The Housing Market Is Changing

A mid-year look at where things stand

Welcome to The Sunday Morning Post! Each week I write about the economy with a focus on real estate and housing. Subscribing is free.

If you’re new to The Sunday Morning Post, you might enjoy these recent articles:

Rental Vacancies Have Been Dropping for a Decade. Why?

Huge Rate Hike Shocks Housing Market

Multiunit Rental Construction Hits a 35-year High

The Housing Market Has Changed

After 2+ years of roaring demand amid precious little inventory and historically low interest rates, the U.S. housing market is starting to look much different. What happened? What does it mean for you? And what comes next? Let’s dig in.

The Numbers

At least through May, which is the most recent month for which comprehensive data is available, home prices continue to rise. According to the National Association of Realtors, home prices were up 14.8% in May on a year-over-year basis to a median price of $407,600. This was the 123rd straight month of year-over-year increases, the longest streak on record. It was also the first time in history that the median home price topped $400,000. Prices increased in all regions of the country with the strongest increases coming in the South (+20.6%) and the West (13.3%). Homes here in the Northeast were up by a more modest 6.7%.

According to the St. Louis Fed/FRED, the average home stayed on the market for 22 days in May, the lowest amount of time ever recorded. As a side note, it interesting to observe the seasonality of home sales in the chart below with homes typically staying on the market longer in the fall and winter months than in the spring and summer:

On Friday of this week, data from the U.S. Census Bureau and HUD showed that new home sales were at a seasonally adjusted rate of 696,000, up 10.7% over April but still down 5.9% over one year ago in May 2021. In other words, home sales are modestly picking up, but the overall volume is still low.

Interest Rates

I’ve written a lot about rising interest rates over the past few months, so I won’t dwell on it too much here other than to note that the average 30-year fixed mortgage rate has increased from about 3.00% to about 6.00% since the start of the year. The combination of higher home prices and much higher interest rates means that monthly mortgage payments are, of course, much higher, too. The chart below shows how the huge jump has been since January:

In response to this, you might think that homebuyers are pulling back. However, while data pointing to the number of transactions shows a decline in overall activity, the number of mortgage applications actually increased last week for the second straight week. According to the Mortgage Bankers Association of America via Trading Economics:

Mortgage applications in the US increased 4.2% in the week ended June 17th, following a 6.6% rise in the previous period driven by a 7.9% rise in conventional applications. Meanwhile, the refinancing index fell 3.1% as the average rate on a 30-year fixed-rate mortgage rose by 33bps to 5.98%, the highest since November 2008.

I suspect that future data will show that the number of mortgage applications is actually going to decline and that this modest burst in applications over the past two weeks at least in part represents a rush of prospective buyers trying to get into the home market before rates increase even more, which they are projected to do. For now, however, the fact that mortgage applications actually increased despite the sharp recent rise in rates is a positive sign that the state of the home-buying American consumer actually remains strong. This is a counterpoint to the hypothesis among some that the housing market and the overall economy are doomed to collapse or at least notably decline.

Inventory

The problem of stubbornly low inventory that has plagued the housing market for the last several years continues. The chart below via Altos Research and Mike Simonsen shows the steady drop in inventory over the past few years (this chart also shows seasonality of inventory picking up in the spring each year). Whereas seven years ago there were over one million homes for sale, today there are under 500,000:

Does the far right end of the chart above show a sign of home for prospective homebuyers? Possibly. While home inventory is still low historically speaking, it is up over the past couple of months. This is fueled at least in part by the function of seasonality as noted above, but there may be more at play. According to Bill McBridge of the Calculated Risk Blog:

As of June 17th, inventory was at 419,000 (7-day average), compared to 396,000 the prior week. Inventory was up 5.6% from the previous week. Inventory is increasing much faster than normal for this time of year (both in percentage terms and in total inventory added.

Anecdotally speaking, I am seeing evidence of the inventory roadblock loosening up in conversations with bank customers, friends, and colleagues. It feels to me that some sellers have been waiting in order to try to time what they perceive to be the top of the market so they have been holding back on selling; some are now quickly listing, fearful that the top has either passed or is about to. Others who have been on the fence about selling are themselves rushing to list their homes to take advantage of the strong sellers’ market before prices potentially drop. If the trickle of examples I’ve heard so far becomes a rush, there will be many more homes on the market in the months to come.

