Inflation's Groan

The collective groan you may have heard on Wednesday at 8:30 am was bankers and borrowers absorbing the latest Consumer Price Index report, which showed inflation ticking up stubbornly to an annualized rate of 3.5%. While this is down from 4.9% a year ago, it is up from 3.1% in January and 3.2% in February. The settling out of inflation now looks more like a hammock than a grave (although hopefully not a trampoline). The stock market reacted poorly to the news, posting its worst week in over a year.

Why does this matter? For starters, American consumers are weary of high prices. Plus, some of the sharpest increases in prices have been in the areas of spending most Americans have little control over like gas, utilities, medical care, and, for some reason, car insurance, which is up a staggering 22% on a year-over-year basis. Although food prices eased off a bit in March, costs at the grocery store not to mention eating out have been frustratingly high for much of the past year as well. People are sick of it.

For many borrowers including would-be homebuyers, the inflation report combined with last week’s strong labor market report spell doom for any immediate hope of interest rate declines. On the one hand, you would think that last week’s report showing over 300,000 new jobs created and an unemployment rate that dropped to 3.8% would be good things for the economy, and of course in many ways those are very positive things: people are working and wages are rising. But in some ways, they are too good - at least if you are an official at the Federal Reserve.

The Federal Reserve has a dual mandate: promote full employment and keep inflation running at a rate of around 2.0%. These two goals are sometimes in conflict with one another, but not right now: the labor market is strong and, as of yet, has shown absolutely no signs of deteriorating. The high interest rates themselves over the past year have been, in fact, meant to cool off the economy. So far, this hasn’t happened enough to actually bring inflation down to the 2.0% target. What that means is that the Fed can (and will) stay patient with interest rates (i.e. not bring them down) because they are getting absolutely no pressure from the labor market as the jobs situation just continues to be so strong.

