The Credit Card Debt Bomb is Ticking

Plus: a look at other delinquency rates for clues on the economy

Thanks for reading The Sunday Morning Post! Each week I write about the economy with a focus on real estate and investing from my perspective as a commercial lender here in Maine. Today I write to you from the outer bands of Hurricane Lee (okay, technically at this point it is “Post-Tropical Storm Lee”). I hope everyone is staying safe and dry this weekend, especially those readers along the coast of Maine.

This past spring, I wrote about how Americans’ collective credit card debt was about to pass the $1 trillion mark for the first time in history. Well, America, we did it: total credit card debt hit this dubious milestone the week of July 26th. Now to be fair, credit card balances are generally going to rise naturally as the price of goods and services goes up; $1 trillion doesn’t buy as much as it used to. But still, the high collective balance of credit card debt is a cause for concern, only the more so because credit card interest rates are also at all time highs, with the average interest rate coming in at a whopping 20.68% as of May 2023, which is the most recent month for which official data is available (although WalletHub has the average rate as of this past week at 22.74% for all new credit cards).

And now, like clockwork, facing the mathematical reality of large balances and high interest rates, Americans are starting to fall behind on their credit card payments. In fact, the second quarter of 2023 saw an 11-year high in credit card delinquencies, with 2.77% of all credit card payments being missed. The last time delinquencies were this high was the third quarter of 2013 when the rate was 2.82%, although the key difference between then and now is that the 2.82% rate in 2012 was on its way down from a peak of nearly 7% during the Great Recession whereas today’s rate of 2.77% is up from an all-time low of 1.55% in the summer of 2021.

One other interesting tidbit of information is that credit card deliquencies are notably higher for credit cards issued through smaller banks. According to data from the St. Louis Federal Reserve, the delinquency rate on credit cards issued by the top 100 banks in terms of size is 2.63%, whereas for banks outside the top 100 in size the delinquency rate is 7.51%. This delinquency rate of 7.51% surpasses the highest delinquency rate for smaller banks in history, even higher than the 5.61% at the peak of the Great Recession. This difference between large and small bank credit cards could reflect greater weakness in the rural economy nationwide as this is where smaller banks are more likely to be based, but it could also reflect tighter underwriting standards to begin with at the larger banks, which would typically manifest itself in lower delinquency rates on the back-end. Regardless, 2.63% vs. 7.51% is a pretty sizable difference, and curious to say the least.

As another quick aside, the chart below shows the delinquency rate on credit cards over the last decade. The dip during the pandemic is very interesting. Fueled by government stimulus checks and lacking some of the usual discretionary spending options like travel and entertainment, people actually kept up with their credit card payments better in 2020-2021 and even paid balances down. That did not last, however: once the stimulus checks ran out and the world re-opened, both credit card balances and credit card delinquencies jumped again.

Other Delinquency Rates

On a more positive note, the delinquency rates on other types of debt are actually very low. On home mortgages, for example, the delinquency rate in the second quarter of the year was just 1.72%, which is the lowest rate since 2006. Home mortgage delinquency rates have been on a pretty steady decline since the Great Recession as shown in the chat below, with a very slight bump up during the early days of COVID-19:

Why are home deliquencies so low while credit card delinquencies are so high? It is all about the interest rates. I would estimate that at least 90% of existing home mortgages out there were established prior to 2022, which means they likely carry an interest rate in the 2.50-3.50% range, making the payments more manageable relatively speaking versus the 20%+ interest rate on credit cards. And if someone is struggling with their own cash flow or if there is a loss of household income, they are more likely to still prioritize their house payments to avoid foreclosure whereas the credit card payment may fall by the wayside.

What about business loans? The 1.72% delinquency rate on home mortgages is impressively low, but the delinquency rate on commercial loans is actually even better: 1.01%! Other than the 0.98% delinquency rate just one quarter prior, this is an all-time low at least within a dataset that goes back to 1987:

What Does it All Mean

The data tells a tale of two economies. On the one hand, homeowners and businesses are doing historically well at least as far as delinquency rates go. On the other, the credit card picture is pretty bleak if not dire. For credit card delinquency rates to be this high when the labor market is as strong as it has been is particularly worrisome. Consumers especially those on the margins are undoubtedly struggling with high costs of food, rent, utilities, and more. Even though inflation has eased off from where it was 6-8 months ago, many of these staples of everyday living remain very high.

When the unemployment rate inevitably rises, all the more pressure will be put on the consumer as credit card usage typically rises in a weaker economy. Rising usage as more people find themselves out of work or without income is a recipe for contagion throughout the entire economy. Eventually the credit card debt bomb will have to either get resolved through actual paydowns of debt or it will explode.

