What's Happening in the Bubbliest Housing Markets

Inventory up, sales down, prices starting to drop

What’s Happening in the Bubbliest Housing Markets

Home prices nationwide have risen dramatically over the last two years. But storm clouds are brewing in the form of significantly higher interest rates, inflationary pressures that are putting dents in Americans’ household budgets, and fears of a recession that could take the top off of a strong economy.

Certain U.S. markets have seen home prices rise more significantly than others in recent years, and it is worth taking a look at recent action in these markets as they may give clues as to what could happen nationwide in the months to come.

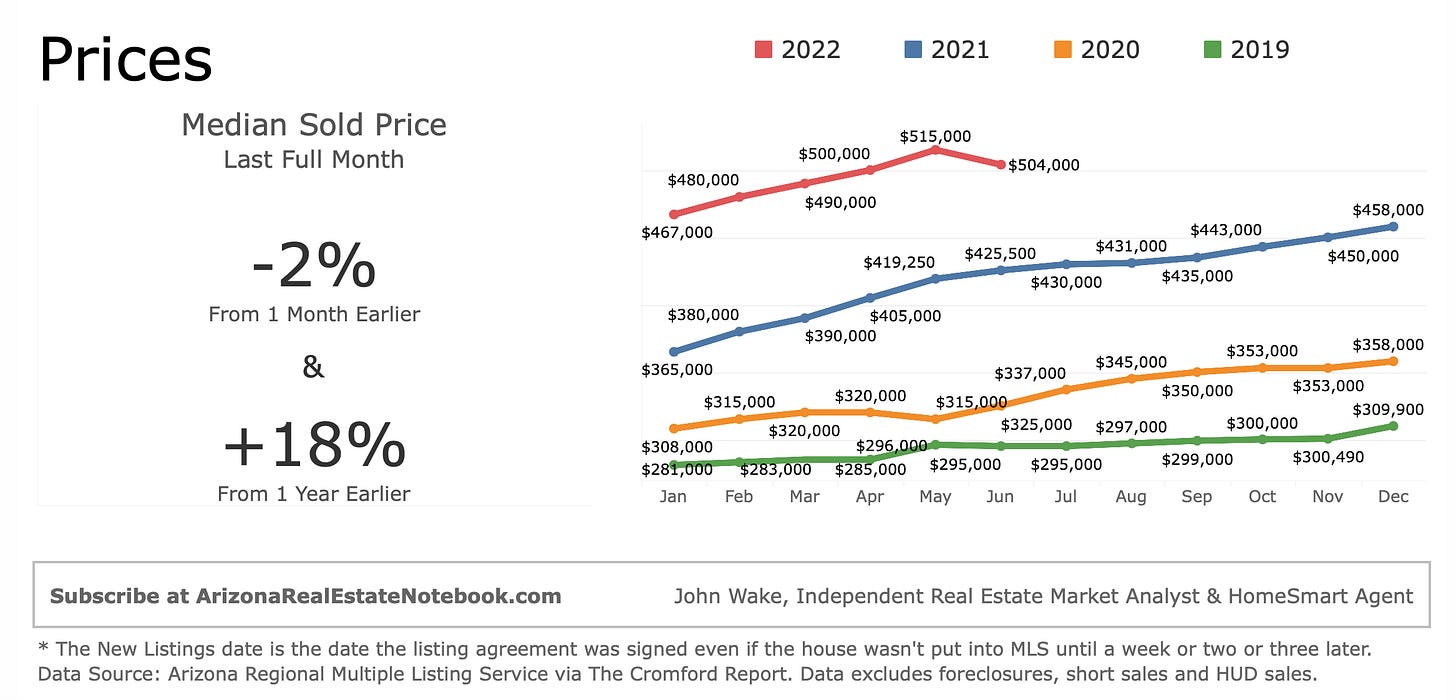

Phoenix, Arizona

Phoenix, which Moody’s recently described as one of the most overvalued housing markets, saw prices actually drop 2% in June, which breaks the cycle of previous seasonal trends where home prices typically have continued to rise throughout the summer. Is this the sign of a peak? Phoenix real estate agent and analyst John Wake says if you’re looking to sell at the top, it’s too late. As you can see in his chart below, it is abnormal for prices to drop at this time of year in Phoenix the way they have in 2022:

Boise, Idaho

A major beneficiary of the COVID-related work-from-home migration out of the western tech hubs around the Bay Area, home prices in Boise surged during the pandemic by more than 50%. But, like Phoenix, the Boise market saw prices a decline in June by 3.5% with the number of transactions dropping by 28%.

