Patient Money Makes Money

Patient Money Makes Money

I was in board meeting recently and the chair of the investment committee, who is a seasoned and thoughtful investment advisor, said, “Most people don’t realize you make your money in bear markets.” This comment was meant to ease the worries of non-investment-minded people serving on the board, but also to deliver a double shot of truth and optimism.

We have been experiencing a bear market this year (generally defined as a stock market drop of 20% or more). But a bear market is also when things are on sale. Some great companies have seen their stock prices drop precipitously this year (oftentimes far more than 20%), but they will bounce back eventually. People with a long-term time horizon and cash to deploy are buying right now knowing that while there is still plenty of downside risk, a lot of the bad news is already baked in and the bounce-back potential is strong.

And market rebounds can happen fast. The S&P 500 is up 12% since mid-October. When the market bottomed out on March 23, 2020 in the most perilous early days of the COVID-19 pandemic, many investors went to the sidelines. But what happened next was the S&P 500 doubled over the next 354 days. By August 2021, patient investors who stayed in the market achieved a stunning 100% rate of return. It was the fastest doubling in stock market history.

Patience Today

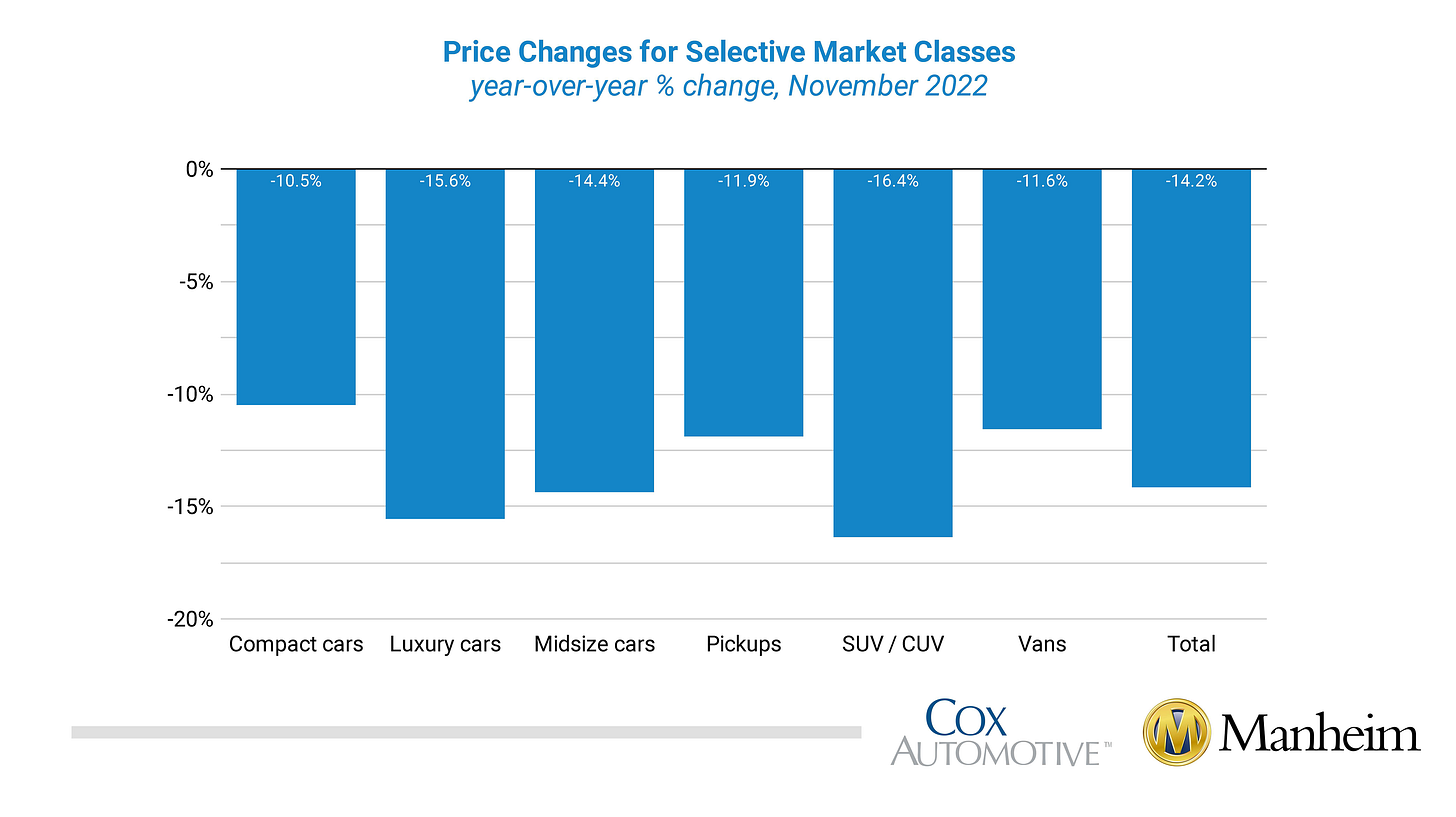

It is not only stock market investing where patience matters. Consider the used car market. If your car breaks down and you absolutely need one for work or family, you probably do need to buy one at that moment. But over the past year or two, if you haven’t needed a new car but are in the market for one, patience has been rewarded. Used car prices are down 14.2% in the last year according to the Manheim Used Car Vehicle Index and the price drops have been even more notable for luxury vehicles and SUVs:

One caveat to this is that the rise in interest rates has tempered the savings from lower prices, but what I am hearing in my discussions with car dealers is that inventory is improving, buyers are fewer, and the deals are better. And, in fact, it is likely prices will continue to drop over the next few months.

Patience in Real Estate