One caveat to this, however, is that for prospective sellers who need to finance the acquisition of a new home (i.e. they are not cash buyers or don’t have a second home to go to or a rental unit lined up), it is frustrating and perhaps prohibitive to think about financing a new home at a 6.00%+ interest rate after selling a home that might have been either paid off or be carrying an interest rate in the 2.00-4.00% range.

Priced Out

Home prices ultimately are a function of supply and demand. Prices will ease or drop only if supply significantly increases or demand notably declines. Increasing the supply is really all about the creation of new homes: reducing barriers to construction, easing zoning restrictions, even financially incentivizing certain types of building - all of these options should be on the table. Plus as I’ve written about before, the private sector may offer its own solutions to the housing crunch as builders and developers swoop in to take advantage of such robust demand.

On that demand side of the equation, while keeping in mind the recent uptick in mortgage applications despite higher rates, the simple math of it all is that as interest rates rise fewer people are going to be able to qualify for loans. Unfortunately this will be particularly impactful to low and moderate income homebuyers and many first-time homebuyers, who typically have more marginal qualifications for mortgage financing including thinner cash flow, which is one of the most important variables in a bank’s underwriting formula. As economist Ali Wolf notes, prospective homebuyers have lost well over $100,000 in buying power for a home worth $450,000 since the start of the year simply due to rising interest rates:

John Burns Real Estate Consulting estimates that 18 million American households have been priced out of the housing market due to the rise in rates. The chart below shows the number of households that qualify for three different-sized mortgage. As you can see, there is a decline at each price point:

Price Reductions

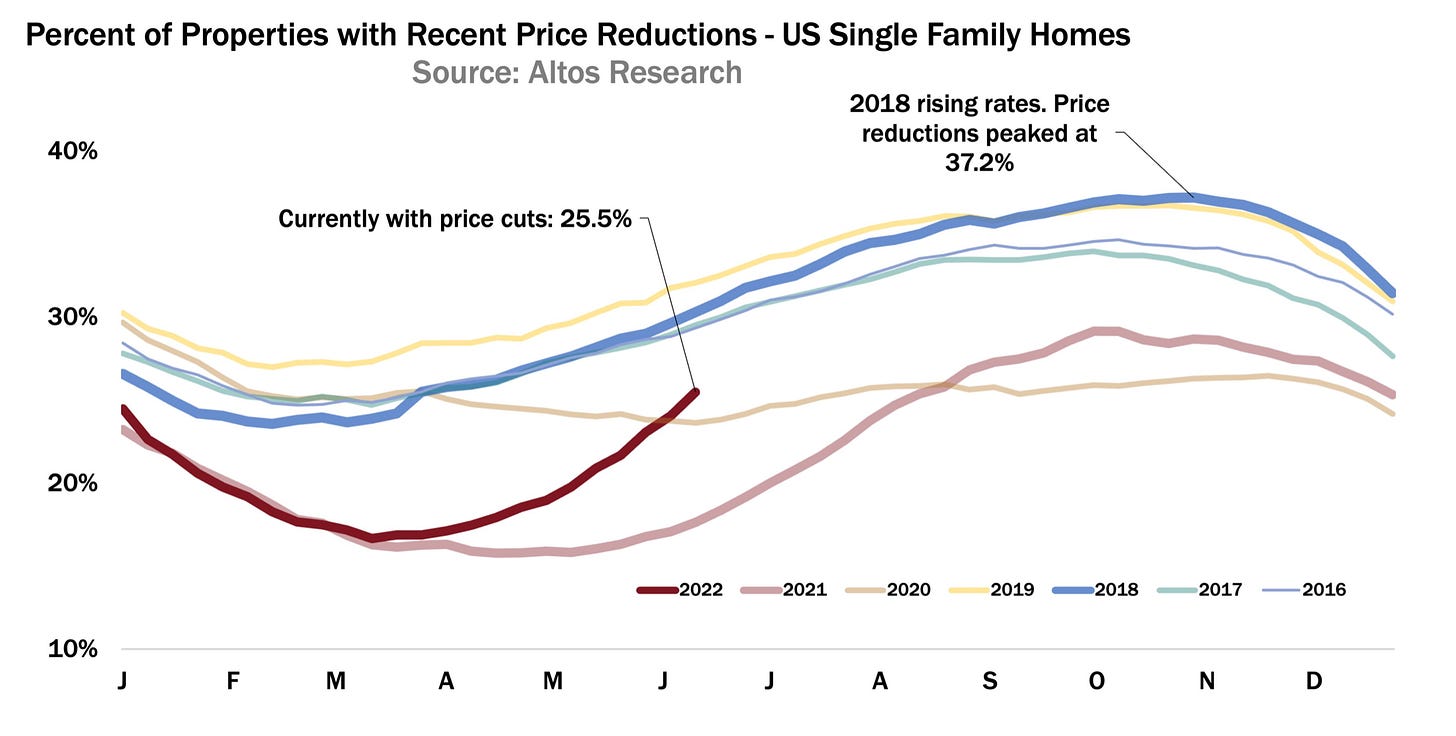

There is some interesting data from Altos Research that shows that sellers are now reducing their prices on homes once listed at a brisker pace. This is likely evidence of two things. First, it is a sign that the market is softening a bit and itchy sellers are pulling the trigger on price reductions sooner rather than later for fear of missing out on a peak sellers’ market. However, it could also mean that sellers have overshot on their original sale prices whether out of cheery optimism or general greed. I’ve heard some stories myself of people selling their homes simply because they knew they could get such outrageous prices. Some of these price reductions may be coming from people who purposively exaggerated their original prices just to see if they could get it.

Nevertheless, regardless the reason, the chart below shows that just over one in four single-family homes for sale have experienced a price reduction, a marked increase over recent months. Again, the seasonality of the housing market is also evident with prices being cut more commonly in the late summer and fall months ahead of the winter:

What Comes Next

There are several major levers at play impacting supply and demand in the housing market. The way those levers move in the next few weeks are likely to determine the direction of the housing market over the several years.

Do interest rates continue to rise so significantly that more buyers move completely to the sidelines, which would potentially lead to home prices dropping in the absence of potential buyers and fewer bidding wars.

Does inventory continue to pick up, adding to the supply of homes, easing prices in the process by giving prospective buyers more purchase options.

Does the state of the American consumer hold up, or does an economic recession lead to job losses, reduced incomes, and overall economic uncertainty, which would send uncertainty through the housing market.

Time will tell on all of this. Here is what I predict based on what I see on a day-to-day basis and my analysis of the data:

Mortgage applications are going to steadily decline as rates continue to rise. This will take more potential homebuyers out of the market. With fewer buyers, prices will moderate.

By “moderate,” I do not necessarily believe prices will decline nationwide in the months to come, but perhaps could a year out or more. Despite rising fears of a recession, the state of the American consumer remains strong. Unemployment continues to sit at a historically low level. Americans are working and they have money to spend. Many still have more savings than usual thanks to the lingering impacts of stimulus payments during the COVID-19 pandemic. Inflation, though, is a major force in opposition to this and if inflation is not brought under control all bets are off.

Although the piece is nearly a year old, I think much of what I wrote in the summer of 2021 about how the housing market is not in a bubble remains true: a generation of potential homebuyers is coming of age, household finances remain relatively strong (although, again, inflation is a powerful countercurrent to this), and supply chain issues are continuing to settle out.

I do think more homes will come on the market as sellers try to take advantage of what could be a peaking sellers’ market. Homes will stay on the market for longer and price reductions will be more common. All of this will have that same moderating effect.

Just as it is impossible to time the stock market, it is difficult to time a peak in the housing market. For prospective homebuyers, I would not necessarily sit out the market waiting for a pullback in price. I think it is still more likely that prices rise 10% in the next year than fall by 10%. And there is a decent chance that the interest rate on a 30-year fixed mortgage is 6.50%-7.00% by the end of the summer, so best to lock in rates now before they go up again (that is, if you can find a place to buy). If you are a seller, now is the time especially if you’re in a geographic market that has seen steep run-ups in the last 2-3 years. With all that being said, price, though perhaps the most important variable for buyers and sellers, is just that - one single variable. Other factors including timing, fit, geography, and what prospective buyers and sellers have going on in the rest of their financial lives all matter too.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram. Opinions and analysis do not represent First National Bank.