The other ticking bomb is that of commercial debt, which is typically not fixed for as long as residential debt. I know from my perspective as a commercial lender, we did an awful lot of commercial loans from March 2020 to March 2022 with five-year fixed interest rate periods with rates that started with a 4 or a 5 (i.e. 4.00-5.99%) When we get to March 2025 and a lot of those five-year fixed rate periods end and the loans become variable (or re-fixed at whatever the new market fixed rate is at the time), it will be quite challenging for business borrowers as their monthly payments are likely to rise substantially. An interest rate that was fixed at 4.50% for five years in 2020 is likely to become variable at 9.00% in 2025 unless rates drop substantially between now and then.

Lastly, from where we sit in September 2023, there are a couple of major bogeys out there in the economy that could contribute to the further swelling of the credit card debt load. The first is that student loan payments restarted recently after a long period of deferral during and following the pandemic. According to one report, 43.5 million Americans have some sort of student loans, which represents approximately 13% of the population. As these payments resume, individual and household budgets will be stretched. And secondly, about 13,000 autoworkers have just gone on strike against the Big Three car companies. There are actually 150,000 union autoworkers in the country nationwide and it is possible the strike could expand to many of them. In the meantime, it might seem like the lost wages of 13,000 people would not be enough to teeter the economy to the brink, but a lot of the communities where these workers live are dependent on their flow of wages and spending. Even though restaurants, retain, and various service businesses are not directly involved with the strike, they are sure to see reduced activity if the strike is a prolonged one. The striking workers will be receiving emergency funds from a $835 million strike fund that the union has built up over time, but those weekly payments are only enough to replace about 40% of the workers’ salaries. If the strike drags on and is particularly acrimonious, which it seems like this one could be, it could have ripple effects throughout the overall economy.

For now, the nationwide debt story is telling two different stories, but there are a lot of risks out there. If the unemployment rate does rise, which I think it will as the Federal Reserve’s hawkish policy on interest rates is likely to be felt in the labor market eventually, that is when we could start to see delinquency rates rise on home and business loans (not to mention a further accelerating of credit card delinquencies).

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com.

Weekly Round-Up

Here are a few things that caught my eyes around the web this week:

The average student loan borrower has saved about $5,000 over the past three years thanks to student loan deferrals. But as noted above, repayments begin this month. Read more here.

Liz Ann Sonders of Charle Schwab shares data in the chart below via Fortune showing the financial obligations of supporting a family of four are beyond what can typically be achieved on a single salary. This is undoubtedly a reason why birth rates are low, and also probably why credit card debt is up. It’s expensive to raise kids these days!

Per Lance Lambert of Fortune on X (formerly Twitter), home prices in Austin and San Francisco are both down 10%+ year-over-year. But a lot of communities in the northeast and the midwest are actually still up over the last twelve months.

Per Charlie Bilello, investor purchases of rental properties are down 45% thanks mostly to rising interest rates that make the cash flow from said investments non-viable. View video here.

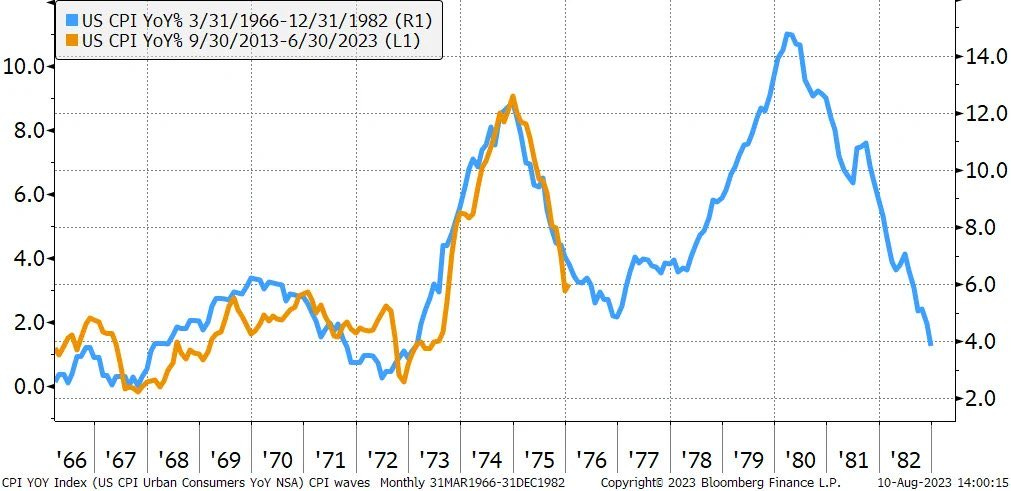

Larry Summers shared the chart below showing current inflation (yellow) compared with inflation in the 1970s (blue), which underscores the Fed’s need to remain vigilant about tamping down inflation (even if I think they have overshot on rates a bit). This chart is pretty eery, though.

Hello from the winds and rain in Downtown Bangor, Maine. Have a great week, everybody!