The Perils of Prediction

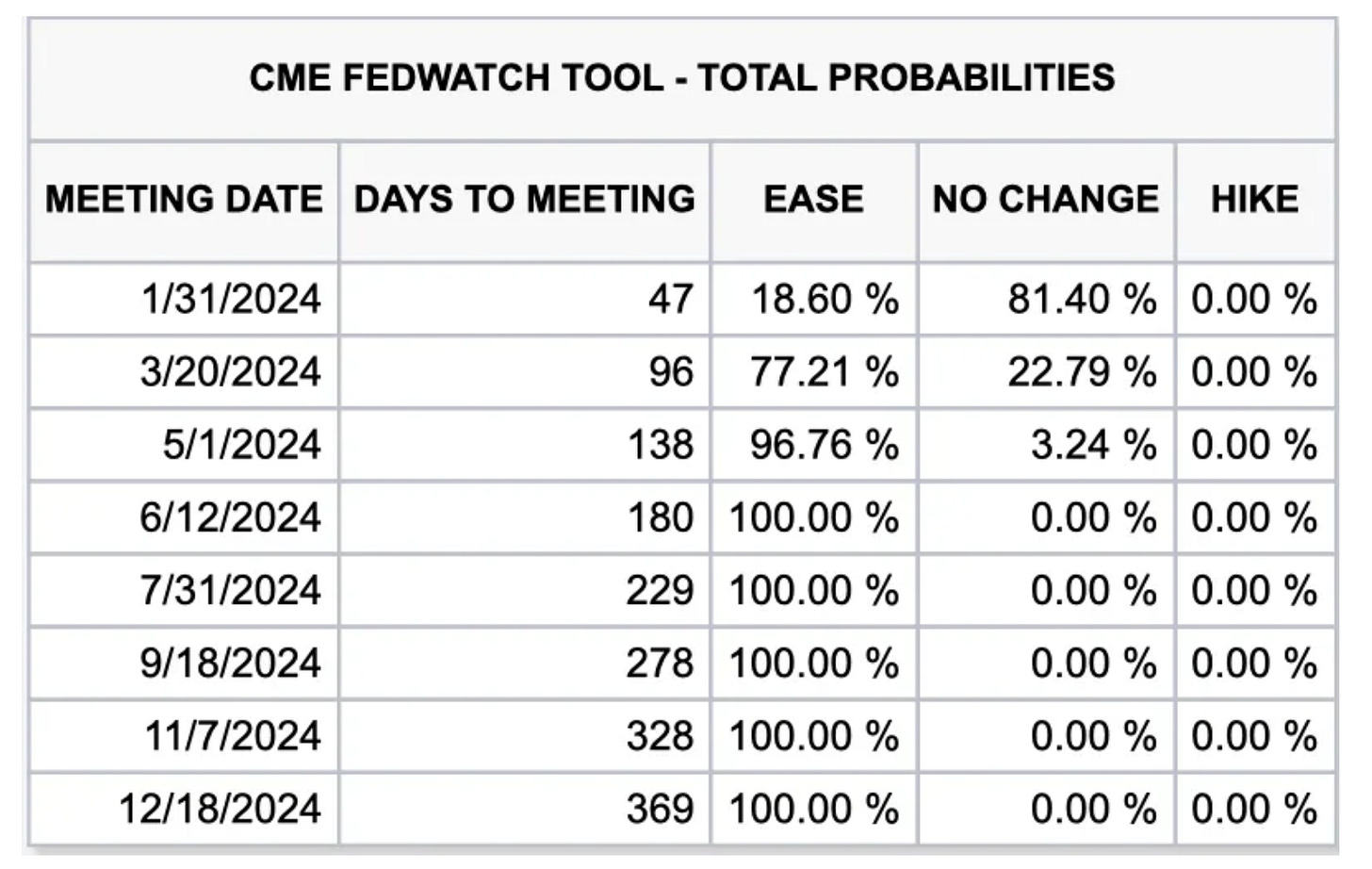

In December, I shared a table showing economists’ predictions for interest rates cuts. At the time, the odds of a May rate cut were nearly 97%:

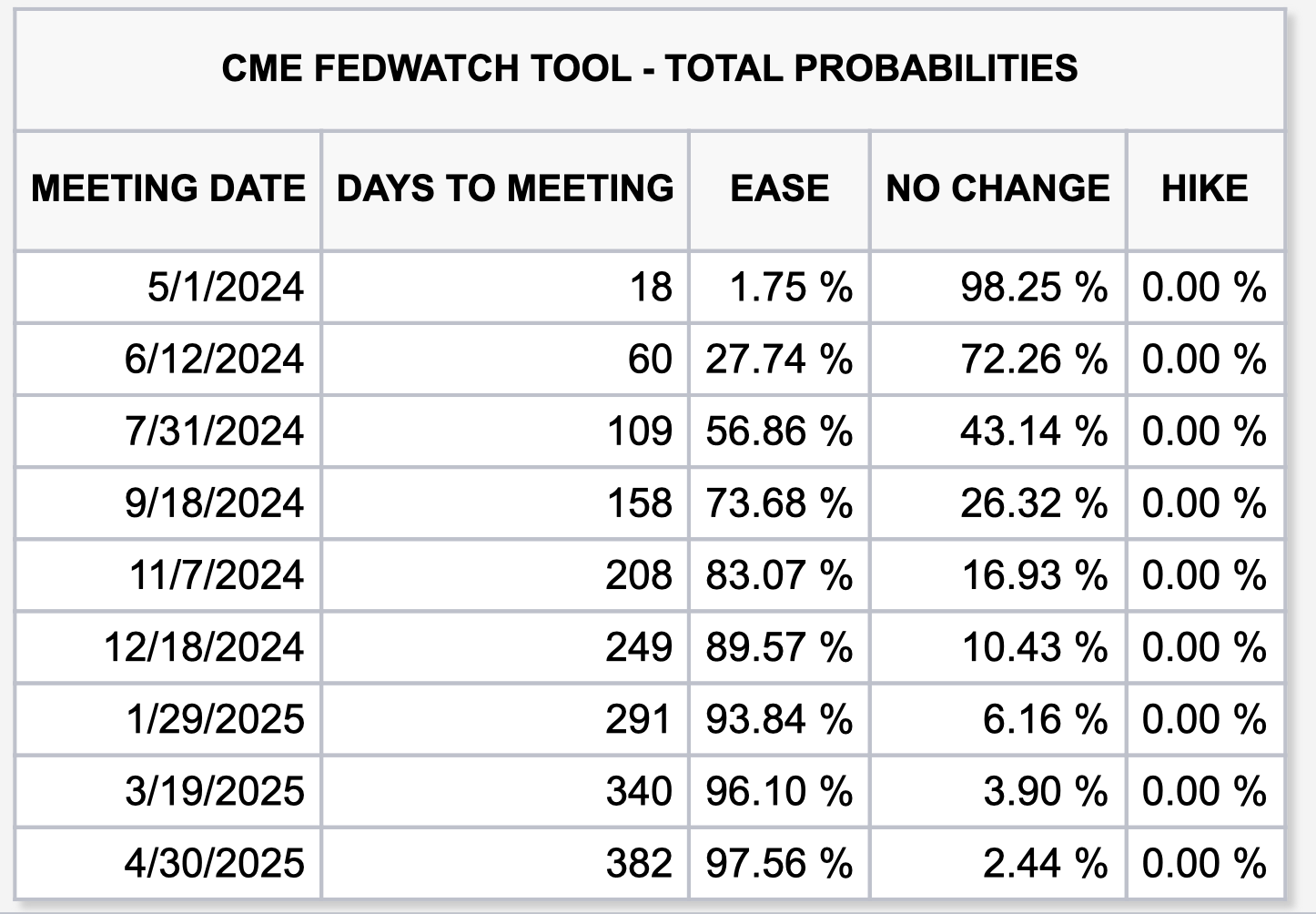

Flash forward to today: the chance of a May interest rate cut is almost non-existent. Fed-watching economists only now project an interest rate cut in May to have a 1.75% likelihood. And moreover, prognosticators only give a 27.7% chance of a rate cut by June:

Sharp-eyed observers will note that in the first chart above from December, prediction markets gave a 100% chance (!) of rate cuts by June. I’m not a statistician by any means, but I know what 100% is meant to mean, and it hasn’t come to pass.

This may be an obvious statement, but predictions are hard. With that in mind, it sometimes feels to me like market prognosticators whether they are looking at the stock market, interest rates, prices, or any other closely watched variable, almost always clump together. It feels like predictors are wary of straying too far from one another. This feels especially true in academic settings, or in settings where there might be reputational consequences from being an outlier from the group. Groupthink is real, even among otherwise intelligent people analyzing data and making predictions.

What Comes Next

Banks remain tight. Loans both residential and commercial are not as forthcoming as they were a few months ago let alone two or three years ago. The main reason for this is that oftentimes deals just do not work at a higher interest rate. At a certain point it is just a question of mathematics. But the other reason is that banks are experiencing pressure on the deposits side of the ledger, as well. As long as rates stay high, banks will need to offer attractive deposit rates. And deposits are how banks fund their loans, for the most part. As long as deposit costs remain high, margins will be thin, loans will carry high interest rates, and banks will be tight.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.

Weekly Round-Up

Here are a few things that caught my eye this week.

Speaking of inflation, the price of banana is going up at Trader Joes by 20%! Bear in mind, however, that this only represents an increase from 19 cents per banana, which has been the price for twenty years, to 23 cents. Read more via Ramishah Maruf of CNN.

An ESPN step-by-step timeline of Shohei Ohtani’s interpreter’s descent into over $40 million of sports gambling debt is something to behold. A cautionary tale, even for people who are only betting $5 or $10 at a time. Read it here via Paula Lavigne.

