The Perils of Safe Investments

Many of our common assumptions about money and investments are either based on how things typically work during periods of relative stability or they are built around the ways of the recent past. But what happens when things suddenly change? That is what has happened over the past few months as inflation has shot up at a pace not seen in 40+ years with interest rates rapidly rising to boot.

Inflation hits people differently based on their habits and circumstances. Certain types of inflation, like wage inflation, can actually be good for many people. In fact, a silver lining for many over the past two years is that wage growth has accelerated at the lower tier of the wage spectrum as lower-income workers have been in such high demand that they have been able to command higher pay (although, to be fair, inflation has been so strong over the last 12 months that even healthy pay bumps might not be enough for people to keep up).

Inflation is most detrimental to so-called “savers,” people who hold their assets either in cash or purportedly “safe” investments like CD’s and bonds. Would you believe that the historical yield on a Money Market account based on data from 1954-2017 is actually 4.546%? Try going into a bank today and asking if they have anything that could give them a guaranteed 4 percent! Most Money Market accounts today are yielding almost literally nothing (i.e. 0.01%-0.10% on an annualized basis) and have been for the last few years.

The challenge for savers is that there are really very few safe havens right now that generate a guaranteed yield that can keep up with inflation. Sure, maybe you can get 1.00-2.00% on a CD, but you have to lock up your money for a 12-24 months or more, and what good is earning 2% if inflation is 7%? Your actual dollars might nominally grow over the course of two years, but they will actually be worth less than they were when you began!

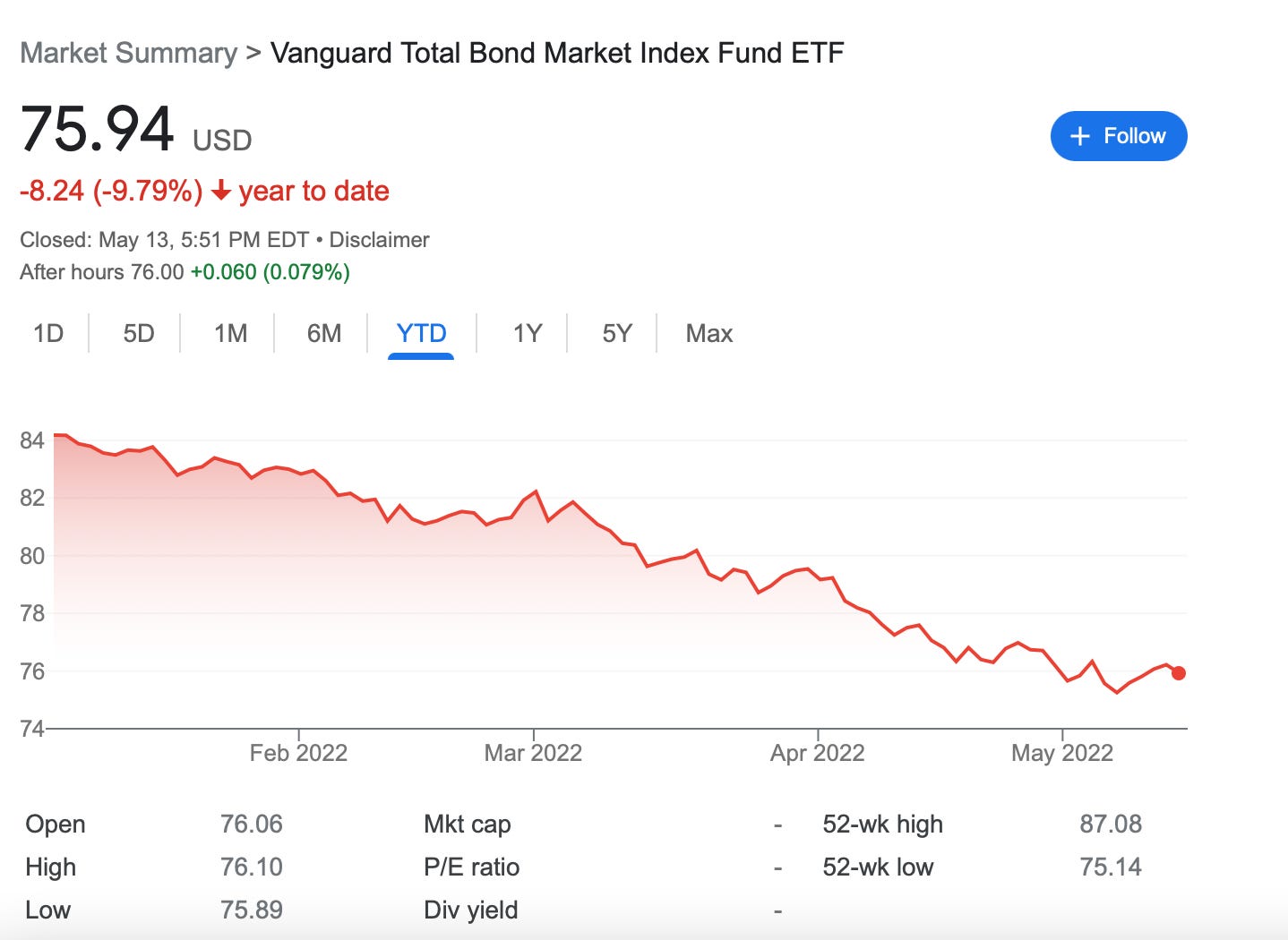

The drop in the stock market over the past few months has gotten a lot of the media attention (in part because so many people are invested in the stock market either directly or through their 401(k)’s and 403(b)’s and because a big stock market drop generates some eye-popping headlines). However, the bond market has also gotten crushed this year, and the drop in bond prices might be even more notable than the stock sell-off as it has hit people with losses more unexpectedly than the stock market has. Most people who invest in stocks at least philosophically acknowledge that there is always risk of loss. But people who invest in bonds? More often than not they are doing that because they either do not have the stomach for losses or their financial objectives can not be realized with losses. Avoiding losses is often the entire reason people invest in bonds.

