Rising Real Estate Values Mean Higher Property Taxes

Cities and towns eyeing increased revenue amid soaring costs

Significant appreciation in real estate values has cities and towns throughout the United States eyeing increased revenue as tax-assessed values are adjusted upward. While this is potentially good news for municipal policymakers, it is another blow to household budgets and those of real estate investors, all of whom can add taxes to the long list of expenses that have gone up over the past few years. And while more dollars coming into municipal coffers might seem like a boon with at least some carry-through benefits to residents, cities and towns have seen their fair share of rising costs too including wages, so the increased revenue might be a wash in terms of providing any meaningful benefits to the community.

So what does it look like? A sampling of data from around the country yields plenty of examples of rising taxes hitting homeowners. And most of the increases so far are due mostly to rising municipal costs and not necessarily rising valuations. Per Georgia Kromrei of Housing Wire:

The average property tax bill in Tennessee, which has one of the lowest tax rates in the country, saw a 30% increase in average property taxes paid on single-family homes last year…Average property tax bills in Milwaukee increased 19%. Residents of Baltimore saw their tax bills rise 12% in 2021.

According to ATTOM Data Solutions:

Among metro areas with a population of at least 1 million that had the largest increases in average property taxes [in 2021] were Nashville, TN (up 27 percent); Milwaukee, WI (up 18.6 percent); Baltimore, MD (up 12.3 percent); Grand Rapids, MI (up 12.3 percent) and Louisville, KY (up 11 percent).

Despite these recent hikes, the real brunt of property tax increases will likely come over the next 2-3 years because there is a lag effect at play. Even though real estate values are likely going to come down this year, it generally takes municipalities a few years for their valuations to catch up to the reality on the ground. This is evident in data from ATTOM, which found that despite home values rising by 16% in 2021 nationwide, property taxes only increased by 1.6%. According to Rich Sharga, ATTOM’s Executive Vice President of Market Intelligence via CBS News, “Homeowners should probably expect to continue to see their property taxes go up over the next year. My guess is tax assessors will be playing catch-up."

At the bottom of today’s article I have an addendum with a closer look at the landscape from where I write in Bangor, Maine, so stay tuned for that or scroll to the bottom to read ahead. Lincoln Millstein, who writes a popular Substack on local politics in and around Mount Desert Island here in Maine called The Quietside Journal, also has a recent article about a proposed 15% property tax hike in Bar Harbor, although to be sure that proposed increase is independent of rising valuations.

How Property Taxes Are Assessed

From 2011-2020 I served three consecutive terms on the Bangor City Council including two stints as Council Chair. Once or twice a year we would meet with the city assessor for an overview of any notable movement in the property tax base, positive or negative.

One thing I think people on the outside of municipal government might not understand or appreciate is what a data-driven process tax assessment is. While there is always a degree of subjectivity to placing a value on something, updates over time to property values are largely based on comparable sales by property type and neighborhood. And assessors are bound by tight regulations and must be able to justify their valuations. It is a very quantitative process. While it may be tempting for municipal leaders to tip the scales on their real estate bases to generate some extra money for the city coffers, this generally does not happen. Plus all property owners, both residential and commercial, can appeal their assessments, so there are some checks and balances carved into the system.

What is likely to be happening now in town halls all across America is that assessors are seeing significant jumps in their data as the property sales over the previous 2-3 years start to hit the numbers. Then even if the property tax rate (or the mil rate) stays numerically the same, which would imply a flat budget, if the tax-assessed value of a property is increased from $250,000 to $300,000, that same rate applied to a higher valuation means a higher dollar amount owed in property taxes. Many homeowners and property owners (commercial and residential) are going to experience this when they open their tax bills over the next couple of years. The mill rate could stay the same, but the amount owned could be higher.

Impact on Housing and Rental Markets

Higher property taxes could have a dampening effect on the housing market. People make economic decisions based on a variety of variables, and if the carrying costs of home ownership increase, it makes owning a home less attractive even if the difference is slight (i.e. a few hundred dollars a year more in property taxes).