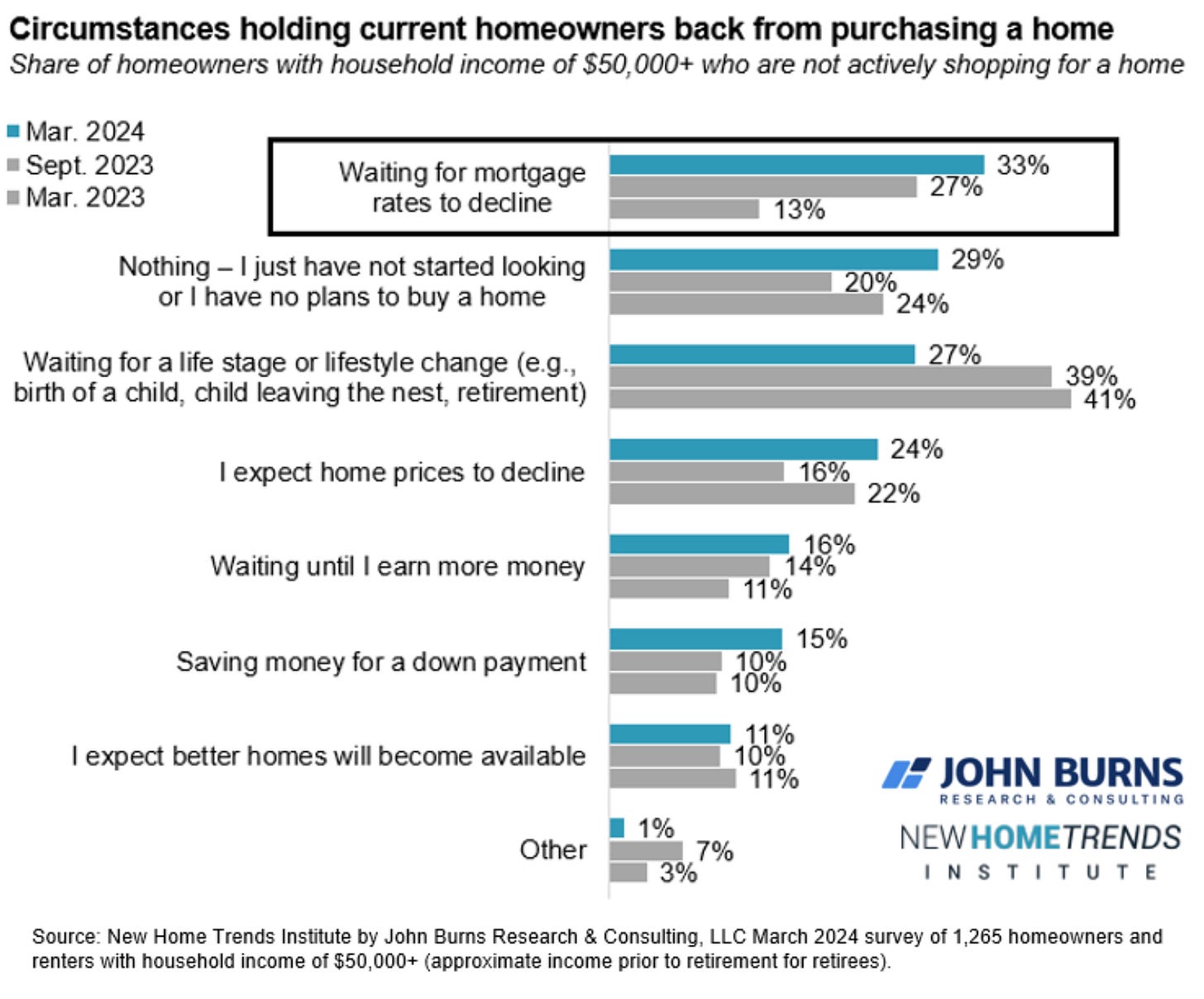

Via John Burns Real Estate Consulting, “Waiting for Mortgage Rates to Decline” has popped into the #1 spot of reasons why would-be homebuyers are waiting. Historically the top reason has been “Waiting for a Life Change” like having a baby or moving between cities:

The Great American Eclipse

Here is another thing that caught my eye this week: Maine was in the path of totality for the Great American Eclipse! Our family watched from Guilford, Maine. It was a remarkable day - sunny and 60 degrees and, in fact, the sunniest day of the year so far in Maine without a cloud in the sky. It was actually a quite moving experience, made all the better by seeing it with my family.

Have a great week, everybody!