Used Car Prices Finally Starting to Ease Down

Plus: impact on inflation and the news of the week

Is now a good time to buy a car? If you look at interest rates, perhaps not. According to Experian via Nerdwallet, the average rate on a new car loan was 6.07% in the fourth quarter of 2022 and 10.26% for a used car. Both rates are likely even higher now as we close in on the end of the first quarter of 2023. Those rates are nearly double what they were a year ago, adding about $60/month onto the average car loan payment.

But there is better news on prices, which are starting to ease downward, especially on used cars. This is after car prices spiked during the pandemic due to global supply chain issues, robust demand as a result of multiple rounds of stimulus, and free-spending habits during what I have described as the Eat Drink and Be Merry for Tomorrow We Die Economy. This perfect storm of variables led to a surge in vehicle prices from the spring of 2020 to the summer of 2022. The rise is evident in the chart below of used car prices, but so too is the decline in recent months:

According to the latest CPI data from the U.S. Department of Labor Statistics and the U.S. Census Bureau, which was released on March 14th, in the month of February used car prices were down 13.6% as compared to February 2022. New car prices were still up 5.8% year-over-year, but the rate of increase is slowing on new cars, which on a monthly basis have been up 0.8%, 0.7%, 0.6%, 0.5%, 0.6%, 0.2%, and 0.2% over the last seven months respectively going back to last August. It is likely that by this summer new car prices will show a decrease in their year-over-year numbers as the market continues to normalize.

So why are prices coming down? Well, supply chain issues have largely settled out. Dealers have more inventory than before, and this increase in supply has supported an easing out of prices. And all of those pent-up purchases during and following the pandemic have also settled out; a lot of would-be buyers today bought instead from 2020-2022 and are not in the market for new or used vehicles at the current time, dwindling the pool of demand.

But demand may also be declining due to people’s feelings of insecurity about the direction of the overall economy. As inflation has roared in other areas of family budgets including food and utilities, it has meant less funds available for vehicle purchases. And, of course, higher interest rates are a major driver of reduced demand, as some people just cannot afford to purchase a vehicle with rates as high as they are or simply choose not to, relying on public transportation, walking or cycling, and other methods instead.

Will prices continue to drop? I think they will for the remainder of the year. Interest rates are not coming down anytime soon, so that variable will remain in place. And barring some sort of global shock that disrupts supply chains again, manufacturers of auto parts from here to China should have relatively normalized operations. Dealer lots should be full, so there will be less of a frenzy among buyers who now have more choices and can be more patient. Lastly, there is more downside risk in the current economy than upside, and if the employment situation becomes less stable, consumers will be pulling back.

It should be noted that although used car prices are down 13.6% in the past year, they are still up as compared to before the pandemic. A good portion of the recent decline is likely due only to the car market finding equilibrium again. It’s not good or bad, per se, it’s just a reduction from an artificially high price point to a more normalized range. I spoke to one used car dealer this week in preparing to write this article who estimated that prices were up about 30% from 2020 to the summer of 2022, and have since dropped about 15%. That matches the numbers pretty well from the CPI data, which, if you get right down to it, shows that even though prices are down in the last year they are still roughly equal to May 2021 prices, which was well into the pandemic. There would have to be even more of a decline in the months to come for prices to get back to their pre-pandemic levels.

So is it a good time to buy a car? Yes, especially if you do not need to fully finance it. But if you can hold off, though, the opportunities and savings are likely to get even better in the months ahead as prices of both used and new cars continue to ease down. As with many things, stay patient if you can.

Addendum - the Impact on the Key Inflation Statistic

Economists, investors, and government officials watch the monthly CPI report like a hawk in order to understand the impact of changing prices on consumers and, with it, the overall economy. Inflation is also one of the most important variables in the Federal Reserve’s calculus on whether to raise or lower interest rates, which has far-ranging effects.

So what to make of the decline (and anticipated further decline) in car prices? In short, it is good news on the inflation front. New and used vehicle prices make up about 8% of the overall CPI statistic. A drop in prices in this category will contribute to a lowering of the overall inflation number, which would be good news from the perspective of many including those in real estate as it would help signal less of a need for the Fed to keep raising rates, which would be welcome news to homebuyers, real estate agents, and many others involved in the real estate business.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram. Opinions and analysis do not represent First National Bank. © Ben Sprague 2023.