Another point of impact is that residential loan underwriters include property taxes in their formulas to calculate whether a person qualifies for a home loan and in what dollar amount. If property taxes are higher, it will mean that some people on the margins of being approved anyway may no longer qualify, and others will not qualify for as large of loans. The differences may be subtle, but fewer buyers (even by a small amount) and buyers who are qualified for smaller loans are both dampeners on the overall market as they soften demand.

With regard to the rental market, higher property taxes are bad news for both landlords and tenants. Anytime you have higher costs it eats directly into the property owner’s net profits. If those costs are passed along to the tenants, it means higher rents. However, passing the costs along is only possible if the market can actually support higher rents. If tenants collectively cannot afford anymore upward pressure on rents (and they’ve seen a lot of upward pressure over the past few years), landlords will eventually start to see a lack of prospective tenants at these higher price points and, ultimately, some higher vacancy rates.

What Comes Next

At various times during my nine years on the Bangor City Council, I would suggest that Maine was in need of massive tax reform. People always talk about government being run like a business, but successful businesses have diversified revenue streams. Cities and towns are far too beholden on property taxes. Here in Maine, municipalities are not permitted by law to have a local sales tax or a meals and lodging tax. The State of Maine itself does have these taxes, but all of the revenue goes to the state budget in Augusta, which deprives cities and towns, many of which are drivers of development and promoters of economic activity, of much of the revenue needed to support themselves.

But all of that is beyond the scope of today’s topic. The truth of the matter is because of both our fractured politics and the power that special interests with armies of lobbyists have to influence policy, meaningful tax reform is unlikely here in Maine or beyond. The property tax system we have now is likely to live on. And for all the reasons noted above and with home values rising 10.4% in 2020, 18.8% in 2021, and nearly 10% in 2022, many if not most American property owners are likely to see higher property taxes over the next few years.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram. Opinions and analysis do not represent First National Bank. © Ben Sprague 2023.

Addendum - The Current Look at Property Taxes in Bangor, Maine

The following information is based on a recent memo from City Assessor Phil Drew to the Bangor City Council as part of an upcoming workshop. It is publicly available information and the memo is not confidential.

First, the lay of the land, per the assessor:

Beginning Fall of 2021 to the Fall of 2022, the average appreciation rate for all homes in the Bangor region was up 16% as indicated by the Federal Housing Finance Agency Home Price Index Calculator. In addition, the Zillow “typical home value” estimate reported a steady increase for the Bangor area throughout 2022 from $221,300 in January to $245,000 in December.

He continues with a nice summary of the quantitative side of his analysis, the bottom line of which is that properties in Bangor and generally selling for more than their tax-assessed values and by a fairly large margin:

We have completed our annual ratio study analyses using sales between July 2021 and June 2022. A ratio study analyzes the relationship between assessed values and market values. When the assessed value is lower than the sale price the ratio will fall below 100%. For example, a home that has an assessed value of $175,000 at the time of sale and sells for $225,000 has a sale ratio of 77.8%. When individual sales are grouped for a segregated-study, the ratio of interest is the Median Sales Ratio (MSR). The ultimate goal is to achieve an MSR of 100%.