That being said, the Vanguard Total Bond Index Fund, which is a fair gauge on the state of the overall bond market, is down nearly 10% for the year so far before dividends, which yield 2.22% on an annualized basis. This is really a staggering drop for an investment of this type!

What has happened in the bond market? Bonds can lose value two primary ways. First, if the ability of the bond issuer to repay the bond is in doubt, investors will require a higher yield in order to compensate them for the risk and/or the price of the bond might drop. These are called high-yield bonds or junk bonds. If the market believes that a bond issuer will actually default on the debt, the price of those bonds will plummet.

More commonly of late, however, bonds have dropped in value for a second reason: because interest rates are going up. The reason for that is that the price of a bond (i.e. what you could re-sell it for) is inversely related to interest rates. Think of it this way: if you own a bond that pays a 3% yield but then interest rates go up to 4%, not as many people want the 3% bond anymore, so the price of that bond (i.e. what the holder of the bond could re-sell it for) drops. It also works the opposite direction: if you own a bond that pays a 7% yield and interest rates drop to 6%, your 7% bond is comparatively more valuable and the price/value of that bond would likely actually increase.

For basically the last forty years interest rates have dropped (with flurries and spikes along the way). The following chart shows the yield on the 10-year U.S. Treasury Note. Observe the prolonged drop in the yield from the early 1980s onward:

But observe the sharp run-up in bond yields over the past year (if you were to zoom in on the very far right side of the chart above, it would look like the chart below):

To go from a yield bottoming out around 1.20% in July 2021 to around 3.00% today is a pretty sharp jump. And this is the reason bond prices have dropped because, remember, bonds become comparatively less valuable as interest rates rise because all new bonds issued are generally going to be issued at a higher interest rate, making the current bonds that were issued at lower rates comparatively less valuable. If an investor can get a new U.S. Treasury Note yielding 2.80% today, the price of a U.S. Treasury Note issued one year ago for 1.40% has to be comparatively less.

Now, to be sure, if you are a conservative-minded investor, you can get a safe 2.80-3.00% annual yield on a ten-year U.S. Treasury Note if you hold it for the full duration of ten years. In the case of holdings bonds to maturity, the fluctuating price of the bond doesn’t really matter; you can simply collect your annual 2.80-3.00% and call it good. But what has actually happened in the last few months is that bondholders have realized (maybe for the first time) that the actual day-to-day and month-to-month values of their holdings are dropping. Plus a lot of bond investors are actually not invested in individual bonds that they could even hold to maturity if they wanted to - they are invested in things like the Vanguard Total Bond Index Fund or the PIMCO Total Return Bond Fund or other similar investments that basically act as an index fund or mutual funds for bond holdings. These types of investments are highly susceptible to fluctuating interest rates, as illustrated in the charge above of the Vanguard Total Bond Fund.

On top of all that, here is the additional peril for conservative investors: is a 3.00% annual yield even attractive in an environment where inflation if running at 7-8%? Now, to be sure, given how much the stock market has dropped of late, a 3% yield in 2022 specifically might not be that bad even if inflation is running hot because at least you didn’t lose more. But over the course of ten years? The value of those dollars invested in bonds might be worth a lot less both relative to the stock market and to inflation over a long-term time horizon.

What Comes Next

At some point, safe havens will return. Bond yields are likely to continue to rise and there will probably be a day where investors can not only get solid and safe yields on bonds but also on things like CDs and even Money Market accounts. But it will probably be awhile. Banks are reluctant to raise rates on these types of accounts until they need to do so in order to attract deposits and deposits have been pretty solid over the past couple of years so banks are not scrambling to raise rates in deposit accounts and CD’s.

Other investment options include gold, which as a hard-asset is not as subject to interest-rate risk. Indeed, gold is currently trading at its highest rates in recent history, as the chart shows below of average gold prices going back to the early 1970s:

It doesn't take far to look in the news today to see what has become of other investments that were believed to either be hedges against inflation or hedges against the declining value of the dollars. All sorts of cryptocurrencies, digital coins, and digital tokens including NFT’s have seen their values become completely obliterated over the past several weeks including some that have lost over 90% of their values. I will likely expound upon this in a future article, but it appears to me that the emperor had no clothes as it pertained to many of these new types of investments. Whether there is still a role for the more stable assets in the market like Bitcoin remains to be seem (I think there is, it just will take some time to sort itself out).

To briefly summarize my main points today, however, “safe” investments are not always safe as in the case of bonds where their values can actually decline both in real terms and relative to inflation despite what investors expect, as well as in the case of other more exotic investments that are meant to be a hedge against stock market risk or the risk of the declining value of the dollar, many of which have plummeted in value exactly at the moment in time when they might have been most useful. And investors in more typical conservative investments like bonds should be mindful that bond values can actually go down, something they have not commonly done over the decades-long steady drop in interest rates going back to the early 1980s.

I wrote about a home as an inflation hedge in March and will likely come back to that topic and the general concept of whether investing in real estate is a viable way to beat inflation in a future article, so if you’re new to The Sunday Morning Post make sure you’re subscribed below to get my articles (for free!) each Sunday morning. Thank you and welcome to all of the new readers over the past couple of weeks and thank you especially to the people who have been sharing the articles with your contacts on and on social media. I appreciate your support.

Ben Sprague lives and works in Bangor, Maine as a V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram.

Hi Ben. What are your thoughts about Treasury Direct.gov and the I-share bond? I understand it is locked in for 6 months at over 9%. Is that true?