The Weekly Round-Up

The Internet - curated by me, for you! Here is what caught my eye this week:

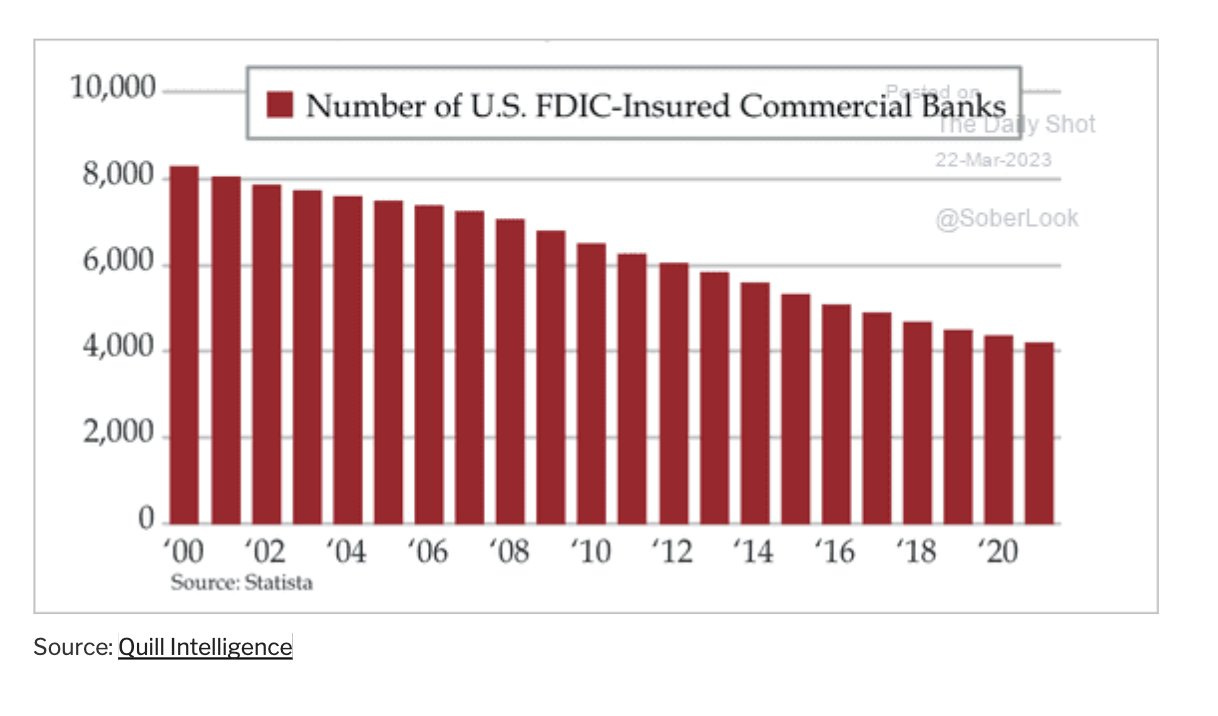

In 2000, there were just over 8,000 FDIC-insured U.S. commercial banks. Now there are just over 4,000. The trend is towards consolidation, for better or worse. H/T Adam Tooze.

On the heels of the collapse of Silicon Valley Bank, the ailing 166-year-old Credit Suisse was purchased by UBS last weekend in an emergency, forced-marriage style deal for $3 billion, which was about 60% less than the company was worth when its shares closed for trading on that Friday before. Life comes at you fast, as they say. As Sujeet Indap from the Financial Times noted, UBS is calling it an acquisition while Credit Suisse is calling it a merger. Awkard.

On Wednesday, Fed Chair Jerome Powell said, “All depositors' savings are safe.” Elsewhere in the capital on the very same day, Treasury Secretary Janet Yellen said, “I have not considered or discussed anything having to do with blanket insurance or guarantees of all deposits.” The mismatch in statements may have contributed to a jittery Wall Street, which experienced some pretty wild fluctuations all week, although the S&P 500 did end up 1.4% for the week.

Bill McBride of the Calculated Risk Blog (which you can read on Substack) notes that it is taking longer and longer to build a house:

In 2022, it took an average of 8.3 months from start to completion for single family homes, up from already elevated 7.2 months in 2021. For 2+ unit buildings, it took 17.0 months for buildings with 2 or more units in 2022, up from 15.4 months in 2021.

Have a great week, everybody!