 2024 revolved around inflation, particularly with regard to the impact of rising prices and the subsequent economic angst among voters as they headed to the polls in November. Other notable topics included the buoyant stock market, cryptocurrencies, and a mix of political and academic talk about the impact of tariffs (what a year!).

But one topic continues to pulse through the civic discourse, and that is high cost of housing. Next week I plan to write about the rental market, but for today, I wanted to take a look at the state of the market for single-family homes and discuss the outlook for the year ahead.

Whether you are a potential buyer or seller, if you work in the real estate industry either directly or indirectly, or whether you just have a vested interest in the health of the U.S. economy (which is all of us), the trajectory and stability of the housing market are important to understand.

Housing-related expenditures represent nearly 20% of U.S. GDP. As we saw from 2007-2010, a bad housing market can weigh heavily on the broader economy. And as we saw from 2019-2023, a robust housing market can ignite economic growth and create ripple effects across many different industries.

Before we look forward, let’s quickly re-hash 2024.

A Quick Look Back

I won’t revisit my entire 2024 housing preview article written this time last year, which if you are particularly keen to review, you can find here. My big conclusions when writing in January 2024 were:

I expect home prices to stay basically flat or to modestly decline in 2024 in most markets…I also think buyers have become much more rational in the past 6-12 months, which should help prevent further price spikes. There was a frenzy of buying from 2020-2022, but a lot of the noise and emotion of that has quieted down. Buyers have become more patient, and aren’t willing to duel with one another as much for something that is not actually the right fit.

I do expect prices to fall more in the West, which is where prices rose the most from 2020-2022. Places like Phoenix, Denver, Boulder, and throughout California plus trendy communities with frothy real estate markets like Austin, Tampa, and Miami could be poised for further drops of 10-15%. Here in the Northeast, I expect prices to be basically flat in 2024.

Different data sources provide modestly different conclusions, but overall, prices have decelerated and are showing signs of slight declines. According to the S&P CoreLogic Case Shiller U.S. Home Price Index, prices were up nationwide 3.60% from October 2023 to October 2024 (year-end data to compare December 2023 against December 2024 are not quite available), but as you can see in the chart below, prices leveled off and started to modestly decline starting in July:

According to data from the St. Louis Federal Reserve/FRED, home prices did, in fact, drop from Q3 to 2023 to Q3 2024, with a median nationwide sale price falling from $435,500 to $420,400 from October 2023 to October 2024, a drop of 3.5%.

I think we can call the 3.6% increase under Case-Shiller Index and the 3.5% drop in the Fed Index through October essentially a wash. Prices did ease down marginally in some of those big western markets and through parts of the Sunbelt, although not by 10-15%. Prices were modestly higher here in the Northeast. From where I write here in Maine, prices in November 2024 were up 8.45% over the previous November, so there is no real relief yet here in Vacationland at least on the buyer side of the equation.

On a non-quantifiable basis, it does feel that a lot of the frenzy in the housing market has subsided. I see a combination of three variables to explain this:

The interest rate lock-in effect: existing homeowners with pre-2023 mortgage rate of 3.0% or better are simply staying put.

The math: a lot of would-be homebuyers simply do not qualify at 7.0%+ mortgage rates, so they are out of the buyer pool.

Self-section out: for those homebuyers who do still qualify, many are simply withdrawing from the race in hopes that prices and interest rates will eventually come down or because they just can’t justify paying high prices with high interest rates, a double whammy as far as the math is concerned.

What does the reduced frenzy look like quantitatively? Fewer homes sold. In fact, per NPR, new home sales in 2024 were at their lowest level since 1995, a time when the population of the United States was 20% less than it is today. This comes even as inventory is ticking up. As of December 2024, there were 871,509 active home listings nationwide. That is up 22% over the 714,176 active listings in December 2023, and up 28% over December 2022 (note: it is important to compare a month/season/quarter of the year with the same period from the previous year, particularly with regard to the real estate market. Not only does comparing year-over-year smooth out some of the noise from short-term fluctuations, but the real estate market itself is quite seasonal; it would not make sense to compare December with June, for example, as the market is significantly more active in June due to reasons of seasonality).