Austin, Texas

One of the hottest housing markets in the last decade, Austin, Texas also saw home prices drop in the month of June by about 3%. The median home price in Austin is $630,000, down from the May 2022 peak, but up considerably from pre-COVID levels, when the median home price was about $400,000, as shown in the chart below. Also notable in the Austin area, inventory levels are surging in the surrounding communities. According to Carson Ganong in Community Impact, “Round Rock, Pflugerville and Hutto had 933 active listings in June, compared to 498 in May and 309 in June 2021.” This tripling of inventory in a year and near-doubling of inventory in a month is a sure sign of a shift in the overall Austin-area housing market.

Florida

After two years of steady month-over-month and year-over-year increases, the median single-family home price in Florida in the month of May was $420,000. In the month of June? Exactly the same: $420,000. Condo sale prices increased marginally from May to June from $322,000 to $324,900, but the flattening of prices overall signals a major change as Florida home prices had been surging since the start of the pandemic. Statistics show that bidding wars in hot markets in Florida are in major decline. According to Redfin, there were bidding wars in Tampa on 58.8% of sales in June 2021. In June 2022? There were bidding wars on just 28.9% of sales. Available inventory is surging around the state, with listings in Miami-Dade up 28% in July 2022 vs. July 2021 while the number of sales is down 41%.

Other Markets

Other housing markets that have experienced sharply rising prices that are now seeing a leveling off plus notably fewer sales include Salt Lake City, Fort Collins, Bozeman, and numerous other medium/large cities in the western part of the country, which, like Boise, attracted in-migrations of new residents during the pandemic. Now they are all seeing similar shifts of decelerating prices combined with surges in the inventory of available homes for sale.

What it Means Nationwide

The real estate market over the last two years has not been normal by any means. But in the last 6-12 months, the story has been one of declining sales but still-rising prices. That is the case here in Maine, for example, where in the month of June the number of transactions declined by nearly 10% but prices actually were up 16% compared to the previous June.

Bu what is telling about some of these bubbly markets discussed above (and what signals a real shift) is the combination of the number of sales declining and prices declining at the same time. In a perfectly efficient market, as prices decline you would see sales increase. But that is not happening mostly because there are fewer eager buyers right now. This is due to swaths of potential buyers getting priced out of the market due to high sale prices plus high interest rates and others simply deciding to be patient instead of potentially overpaying at what could be a peak.

There is a clear shift happening away from this being a sellers’ market. Things are still pretty hot, but in the coming months inventory is going to continue to surge (including newly constructed homes), interest rates are going to continue to rise, and prices will continue to moderate and even drop in many markets. My advice to buyers is to be patient. I don’t see a wholesale collapse of housing about to occur, but I do see strong signs that the power in the real estate market is shifting from sellers to buyers and in the months and perhaps several years to come, opportunities for buyers who have been frustrated over the past 2-3 years will abound.

Ben Sprague lives and works in Bangor, Maine as a Senior V.P./Commercial Lending Officer for Damariscotta-based First National Bank. He previously worked as an investment advisor and graduated from Harvard University in 2006. Ben can be reached at ben.sprague@thefirst.com or bsprague1@gmail.com. Follow Ben on Twitter, Facebook, or Instagram. Opinions and analysis do not represent First National Bank.

Addendum

I happened up on this ad for a home from 1955 (via Lost in History on Twitter). In today’s dollars the $7,450 home would cost $82,370 with a monthly payment of $530. The bottom home would cost $87,345 with a monthly payment of $550. Imagine trying to buy a move-in ready home today for less than $90,000! As I’ve written about before, there are not enough low-to-moderate priced homes being built today.