How to Not Invest in Russia

Thanks for reading The Sunday Morning Post. Check back each week and make sure you’re subscribed (for free) to get my weekly commentary on the economy.

How to Not Invest in Russia

It is rare these days to have a conflict where the line between right and wrong is so clearly marked as it is in the crisis between Ukraine and Russia. Inspired by the courageous example of President Volodymyr Zelenskyy and the bravery and patriotism of countless ordinary Ukrainians who are valiantly fighting for their families, homes, and country, and outraged by the butchery of Vladimir Putin and the Russian military, bombing civilian targets including hospitals, apartment buildings, and refugee escape lines, people around the world are asking both how can we help and how can we punish Russia.

This question is made all the more complicated by the fact that most governments of the world including here in the United States and in so-called peacekeeping organizations like the United Nations and NATO are consciously choosing to keep their own militaries out of Ukraine for fear that direct confrontation with Russian would escalate the current crisis into an uncontainable conflagration.

Economic sanctions are crippling the Russian economy. I believe these sanctions will have their intended effect (eventually) for two reasons. First, the Russian military will run out of resources including weapons, food, and gas and will not be able to afford to replenish them. Second, the destabilizing and demoralizing effect of these sanctions will be so significant within Russia that the sanctions could eventually lead to the political toppling of the Putin Regime by some other domestic force, group, or individual. Hopefully, of course, in short time Vladimir Putin changes course and pulls back from his misguided Ukrainian invasion and the human pain and suffering will end, but the question of when that happens is probably best answered by a psychologist who understands the workings of an evil mind rather than an economist tallying up the ongoing costs.

What to Consider

One thing is clear, however. People around the world do not want to financially support anything that could help the Russian government. There are several things investors should be mindful of in terms of how not to invest in Russia.

The stocks of many foreign companies are traded on the New York Stock Exchange even if those companies are not headquartered here in the United States. This is done through what are called American Depositary Receipts. There are over 2,000 ADRs from 70 different countries including well-known companies like Toyota, Alibaba, Nokia, and AstraZeneca just to name a few.

Russian ADRs are not particularly notable companies to begin with, so most people are unlikely to be invested in them. In fact, in my research I could only find six current Russian ADRs:

Mobile TeleSystems PJSC (Communication Services) (Ticker: MBT)

Ozon Holdings PLC (Consumer Discretionary) (Ticker: OZON)

HeadHunter Group PLC (Industrials) (Ticker: HHR)

Mechel PJSC (Materials) (Ticker: MTL)

QIWI PLC (Information Technology) (Ticker: QIWI)

Cian PLC (Real Estate) (Ticker: CIAN)

There are two other publicly-traded companies that are not based in Russia but primarily serve Russian audiences: Yandex N.V. (YNDX), which is an internet company, and Nexters (GDEV), which is a Cypress-based video game company with close ties to Russia.

I had never heard of any of these companies prior to my research and it would be doubtful that most Americans are directly invested in these six companies. And, in fact, it is currently impossible to trade any of them at the moment because the Moscow Stock Exchange has been closed and the New York Stock Exchange subsequently halted trading in any Russian stocks including the ones mentioned above.. The shares of all eight companies were down significantly (some as many as 70%) year-to-date prior to being halted on February 25th, the day after the Russian invasion into Ukraine began, as investors began to anticipate that political instability if not outright war was going to be damaging to the profitability of these Russian companies.

Assuming most U.S. investors are not, in fact, invested in any of the eight companies noted above, there are still ways people might have exposure to Russia including through mutual funds and Exchange-Traded Funds (ETFs). These would include actively managed funds like the Voya Russia Fund, which is down a staggering 91% since the start of the year, and the VanEck Russia ETF, which is is down 70%. Other mutual funds especially those with an international flavor could have exposure to Russia too. The best bet if you are concerned about this is to find the list of companies a fund invests in or a pie chart of some kind that shows a geographic breakdown, which many mutual fund companies provide through their websites and fund prospectuses.

Bond funds, too, are not immune from Russian losses. Some investors may be particularly surprised to see bond-related assets, which are typically thought of as being safe and secure, losing their value or getting written off altogether. One of the biggest bond investors in the world, Pimco, faces billions of dollars in losses from their bad Russian bets.