Part of the reason there is more inventory right now is that sellers are finally starting to come back to the market (despite the interest rate lock-in effect). But the other reason is that homes are staying on the market for longer. This creates a modest swell in the inventory pool as homes are not selling quite so quickly, so they don’t fall out of the inventory as soon. The average home stayed on the market for 70 days in December 2024, up from 61 days in December 2023 and also up from December 2022 and 2021. So overall, we are seeing a more patient and selective buyer base. (The median number of days on the market for a home for sale bottomed out at just 30 days in the spring of 2022).

What’s in Store for 2025

Interest rates and inventory along with the overall health of the economy will be the key drivers in the housing market in 2025. On the interest rate question, we are starting the year from a disadvantageous position. Rates jumped again this past week to finish the day on Friday at a nationwide average 30-year fixed rate of 7.24%. This is up notably from the low 6’s we saw as recently as this past October, and up from 6.78% one year ago. A strong jobs report on Friday dampened expectations for imminent interest rate cuts, as it is now believed that the Fed could delay further drops given the apparent health in the labor market. More in this to come in future weeks.

In response to the recent run-up in rates, mortgage applications have slowed. According to data from the Mortgage Brokers Association via Trading Economics, mortgage applications have dropped for four straight weeks through January 3rd (I expect data through January 10th will show another weekly drop once it is available). Mortgage loan applications have dropped in ten of the last fifteen weeks, as shown in yellow in the chart below:

Fewer applications today means fewer buyers 60-90 days from now, which means fewer sales (although, to be sure, there are also cash buyers out there who are not subject to the same concerns about the interest rate environment).

On the inventory question, as noted above, inventory is starting to modestly pick back up (although the rise in total inventory is also a result of homes staying on the market for longer). I see inventory continuing to rise throughout 2025, for several reasons. First, there is pent-up demand to move among sellers. 2024 saw the fewest number of movers since the data started to be tracked in 1948, as shown in the chart below:

Eventually the tide has to reverse on this, though. The interest rate lock-in effect is real, but if you view human behavior on a bellcurve, in any given year there are a certain number of people who should be selling their homes either to downsize, move closer to family, move for a job, or move due to illness or a death in the family. These types of sales have all been dampened over the past few years. But eventually the dam is going to burst as would-be sellers either lose their patience or are finally compelled due to personal, professional, or family reasons to move. With these moves comes a tick up in buyers, but also turnover of homes from where they are leaving from.

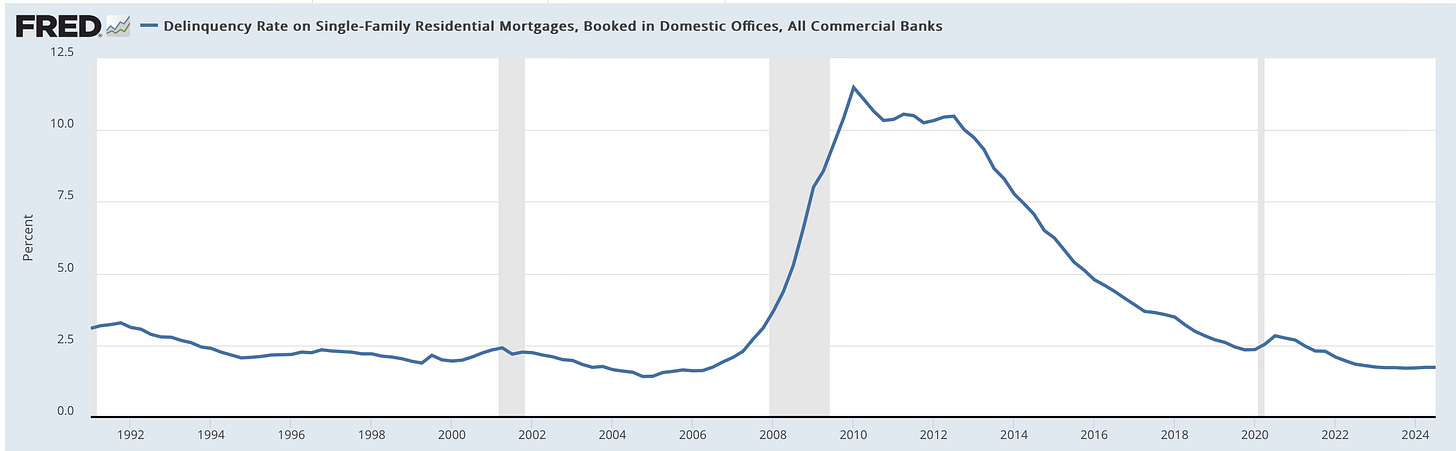

There have also been very few perilous sales, by which I mean sales that are forced for financial reasons. At the moment, the state of the U.S. homeowner is strong. The chart below shows delinquency rates on single-family home mortgages going back to the early 1990s. The delinquency rate in the third quarter of 2024 was just 1.73%, a figure near historical lows.