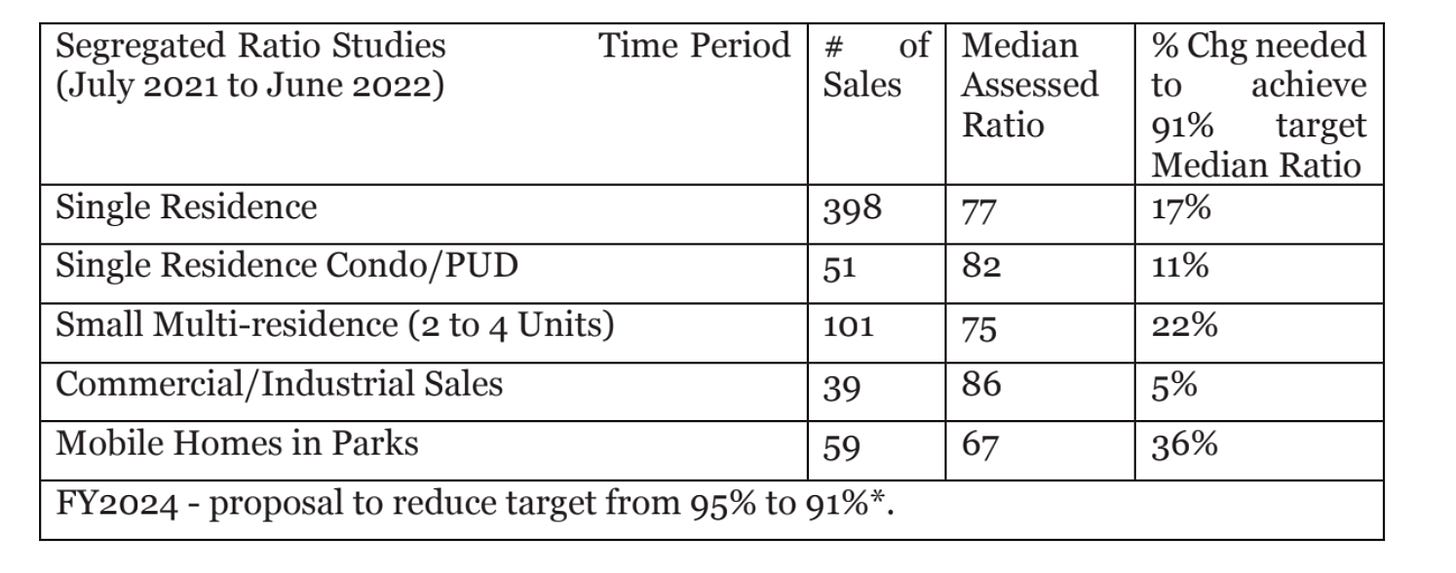

The five general classifications for a segregated-study are: Single-Residence, SF Condo/PUD, Small Multi-Unit, Commercial/Industrial and Mobile Homes in Parks. All five classifications in Bangor had a MRS below 86%. Therefore, all classes of property need upward adjustments in their assessed values for April 1, 2023 but at different percentages. (bold emphasis added).

The chart below, which is part of the assessor’s memo, shows the MSR numbers for each class of real estate. Remember, a lower MSR percentage represents sales of properties above tax-assessed value, as in the example in the quote above of a property with a tax-asssed value of $175,000 selling for $225,000 ($175,000 divided by $225,000 = 77.8%).

The MSR percentages are all below 100%, and the percentages for 2-4 unit properties and mobile home units (note: the units themselves, not the sale of mobile home parks as a whole), are particularly low in addition to a fairly low percentage of 77% for single residences. These categories are the ones that will see the largest increases in valuations for the upcoming tax year as the city assessor tries to bring them back towards 100% MSR percentages, which in theory would represent properties selling at exactly their tax-assessed values. (Additional note: the city assessor in this particular memo proposes to the City Council that they target a 91% ratio for the upcoming tax year. He proposes this anticipating that real estate values may drop by 4% next year, and, I suspect, in order to avoid hiking taxes too much in one single year; if property values were adjusted to a 95% let alone 100% MSR, it would result in some pretty heavy tax increases for most Bangor residents, some of whom could not afford such a jump all at once. Although, to be sure, adjusting to 91% will also be a lot for people to bear.

One final note from the memo:

With these market-based adjustments, the total real property taxable valuation of the entire city is estimated to increase 11.5% to $2.84B as of April 1, 2023.

I hope that city leaders will use this increased revenue wisely!

No weekly round-up this week because I got so backed up with my regular bank work and some other commitments this week that I did not spend as much time perusing my usual sources of content. Check back next week. In the meantime, my Super Bowl prediction: I will be cheering for the Eagles, but I never bet against Patrick Mahomes. Chiefs win 34-31.

Happy Valentines Day

I haven’t yet figured out what to do for my wife for Valentines Day, but I did enjoy taking my daughter to Bangor’s Valentines Dance last weekend! Nice memories even if it was the coldest day in 40 years.

Have a great week, everybody!