Another way investors might be invested in Russian companies is indirectly through a passively-held ETF or index fund. I wrote several months ago in my article How to Invest Small Amounts of Money that Vangard index funds are a great way for most investors to get broad exposure to a diversified group of investments at a very low cost. Investors should be mindful that certain international funds like the Vanguard Emerging Markets Index Fund (VWO) invest in Russian companies. VWO itself has 2.93% of its holdings in Russian-based firms according to one source. Whether passively held investments in Russia that constitute such a modest percentage of an overall holding are enough to breach a moral and ethical line is really up to each individual investor, but it is something to consider.

Lastly, there are plenty of U.S. and international-based businesses that have a lot of activity in Russia. Many including McDonalds, Coca Cola, Nike, and dozens of others have cut back operations in Russia significantly or altogether in response to the Russian invasion of Ukraine. They have done this for noble reasons (to exert pressure on the Russian government, as well as public relations, but also because supply chains in that part of the world have been heavily disrupted and the Russian currency has become so wildly devalued that it is just impossible to do business as usual in Russia right now. According to Barron’s, there were four companies in the S&P 500 that had 4% or more of their sales from Russia last year: Phillip Morris, Pepsi, McDonalds, and EPAM Sytems. All four stocks are down significantly year-to-date and particularly since the invasion began.

What about investing in Russia?

I had to chuckle this week when I came up on an article by Tom Bemis and Riley Gutierrez McDermid in TheStreet speculating about whether it was actually a good time to invest in Russia. They offer, “Separate and apart from one's feelings for democracy, justice and truth, putting something into a Russian ETF could potentially offer a chance for some short-term gains at the very least.” This was published on February 24th. The VanEck Russia ETF traded around $15.50/share on February 24th. It dropped to $5.65 by March 4th and has since been halted. Investors who tried to cynically take advantage of the recent sell off in Russian stocks by buying into the VanEck Russian ETF on February 24th experienced a 63% loss in less than two weeks, which, in my opinion, they fully deserved.

The only moral, ethical, and fundamentally sound time to invest in Russia at this point is once there is regime change. Sure, if the war ends there will probably be a snapback in all sorts of depressed Russian assets, but the greater threat to western investors is that the Russian government nationalizes the companies doing business there. There is already chatter that Russian might nationalize the assets of western companies that are now closed in Russia. In other words, the Russian government could re-open the 850 McDonalds in Russia and operate the restaurants themselves. That would torpedo the profits of these businesses at least as it pertains to their Russian holdings.

It is also really difficult to time the absolute bottom of the market. Plenty of people thought that February 24th was a good time to buy in. They got crushed. And why should March 24th be any different than February 24th given the current crisis? Just because the VanEck Russian ETF is at $5.65/share today doesn’t mean it can’t drop another 63% to $2.10/share once it starts trading again.

Much more importantly than that, however, are the moral reasons to keep investments out of Russia. Not only would western dollars flowing into the Russian economy potentially fund their war machine, but when this war passes, which will hopefully be soon, unless there is regime change and meaningful domestic changes within Russia to protect the freedoms and liberty of both ordinary Russians and their neighbors, the Russian political leadership and their economy must be economically punished. These consequences should serve as a lesson that military invasions against peaceful countries who post no threat will not be tolerated by the international community and its economic powers. Western investors should not prop back up Russian companies once this war is over.

Ben Sprague lives and works in Bangor, Maine as a V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram and subscribe to this weekly newsletter by clicking below.

Weekly Round-Up

Here are four things that caught my eye this week that I wanted to share with you.

San Francisco is setting up its first Tiny House Village, with 70 units for people who are homeless at a cost or roughly $30,000 per unit. San Francisco pays approximately $60,000/year per tent in nearby tent cities, so this project provides both hope for safer, more stable places for people to live but also to potentially save the city some money. Read more.

Blackrock plans to write off $17 billion in Russian assets. Via Financial Times, “Clients held more than $18.2bn in Russian assets at the end of January, the firm said, but shuttered markets and worldwide sanctions imposed after Russian president Vladimir Putin invaded Ukraine have made the vast majority unsaleable, leading BlackRock to mark them down sharply.” Read more.

Maine Senator Angus King plans to introduce a bill in Congress to allow for the development of much-needed housing on a specific 50-acre parcel of land in Acadia National Park. All of Mount Desert Island and beyond is experiencing a major housing crunch and this could help partially alleviate that. Read more.