With such few delinquencies, there is not much turnover of homes. Tragedy as it is for anyone to potentially lose their home, the stability of the overall home market does depend on some turnover, whether those turnovers be perilous or not. This has not really been happening. I can say from my perspective as a community banker, the number of properties in foreclosure or collections is exceedingly low, which both banks and borrowers are of course happy about.

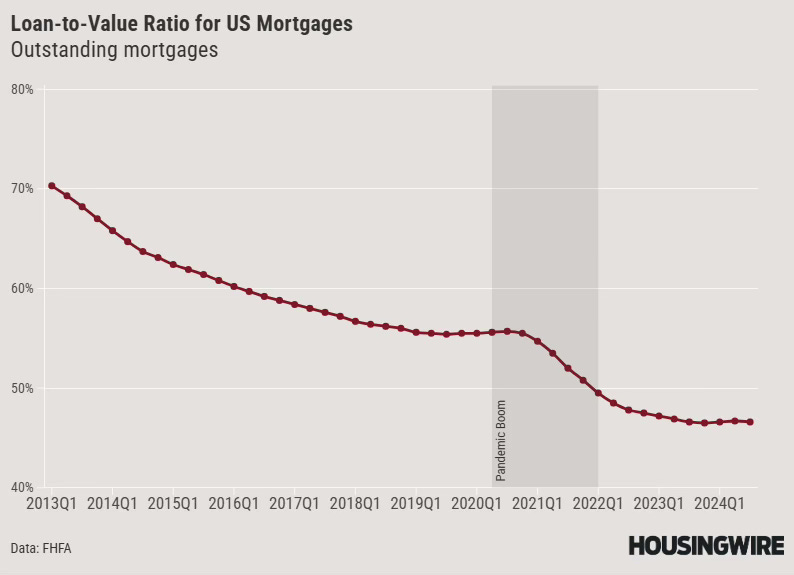

Homeowners do have a significant amount of equity in their homes, as well. The average nationwide LTV (Loan-to-Value) ratio is just 46.6%, which is an all-time low. This means that homeowners owe comparatively little relative to the value of their homes, which is attributable both to the degree homeowners who have stayed put have paid down their mortgages in recent years, and also to the significant increase in property values most homeowners have seen since 2019.

On top of that, an estimated 40% of U.S. homeowners don’t even have a mortgage. When you factor in the healthy LTV figures, the fact that many homeowners don’t have mortgages, and the very low delinquency rates, you get a snapshot of a pretty stable housing market.

I wrote several years ago about how 2021 is not 2007. This was in response to certain worries out there that the housing market was entering bubble territory and was going to burst like it did in 2008. But the data was much different in 2021 as compared to 2007, just as it is today.