Patience is of utmost importance in the real estate market right now. I have written a lot about this over the past six months so I won’t dwell on it here, but the combination of prices that skyrocketed over two years plus sharply rising interest rates since this past summer have made real estate much pricier in the past few months. I believe what is likely to happen is that real estate values will drop by 5-10% nationwide in 2023 and by even more in the bubbliest markets. I plan to write more about this in a real estate preview article in early January, so make sure you’re subscribed to receive that in your inbox. But I believe by December 2023, one year from now, prices and interest rates will both be lower than they are now, which will make for better deals for real estate buyers.

Be patient. Time passes. Six months or a year or even three years in the great scheme of things can pass in the blink of an eye, and patience to find the right deals at the right moment will be rewarded.

Patience in the Face of Fads

One year ago I wrote about The Greater Fool Theory, and how I thought certain things were irrationality priced. I think that article holds up pretty well if I dare say so myself, as I pointed out that the prices of things like NFTs (non-fungible tokens) made no sense:

In my opinion, we will someday look back (and maybe not that long from now) at NFTs as one of the great classic investment bubbles. Price appreciation is not being driven by intrinsic value of the assets; it being driven by the Greater Fool Theory. People are buying these things up because they believe they will rapidly appreciate in value and they think they will be able to sell them to someone foolish enough to pay even more for them. Many of these people have been deluded into thinking these NFT’s have actual value, so they in truth do not even realize they are being fools themselves.

And on cryptocurriences like Bitcoin, I wrote:

Who knows what one Bitcoin is actually worth. Yes, at the time of this writing one Bitcoin is worth about $48,000, but that is not pegged to anything with inherent value. The value of one Bitcoin is just what the marketplace of Bitcoin users and investors believe and collectively tell themselves it is.

What is one Bitcoin worth today, one year later? The value has dropped to $17,111, a drop of 64% from where it was twelve months ago.

Patience in investing does not mean simply waiting for good investments to come along, it also means avoiding the bad ones. When I was an investment advisor, I used to use an analogy with people that the best golfers in the world were not necessarily the ones who hit the most best shots; the best golfers are the ones who avoid the most bad shots. And it is like that with investing. For a successful investor, it is not necessarily the number of good years you have in investing as everyone does pretty well in the good years, but rather the fewest times you hook it into the woods or plunk one into the pond.

