Lots of Homes Being Built, But Cancellations Rise Too

Construction loans for homes have really taken off over the past two years. Faced with extremely low inventory of existing homes for sale, prospective homebuyers have instead been looking to build. This trend was given a boost by historically low interest rates, but also by the COVID pandemic, which suddenly made people look inward towards their own living spaces with more thought and care including the desire for home offices and other work-from-home amenities.

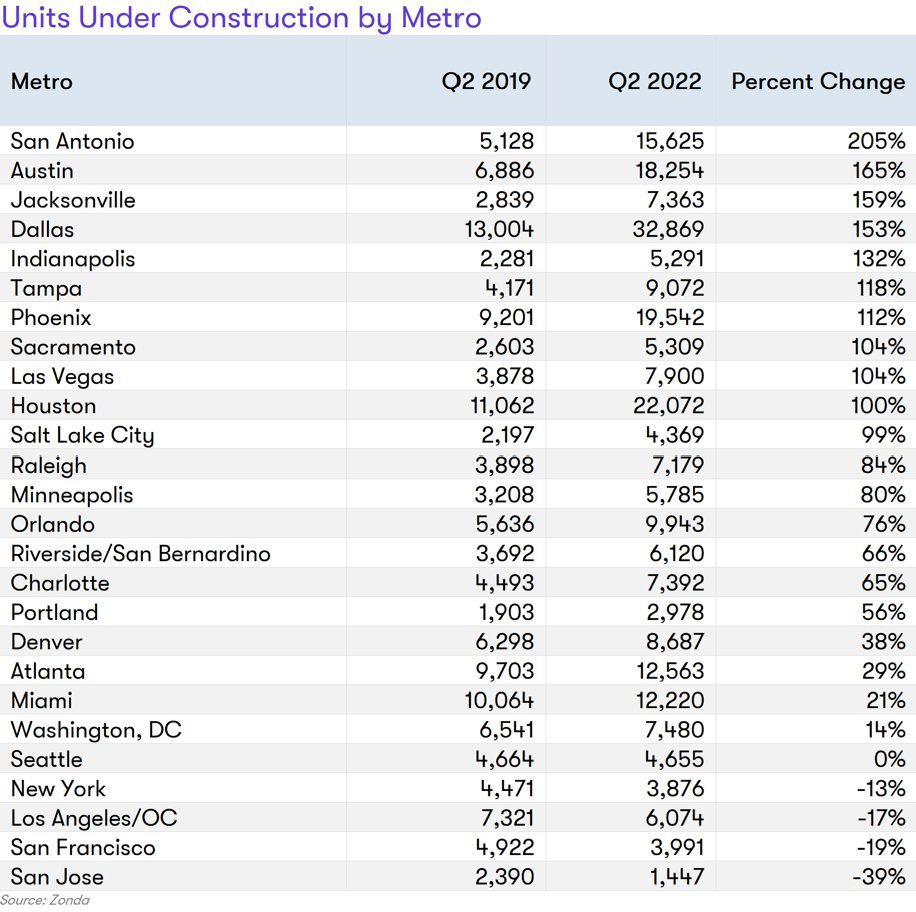

At this point the sheer number of new homes being constructed is pretty significant, particularly in certain markets. Consider the dataset below shared on Twitter by Ali Wolf, Chief Economist for Zonda, that shows the number of homes under construction in Q2 of 2022 versus the pre-COVID Q2 of 2019:

Is it too much?

Doublings and near-triplings in the number of new homes being built in some of these communities are not going to be sustainable. Phoenix, for example, which saw a 112% increase in the data noted above, is already teetering on the edge of a bubble with new home prices already coming down. With a glut of new homes on the market, prices are likely to ease in these communities and even drop over the next 12-24 months as the supply has risen so dramatically to meet demand.

According to the National Association of Home Builders via Bloomberg:

In June, 824,000 single-family homes were under construction in the US, more than at any time since October 2006, according to an NAHB analysis of government data.

That is a lot of new building. But even since June, though, which is the period referenced above, market forces have shifted. Most notably, interest rates continue to rise, which makes the cost of borrowing higher (although in recent days residential home rates have actually decreased slightly). And newly constructed homes are not cheap thanks in large part to expensive building materials and a shortage of labor. So buyers/borrowers are suddenly faced with two variables against them: high purchase prices and high interest rates, which are leading some buyers to back out of deals.

Rick Palacios Jr., Director of Research at John Burns Real Estate Consulting, recently tweeted out data showing that homebuilders nationwide are reporting cancellation rates of 17.6%, up notably in the past few months and up significantly from a recent historical low of 6.3% during the summer of 2001:

Bad news for homebuilders

Unfortunately at a time when the country is desperate for all types of new housing, it has become significantly more expensive to borrow and build. At a certain point (and I think we are just about there), prices are going to ease and even start dropping in certain markets, which will give some relief to buyers, countered in part by higher interest rates.

But many homebuilders I have been speaking to lately are starting to see some writing on the wall that is reminding them of the lead-up to the Great Recession. It is not good for builders to be sitting on homes that are not already sold. Spec building, which refers to building homes without a purchase contract in place, has worked out fine over the past few years because there are dozens of prospective buyers for just about any home that is built, but spec building becomes a real financial liability for homebuilders who have to carry the debt service on a project until it is sold if there are suddenly no willing buyers. There is a lot of downside risk that the homebuilder might not be able to sell the home for even their own costs that they have into the project, which can lead to significant losses of both money and time. And now if nearly one in five buyers who are actually under contract are backing out - well, it spells bad news for homebuilders in the form of uncertainty and financial risk.

I spoke to one contractor this week here in Maine who reported that his homebuilding operations are grinding to a halt and he is quickly trying to diversify into commercial jobs or smaller projects. Some other builders have diversified into building their own rental units to own themselves for the long-term and collect income from rather than building homes to sell.

These are just anecdotes, but another customer of mine who is not a homebuilder ranted to me this week about this friend who is a homebuilder, saying that his friend “just got screwed” by a couple who backed out of buying the home being built for them halfway through the process. Unfortunately I think these examples are only going to become more prevalent as homebuyers get cold feet about the process in what to some is feeling like an overheated market. Plus, of course, as interest rates rise many homebuyers simply no longer qualify for their financing or are deciding they don't want to pay several hundred dollars more per month than they were planning to when rates were lower. All of this is perilous news for homebuilders, and not great news overall for a housing market desperate for new inventory.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram. Opinions and analysis do not represent First National Bank.