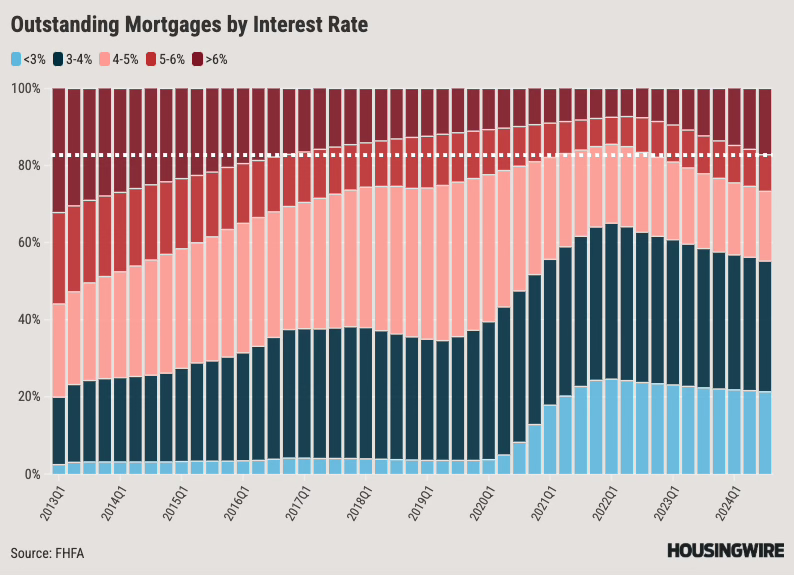

And yet, economies evolve. The percentage of mortgages with an interest are of 6.0% of more is increasing as a share of the total, as show in dark red in the chart below. Concurrently, the percentage of mortgages with an interest rate of less than 4.0% are shrinking, as shown in blue:

With more homeowners carrying mortgages with higher interest rates, is likely that delinquencies will start to tick up. It is really just the math of it all. People with higher rates are not only paying comparatively more in interest, but they also were more likely to have bought homes at higher prices (i.e. within the last two years); these are the mortgages, unfortunately, that are the most likely to go into delinquency.

It’s the Economy

The other big variable is the health of the overall economy. Despite people’s negative feelings about Joe Biden (just 36.2% of Americans approve of his job performance per recent polling), he is handing over an economy with 4.1% unemployment, 2.7% inflation, and a stock market near all-time highs.

There are clouds of uncertainty on the horizon, however, too many to list here. But with all the unknowns in the pending presidency of Donald J. Trump and the pendulum nature of the economy pointing towards some choppy waters ahead, there may be some economic turbulence in the next year. If this is the case, it will have two direct results on the housing market: more deliquencies, more sales, and, I believe, lower prices.

The Final Word: Prices

And this is the million dollar question in the home market: what is going to happen to prices. My belief is that home prices will drop in 2025. This may not be the case in every market and in every price range, but overall, I expect the median home price in January 2026 to be lower than it is in January 2025.

Why? Supply and demand. The housing market has felt anything but rational over the last half decade and homes are not the same type of widget as, say, toasters or pizzas or anything else your typical Economics 101 textbook likes to illustrate on traditional supply and demand curves. However, home prices are still subject to these two overarching variables.

On the supply front, you have an increase. This is coming through the inventory of homes for sale ticking up. There have also been a decent number of new homes built over the past 2-3 years. It would be nice if there were even more homes being built, but alas, many homebuilders are subject to the same interest rate limitations as homebuyers, and as rates have climbed, new construction has slowed. But there have been more new homes built over the last five years than over the five years previous to those, for sure.

On the demand side of the equation, you have a decrease. Buyers are self-selecting out because they don’t want to pay high prices at high interest rates if they are borrowing. Many others buyers are being screened out by not qualifying for loans in this rate environment. And some of the catalysts that did trigger the mania we saw in the housing market during the pandemic including the inward facing behavior many Americans experienced, the desire to live in a rural area, to have a home with an office so facilitate working from home, etc., have subsided a bit.

So add these two things together, an increase in supply and a decrease in demand, and you have a direct formula for falling prices.

I don’t think prices are going to fall off a cliff. For that to happen, you would need a significant economic pullback that includes high unemployment and serious economic failure. Who knows. I don’t see that happening imminently. But if there do start to be indications that home prices are falling, you may see a rush to the market among other sellers who want to try to lock in prices at the perceived top (and beat their neighbors to the market). This could be the beginning of a great reversing of the housing market from a seller’s market to a buyer’s market.

While there will be variability across markets, to sum things up, in 2025 I see interest rates staying at an elevated level (at least relative to where they were 2-3+ years ago), inventory steadily growing, which will provide more options to buyers and serve to decelerate price increases, and as the year progresses, I see home prices actually starting to fall between 3-5% and maybe 10% or more in certain markets.

We will see you next week for further analysis on the rental market and discussion about multiunit construction and the year ahead. Thanks for reading The Sunday Morning Post.

The Sunday Morning Post is always free, never pay-walled, and contains no ads. To learn how you can support this work and keep these articles free from clutter, become a paid supporter here or click to read more here.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.

Have a great week, everybody!

Question, Ben: Assuming you wrote this before the last 5 days of Los Angeles wildfires, will the loss of those thousands of houses have any measurable national effects on housing sales/prices?