A patient investors makes money by thinking long-term, but also by not rushing into foolish and frothy investments marked by exuberance and not value. It is easier said than done as a little over a year ago Bitcoin seemed like a surefire investment. There is a lot of FOMO (fear-of-missing-out) when it comes to investing and it is hard to stay on the sidelines when something is going up steadily in value, but a healthy dose of patience mixed with skepticism at flavor-of-the-month (or year) investments will pay plenty of dividends over a lifetime of investing. Markets for things like used cars and real estate eventually find equilibrium, and stock markets generally rebound after a period of being down. So stay patient.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram. Opinions and analysis do not represent First National Bank.

Disclaimer: consult with a CPA and licensed investment advisor before making any investment decisions. The above is meant to be informational and not specific investment advice.

Community Comments

Thank you to everyone who read and commented upon last week’s piece, Still Bowling Alone. The piece seems to have struck a positive chord with people and I appreciate all of the feedback. I wanted to offer a sample here of comments received via the Substack comment thread, Facebook, and emails received:

Ed Emmons: “Good points this week. I’ve also conscientiously try to block ads that I don’t want. I also block people that continually post about nothing and any who use vulgarity. It has reduced my social feed by about 70%. I noticed it slowly becoming less time consuming , less of a trap and I’m looking for other active things to do.”

Judy Harrison: “I find community at performing arts events. While writing about them is often part of my job, live theater and live music performances are thrilling to be a part of and I hope people get back in the habit of attending them. The pandemic changed all of my work habits and many of the ways I interact with the world. I miss face-to-face encounters with my colleagues but I love the independence that comes with working from home. I also like being able to work in comfortable clothes from my couch with my dog Franklin curled up next to me. One thing not noted in this interesting piece is inflation. It has put a huge damper on my ability to afford going out with colleagues and friends. What was once a weekly ritual is now once every two months or so and always proceeded by a check of my bank balance.”

Nazrin Dixon: “As usual, a very interesting and relevant piece from you Ben. May I add my personal experience of growing up in a big city of Baku with 2.5 million people in it that felt a lot like Bangor or Maine in terms of everyone knowing each other. Growing up in a high rise with 72 apartments in the heart of the city, I fondly remember a good number of our neighbors at our dinner or desert table almost every night. Those gatherings were invaluable and to this day I remember them. They were fun, interactive and something we looked forward to every night.

Here, most people live in individual houses which also makes interactions more difficult. So perhaps, our living arrangements preclude us from being more social.

Another difference is the time people have dinner or go to bed here. Back home, we would only leave the house at around 7 pm to either have dinner at a restaurant or have tea and desert after we ate at home. People go out just to meet up with friends at 7 pm, and stay out till 11 especially when the weather gets nice. I would call my sister now and it is 9 pm there and they are at a cafe by the sea hanging out with kids and friends. Here most people go to bed at 8 pm which also makes it hard to spend time with friends.”

Betsy Lundy: “My parents, who were incredibly busy, went out on dates and did things with their friends. I don’t see a lot of people with young children hiring babysitters so they can have fun anymore. I’d like to bring that back too!”

Rich Kimball: “You make some great points, Ben, but economic inequalities play a significant role in social isolation. A generation or two ago, most households got by on one income and very few people worked multiple jobs. These days, most families with children depend on both parents working, often more than one job, and few single parents have the time left at the end of the day to engage socially. Membership in service organizations has always been a luxury of the middle and upper class and the distance we’ve put between those groups and our growing population of poor people only serves to add to the isolation.”

Sarah Marble Morneault: “This is so well written! I love your voice in it which comes across incredibly thoughtful and almost conversational. And now I shall go take my kids for a walk and maybe say ‘hi’ to a neighbor or two.”

Alice Openshaw: “I heard Putnam speak about the book at Harvard Parents Weekend 2001. It made so much sense then and so much more sense, 20 years later.”

Thanks for reading and for the thoughtful feedback! Have a great week, everybody.