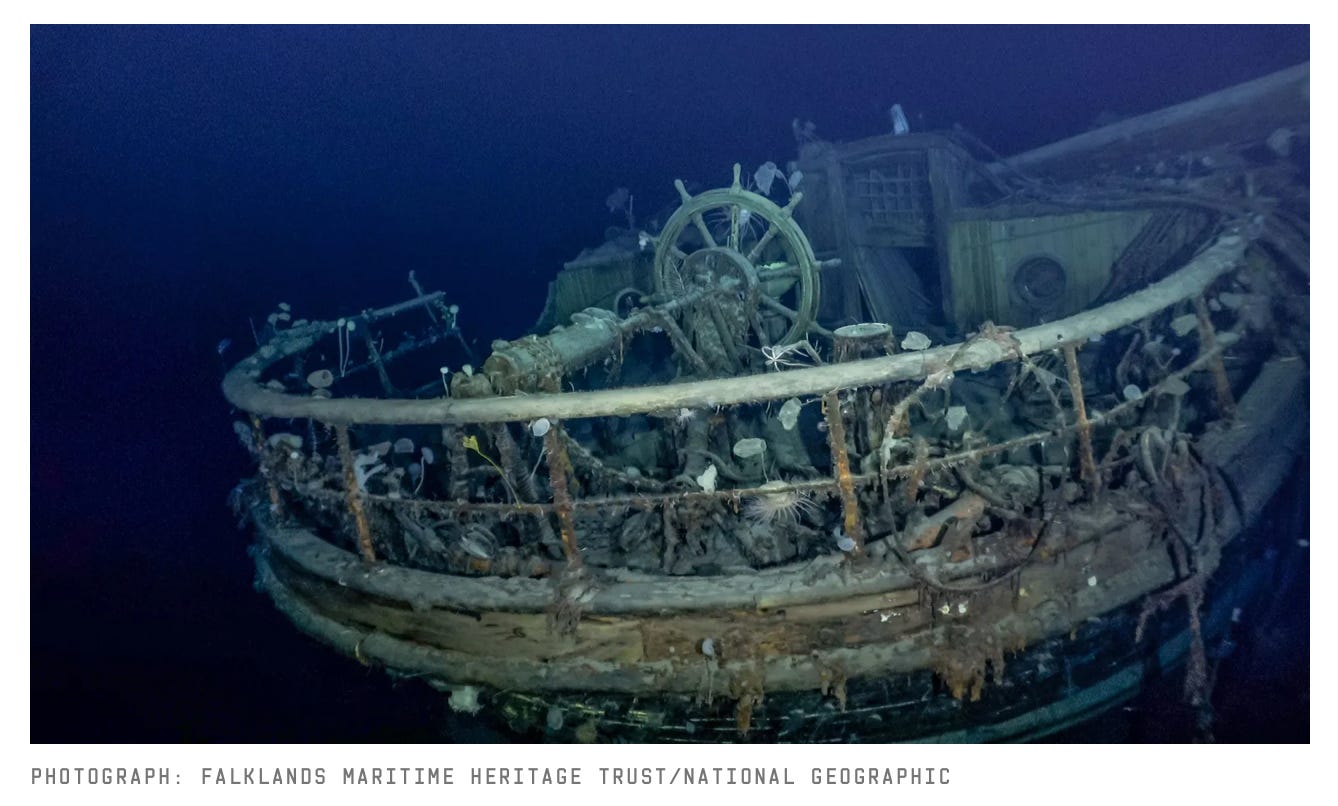

An underwater robot traveled 10,000 feet into the Antarctic sea to send back amazing pictures of the remarkably well-preserved Endurance, which sank in 1914. Upon its sinking, the captain, Ernest Shackleton, and his crew embarked upon an incredible story of survival. Read more (article contains a 94-second video of the wreckage).

One Good Read

Here is the fascinating story of the first McDonalds to open in Russia via Danielle Wiener-Bronner of CNN Business. From the article, “There was a really visible crack in the Iron Curtain…it was very symbolic about the changes that were taking place. About two years later, the Soviet Union would collapse.” Read more.

Plus, a parting thought:

Have a great week, everybody!